[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,972 | -60.25 |

| Oil (WTI) | 76.52 | -0.84 |

| 10 year government bond yield | 3.47% | |

| 30 year fixed rate mortgage | 6.31% |

Stocks are lower this morning after the Fed poured cold water on a dovish shift in policy. Bonds and MBS are up.

The Fed raised interest rates 50 basis points as expected, however it increased its forecast for the Fed Funds rate in 2023 by 50 basis points. So instead of the markets seeing another 25 basis points of tightening in 2023, it looks like we will get another 75. The dot plot comparison is below:

The Fed revised downward their estimate for 2023 GDP from 1.2% to 0.5%, and increased its unemployment projection from 4.4% to 4.6%. The core PCE inflation forecast was increased as well, from 3.1% to 3.5%. The bottom line is that in spite of a couple good prints on the consumer price index the Fed became more hawkish, not less.

The press conference was basically non-eventful with Powell going back to his 3 components of inflation explanation: goods, housing and services wages. The goods issue was a function of supply chain bottlenecks from the pandemic, and this appears to be more or less over. The housing issue (which is really rental inflation) will probably begin to fade as we head into mid-2023. The wages part is the driver for the Fed’s decision-making.

The Fed is looking at a historically tight labor market, and is trying to avoid the 1970s wage-price spiral. FWIW, I personally don’t think that is as applicable today, mainly because we don’t have as many workers covered under collective bargaining agreements, which is where those wage increases got cemented in the past. Regardless, this is the driver of the Fed’s thinking.

The reaction in the markets was muted. Stocks sold off, while bonds tried to sell off and failed. The yield curve continues to invert, and is now fully negative across the board with the overnight rate at 3.81% and the 30 year rate at 3.49%. This is even more interesting in the context of quantitative tightening. Lower long term rates made sense when the Fed was building its balance sheet, but it is odd when you consider they are letting it run off. The inversion of the yield curve is back towards where it was in the early 1980s during the deep and painful recessions of 1980-1982.

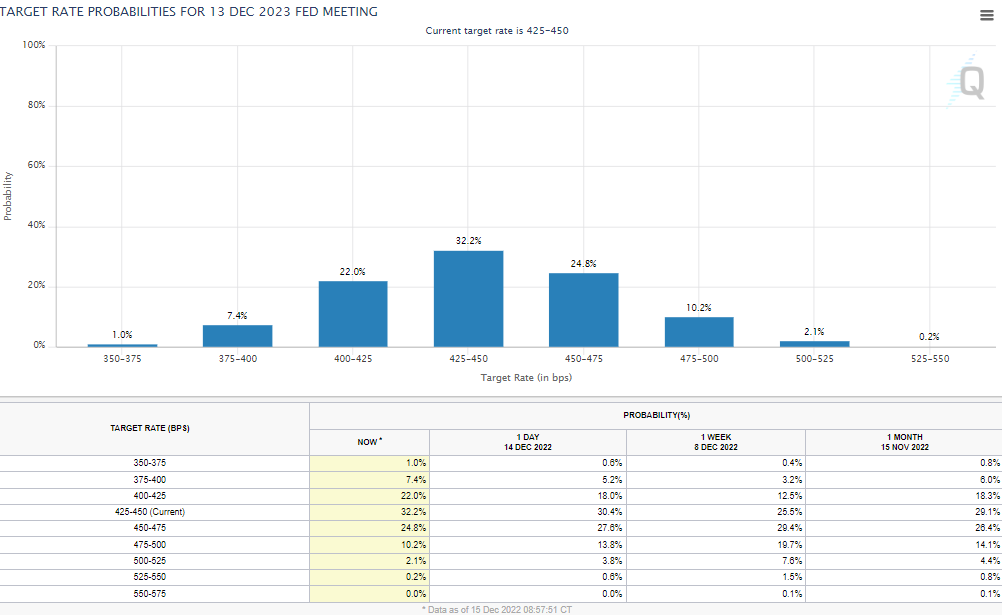

Now check this out: It is still early, but look at the December 2023 Fed Funds futures implied probabilities: They aren’t buying the Fed’s narrative.

The futures may in fact adjust over the coming days, but at least as of this morning, they see the Fed funds rate at 4.25% – 4.5%, exactly where it is today. Really strange.

The press conference was pretty much uneventful, though you are seeing a narrative being formed politically: “The Fed wants you out of work.” Of course that is a simplistic and unfair framing (most narratives are) but watch this germ begin to manifest itself more clearly in the coming weeks. I wouldn’t be surprised to see more and more pointed rhetoric out of Washington over monetary policy as politicians hammer on the idea that workers, who’s wages have not kept up with inflation for decades are finally getting a raise and the Fed is looking to sacrifice them at the altar of 2% inflation. Incidentally one reported asked if the Fed might reconsider its 2% target and Powell basically said it wouldn’t. Personally, I don’t see the magic in 2%, but it they do.

So, bottom line, people who were hoping for the all-clear signal didn’t get it. That said, with MBS spreads still wide and the 10 year kind of solidly stuck where it is, we should see mortgage rates work lower despite all of this.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.