[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,704 | -4.00 |

| Oil (WTI) | 87.50 | 1.98 |

| 10 year government bond yield | 4.17% | |

| 30 year fixed rate mortgage | 7.03% |

Stocks are lower this morning as earnings continue to come in. Bonds and MBS are down.

St. Louis Fed President James Bullard said yesterday that he expects the Fed to end its “front-loading” of aggressive rate hikes by early next year. “In 2023 I think we’ll be closer to the point where we can run what I would call ordinary monetary policy,” he said. “Now you’re at the right level of the policy rate, you’re putting downward pressure on inflation, but you can adjust as the data come in in 2023. Not that there wouldn’t be further adjustments, but they would be more based on the data coming in as opposed to us trying to get off zero and up to some level that’s reasonable.”

Meanwhile, the Beige Book indicated that the economy is experiencing “slight to modest” growth, while prices (inflation) is showing “some degree of moderation.” The labor market appears to be loosening up, with wage increasing beginning to decline.

Speaking of the labor market, initial jobless claims remain quite low, falling to 214,000 last week.

Ally reported earnings yesterday. They are mainly an auto lender (they used to be known as GMAC), however they do have a mortgage origination arm. Their direct-to-consumer mortgage origination volume was $500 million, which was down 85% compared to a year ago. Refinance activity was down 98%.

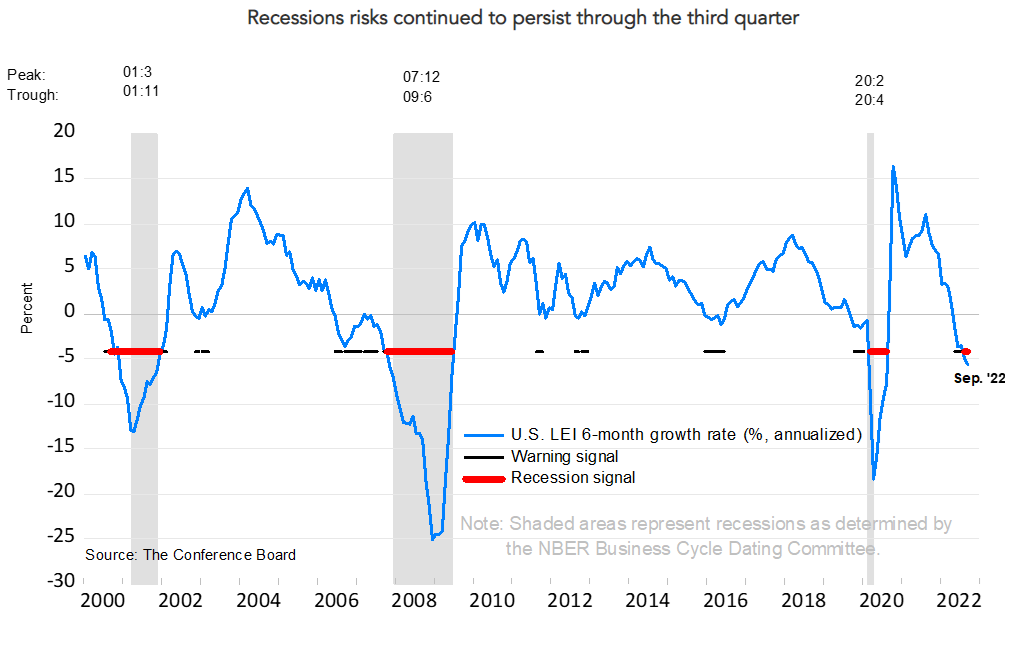

The Conference Board Index of Leading Economic Indicators fell 0.4% in September, which was below the street expectation of 0.3%. “The US LEI fell again in September and its persistent downward trajectory in recent months suggests a recession is increasingly likely before yearend,” said Ataman Ozyildirim, Senior Director, Economics, at The Conference Board. “The six-month growth rate of the LEI fell deeper into negative territory in September, and weaknesses among the leading indicators were widespread. Amid high inflation, slowing labor markets, rising interest rates, and tighter credit conditions, The Conference Board forecasts real GDP growth will be 1.5 percent year-over-year in 2022, before slowing further in the first half of next year.”

Existing Home Sales fell 1.5% in September to a seasonally-adjusted average rate of 4.71 million. Year-over-year, sales are down a whopping 24%. The inventory of homes for sale declined as well, to 1.25 million units. “The housing sector continues to undergo an adjustment due to the continuous rise in interest rates, which eclipsed 6% for 30-year fixed mortgages in September and are now approaching 7%,” said NAR Chief Economist Lawrence Yun. “Expensive regions of the country are especially feeling the pinch and seeing larger declines in sales.”

The median home prices rose 8.5% YOY to $384,800. Days on market rose to 19, and 70% of properties sold within a month. The first time homebuyer accounted for 29% of sales, which is historically a low amount. Affordability constraints are almost certainly an issue, but low first time homebuyer percentages have been low for the past 15 years.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.