[ad_1]

DEC WHT

The uncertainty surrounding the Ukraine Grain Export Corridor Deal – expiring on 11/19/22 – has created roller-coaster price action for the Dec Wht! A week ago Monday, the mkt soared 60 cents off week-end turmoil in Ukraine – suggesting the Deal was in jeopardy! But, since then, news has surfaced that Russia is interested in keeping the pact alive forcing a $1.00 break in Dec Wht! In addition, the Monday Inspections came in well under expectations – 231,842 (350-750). Finally, mounting harvest pressure in corn & beans has spilled over into the wht! Which leaves a bearish looking chart – with new monthly lows scored today!

DEC CORN

For over 6 weeks, Dec Corn has been confined to a 40 cent trading range (660-700) buffeted to & fro by conflicting fundamentals – but to its credit – holding just 20 cents off the $7.00 mark – right thru the heart of harvest! The biggest bullish factor is the short crop – mostly recently forecast at 13,895 BB (2021 – 15,115)! But various headwinds are attempting to counter that! First, the on-again/off-again Ukr Corridor Deal appears to be on again! Second, exports, week after week, continue to be meager – Mon’s inspections were 448,423 (375-625)! The issue is that South American corn is $2.00 cheaper than the US! Then there is harvest pressure – 45% in (avg – 41). And China’s economy is slow as they deal with a zero tolerance Covid policy! Finally, the Macros are bearish as a recession looms! Given that line-up of negatives, the contract’s ability to hold in a tight congestion area – close to the highs – is very impressive & possibly significant!

NOV BEANS

Much like Dec Corn, Nov Beans have been range-bound for 2 months – (1350-1500) but a whopping $1.25 off its recent highs! The reason for the disparity -is the supply situation- for soys it’s not really that short with a 4.313 BB crop (2021- 4.435) but the major “caveat” is South America – namely Brazil – who is on tap to produce a record crop! And demand is very sluggish despite excellent Monday inspections – 1.888 MMT (976 -lw) & 6 different 8am sales announced last week! After the first, SA could become THE export source due to favorable prices! The Macros are also weighing on beans – like all other commodities – as the economy teeters on the brink of a recession & the US $$ hovers at 20 year highs! So All eyes will be on South American growing weather for their emergent crop thru the 1st Quarter of 2023!

DEC HOGS

Dec Hogs have staged a remarkable $13 rally (73-86) this month -on the back of a surging cash & solid demand (73-86)! It’s really remarkable – given the recession fears prevalent in the marketplace! People are cutting back but obviously not denying themselves the joy & pleasure of a nice meal! The high price of meal & corn is keeping the hog #’s down! However, the mkt is extremely overbought now & a correction is imminent!

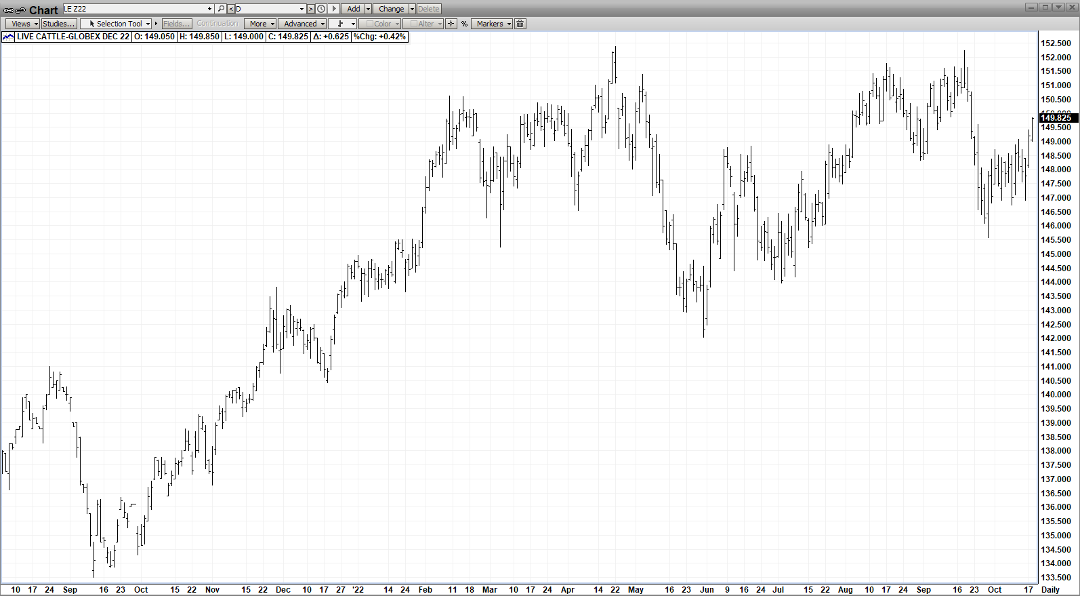

DEC CAT

Much like Dec Hogs & most certainly getting an assist from them, Dec Cat has rallied hard in the midst of a not-so-favorable economy & in spite of higher beef production last week! As well, demand seems to be getting stronger as the economy is getting weaker! Production into 2023 will undoubtably be going down due to accelerating feed costs & demand seems to be hanging tough as the consumer seems to be cutting back on many things but not food!

[ad_2]

Image and article originally from blog.pricegroup.com. Read the original article here.