Vital Statistics:

| Last | Change | |

| S&P futures | 3,996 | 3.15 |

| Oil (WTI) | 95.44 | -0.75 |

| 10 year government bond yield | 2.81% | |

| 30 year fixed rate mortgage | 5.72% |

Stocks are flattish this morning on no real news. Bonds and MBS are up

The index of leading economic indicators fell 0.8% in June, after falling 0.6% in May. For the first half of the year, it is down 1.8%.

“The US LEI declined for a fourth consecutive month suggesting economic growth is likely to slow further in the near-term as recession risks grow,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board. “Consumer pessimism about future business conditions, moderating labor market conditions, falling stock prices, and weaker manufacturing new orders drove the LEI’s decline in June. The coincident economic index which rose in June suggests the economy grew through the second quarter. However, the forward-looking LEI points to a US economic downturn ahead. Amid high inflation and rapidly tightening monetary policy, The Conference Board expects economic growth will continue to cool throughout 2022. A US recession around the end of this year and early next is now likely. Accordingly, we’ve downgraded our forecast of 2022 annual Real GDP growth to 1.7 percent year-over-year (from 2.3 percent), while 2023 growth was downgraded to 0.5 percent YOY (from 1.8 percent).”

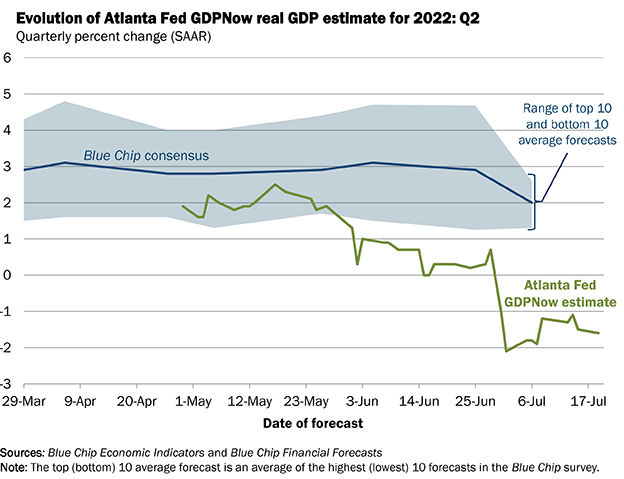

Note that Ford just announced planned layoffs, and initial jobless claims rose to 250k so it looks like the labor market has probably peaked. The recent Atlanta Fed GDP Now index predicts the economy fell 1.6% in the second quarter. According to the classis model of recession (two consecutive quarters of negative GDP growth) we are already in one. That said, the NBER makes the final call, and they can choose to ignore this if they want.