[ad_1]

After entering our covered call writing trades, we immediately enter our 20%/10% BTC (buy-to-close), GTC (good-until-cancelled) limit orders. If and when these thresholds are reached (resulting from share price decline) are short calls will be closed (bought back). At that point, we can plan our next steps to mitigate losses or turn losses into gains. This article will highlight a hitting a double trade I executed with XLP where the short call was bought back in the morning and the same option was re-sold later that afternoon. This result could not have been achieved without our 20% guideline.

What are the 20%/10% guidelines for covered call writing?

After entering our covered call trades, we immediately enter BTC GTC limit orders based on the premium received from the initial trade. We instruct our broker to close the short call if option value declines to 20% or less of the original premium in the first half of a monthly contract or 10% or less in the last 2 weeks of a monthly contract. These trades will be executed automatically if the stated thresholds are reached.

Initial trade with XLP

- 4/18/2022: Buy 300 shares of XLP at $78.59

- 4/18/2022: STO 3 x 5/20/2022 $80.00 calls at$0.84

- 4/18/2022: Place 3 x BTC GTC limit orders at $0.17 (20% guideline)

- 5/4/2022: BTC 3 x 5/20/2022 $80.00 calls at $0.17

- 5/4/2022: STO 3 x 5/20/2022 $80.00 calls at $0.46

- 5/4/2022: Place 3 x BTC GTC limit orders at $0.05 (10% guideline)

May 4, 2022

The market had been reeling from inflation and interest rate concerns as well as the Russian invasion of Ukraine. The Fed was to make an announcement at 2 PM ET regarding an interest rate hike and many investors were expecting a 50-basis point increase but feared a 75-basis point rise. The Fed announced a 50-basis point increase and stated that there was no consideration for a 75-point increase. The market loved the statement and rose by nearly 3%.

Price chart of XLP on 5/4/2022

XLP: “Hitting a Double” on 5-4-2022

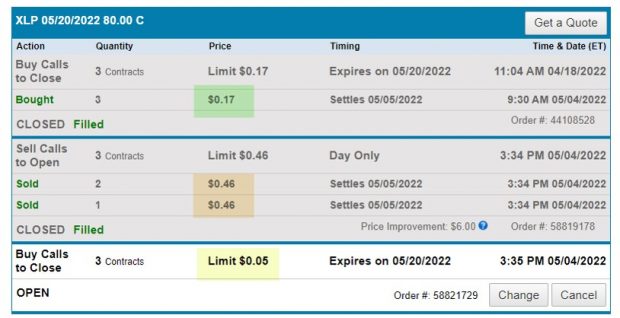

Broker transactions on 5-4-2022

XLP: Broker Transactions

Discussion

By having the 20% guideline in place, along with the market volatility created by the Fed announcement, an additional $87.00 of premium was added to our account [($46.00 – $17.00) x 3]. Since we were approaching the final 2 weeks of the May contracts, I used the 10% guideline for the new $0.46 premium. Generating additional time-value premium in our option-selling trades is not luck. It is the intersection of preparation and opportunity.

Premium Member Benefits Video

This is a great time to join our premium member community with its stock screening and educational (over 200 videos) benefits. We offer more benefits than ever before. For information, click here.

For video explanation, click here.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

I’ve been a premium member for nearly 2 years now. Your simple way of explaining things gave me the confidence to try options. Thus far, the videos cover almost everything. The purpose of this note is to thank you for the information, and great support.

Thanks!

Bob

Upcoming events

To request a private webinar for your investment club, hosted by Alan & Barry: [email protected]

1. Mad Hedge Traders and Investors Summit

Thursday December 8th at 12 Pm ET (topic to follow)

Free virtual webinar

2. Long Island Stock Traders Meetup Group (Private webinar)

Analyzing a 1-Month Covered call Writing Portfolio from Start to Finish

Thursday February 16,2023

7:30 PM ET- 9 PM ET

A real-life example with a $100k ETF Select Sector SPDR portfolio

Covered call writing is a low-risk option-selling strategy that generates weekly or

monthly cash flow. This presentation will demonstrate how to implement this

strategy using a database of only 11 exchange-traded funds for a 1-month option

contract cycle. These are real-life trades taken directly from one of Dr. Ellman’s

portfolios with screenshots verifying each trade. A final monthly contract result

compared to the performance of the S&P 500 will be calculated.

Topics included in this webinar:

What are the Select Sector SPDRs?

How to establish a covered call writing portfolio

What is the role of diversification?

What is the role of cash allocation?

Calculating initial returns

Analyzing each trade in the monthly contract

Final results

Next steps

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************

[ad_2]

Image and article originally from www.thebluecollarinvestor.com. Read the original article here.