[ad_1]

Dear Mr. Market:

Have we started off the year with enough things to worry about? The 2020s have seen more than any horror script one would ever want to draw up. We’ve had an unprecedented global pandemic, a massive stock market crash, and now a war….and we’re just two years in! We’ve constantly reminded people that the stock market always has a boogey man hiding in the darkness. Even in the proverbial “good times” people have a natural tendency to feel as though the party will end at some point. To that point…they’re partly right; the party doesn’t necessarily end but it certainly takes a break before resuming.

Today’s article will be rather short, even though there is much behind it (and of course more to come as this story develops). We often talk about people having short memories but don’t think that the Ukraine and Russia conflict just started last week. Click here if you need to catch up on a conflict that’s been in flux since February of 2014. The point of our “letter to Mr. Market” today, however, is on what to do with your investments.

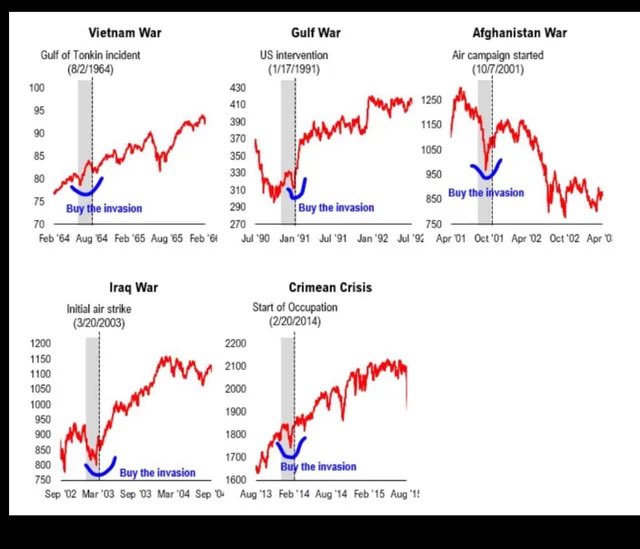

Much like Baskin-Robbins ice cream and their 31 flavors, we found a chart that you need to take a look at; it may not be as soothing as an ice cream cone but it can do wonders for how to put things into context. Below we’re sharing a chart that really want you to take some time to zoom in and reflect on each incident. How did you feel during each one? Were there any that you completely blew off or thought they were overhyped? Conversely, which one scared you the most into actually selling?

Like most people, we all feel the most angst leading up to and during the middle of a stressful time period. It’s typically afterwards that the armchair quarterbacks declare that they “saw that coming” or “I would have done it this way”. Let us be clear…in no way shape or form are we watering down serious geopolitical events nor thinking that it will have zero damage to potentially many areas of life (not just money). Secondly, we’re not suggesting you do anything wildly different right now. If you try to react or change your long-term strategy based on short-term news, you’ve already lost the battle (and essentially are also validating that you’re not in the right mindset). By the way, the chart above with “31 reasons to sell” only goes back 13 years; imagine if we shared one going back further? The point being is that this depicts stretches of worry during a bull market and the “good times”.

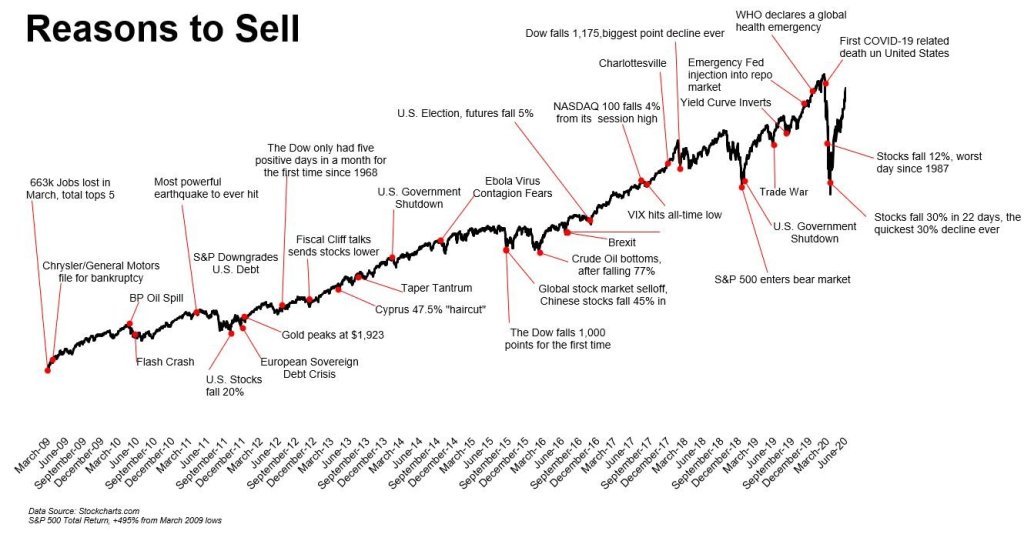

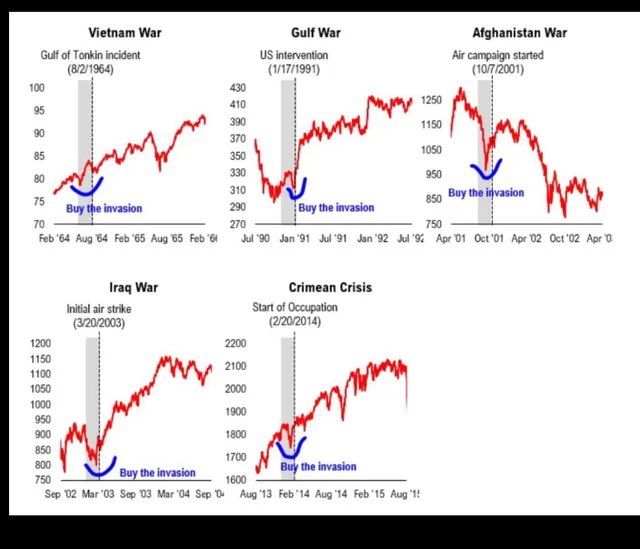

We’re also going to share one more chart with you that does indeed go back a bit further in history. Each of the following “invasions” were not just major headlines which rattled markets, but also missed opportunities for anyone who took their eye off the ball. For those with steady hands it’s clear that things usually work themselves out regardless of how major the story or geopolitical concern was.

Without question the market has a steeper hill to climb than it did before. We have inflation, substantial change coming in monetary policy, a lingering pandemic, border issues, and more than our fair share of division. That all being said, once this subsides you’ll see a market that has been belting our corporate profits that don’t garner enough positive attention. We’ll touch on this more in the near future but when was the last time someone on the news told you that corporate profits for the 3rd quarter broke a record (pre-Covid peak in 2019) by +21%? Of course they didn’t…Good news rarely sells but the other stuff certainly guarantees your pre-conditioned eyeballs and loyal attention.

Lastly, we encourage you go about your business and while it’s not a time to celebrate, you have to stay composed. We’ll never say “I told you so” but once this passes and you’ve been able to possibly sell some of your gold or lagging bond holdings to go back and buy beaten up stocks…you’ll see exactly why being patient and rational always wins out.

“Your success in investing will depend in part on your character and guts and in part on your ability to realize, at the height of ebullience and the depth of despair alike, that this too, shall pass.”

–Jack Bogle

[ad_2]

Image and article originally from dearmrmarket.com. Read the original article here.