[ad_1]

- The price of gold is at its two-month high at $1,790.

- The price of silver climbed above the $20.00 level again yesterday.

- Investors are refraining from placing any big positional bets on the price of gold ahead of key US inflation data.

Gold chart analysis

The price of gold is at its two-month high at $1,790. For the fourth day already, the price of gold is consolidating around the $1790 level, and soon we could see a break above and a price jump to the $1800 level. We need a positive consolidation and a concrete break above the resistance zone for a bullish option. After that, the price of gold must hold above if it wants to continue to the $1800 level. Potential higher targets are $1810 and $1820 levels. For a bearish option, we need a new negative consolidation. After that, the price of gold would retreat to the $1780 level. MA 20 and MA50 would then move to the bearish side; thus, the bearish pressure on the price would increase. Potential lower targets are $1770, $1760 and $1750 levels.

Chart:

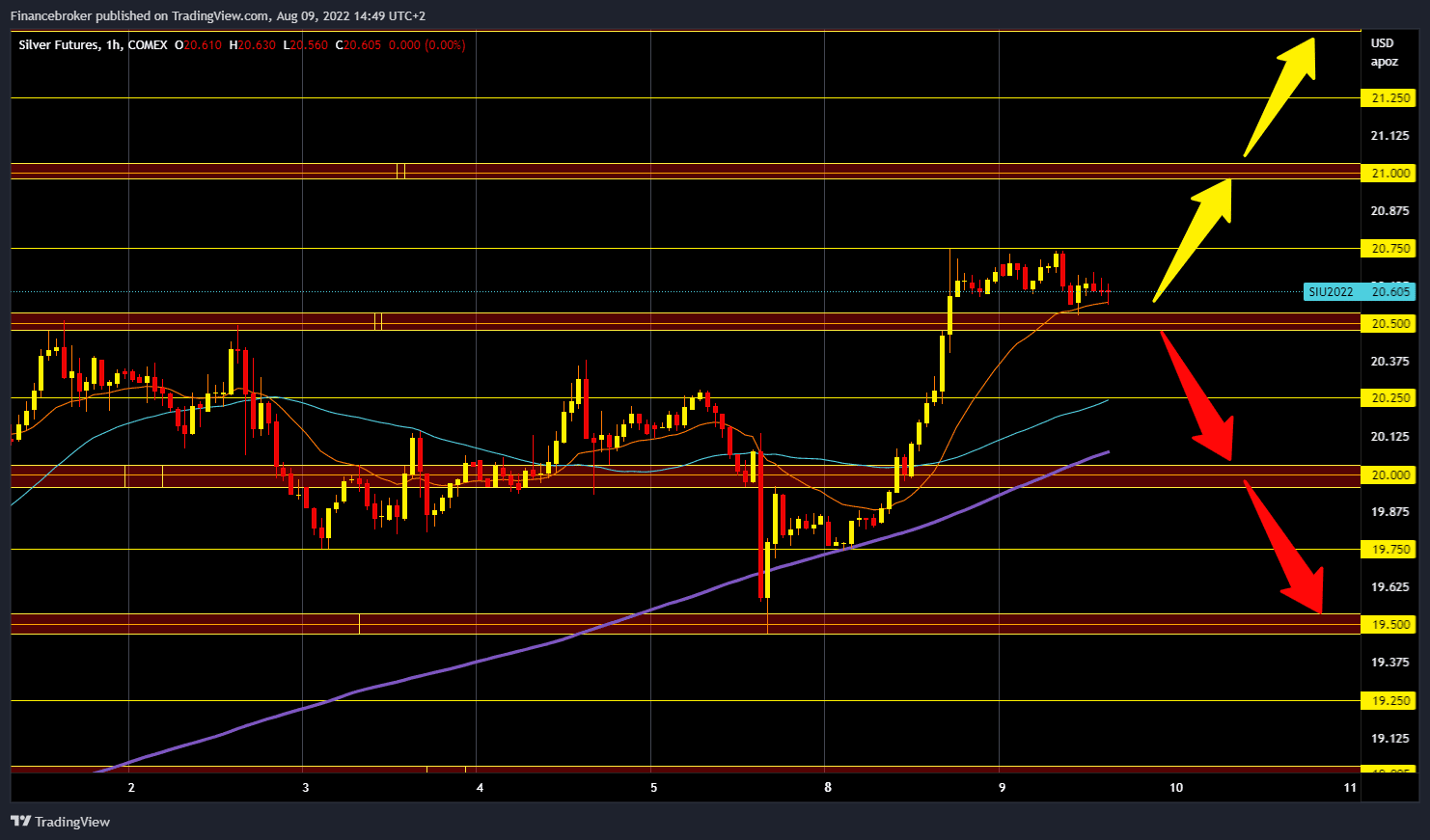

Silver chart analysis

The price of silver climbed above the $20.00 level again yesterday. The impulse was powerful and pushed the price of silver up to $20.75. During the Asian trading session, the price moved in the range of $20.50-$20.75. The price has been in a minor bearish trend for the last couple of hours, and we might see a pullback below that support zone today. We need a negative consolidation and a price drop below the $20.50 support for a bearish option. After that, we look for support at the $20.25 level, and additional support at that level is the MA50 moving average. If the price of silver does not find support there either, we will probably go down to the $20.00 level. We need a positive consolidation and a break above the $20.75 resistance zone for a bullish option. After that, we would have a chance to climb up to $21.00 again. The last time we were there was at the end of June.

Chart:

Market overview

Investors are refraining from placing any big positional bets on the price of gold ahead of key US inflation data due on Wednesday. Excellent US employment data from last Friday boosted the Fed’s expectations of a 0.75% September rate hike.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.