[ad_1]

MAR CORN

Despite paltry exports, March Corn has managed to rally back 25 cents (635-660) in the past 6 trading sessions due to a combination of geopolitical & fundamental factors! First, is the ramping up of the Russian/Ukraine War over the week-end which casts some doubt on the viability of the Ukraine Grain Corridor – second, dryness persists in Argentina & South Brazil -possibly putting a dent in some of the lofty production estimates out of South America! Third, a lower-than-expected CPI energized a 1000 point rally in the DJI – which in turn sparked a hard plummet in the US Dollar to its July lows! Eventually, a sharply lower dollar will make the US export-competitive again in the world marketplace!

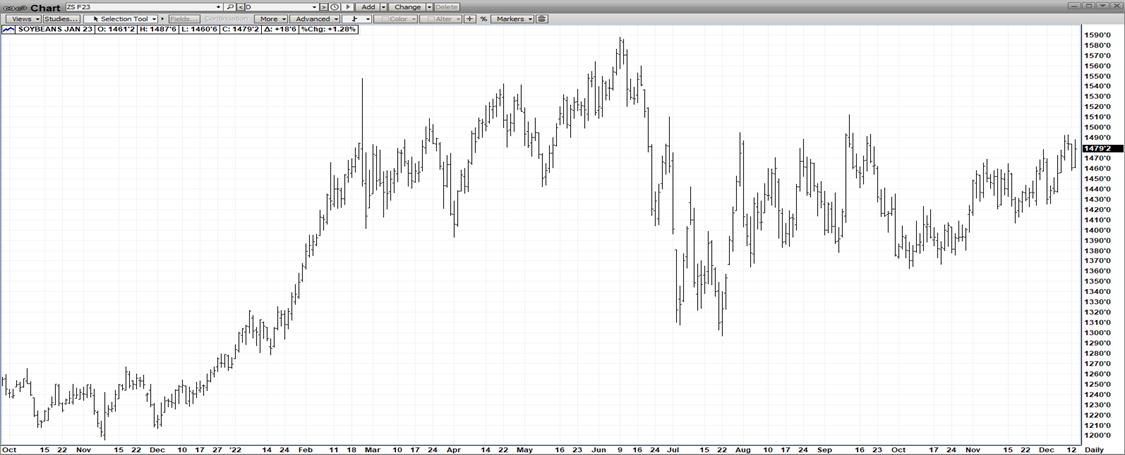

JAN BEANS

Jan Beans have been the clear upside leader at the CBOT in the past 2 months – gaining $1.30 (1360-1490) while Mar Wht lost $2.00 (920-720) & Mar Corn dropped $.60 (7.00-640)! The primary reason is two-fold – first, dry & hot weather in Argentina & second, decent exports in the Mon Inspections, Thur Sales & the occasional daily 8am flash sale! Plus, with all the talk about a record South American crop, a “discount” has been priced in that may not be warranted! Further support has emanated from the outside mkts – particularly, the US Dollar, which has shed nearly 10% of its value in the past 2 months! This eventually will help US exports become more competitive with South America & Ukraine! As well, the DJI has rallied nearly 6000 points since mid-Oct on the perception inflation has topped out! Finally, crude has rallied over $7.00 in the last few days – supporting the biofuel mkts!

MAR WHT

Since mid-May, Mar Wht has dropped $5.00 as the Ukraine Grain Corridor re-opened, Russia birthed a record crop & dominated the export mkt with cheaper offerings! However, now the mkt is grossly oversold & the US Dollar has plummeted – potentially making the US exports more palatable on the export mkt! Should a dry Argentina continue to rally Beans & Corn, Wht will coattail its “sister mkts” higher!

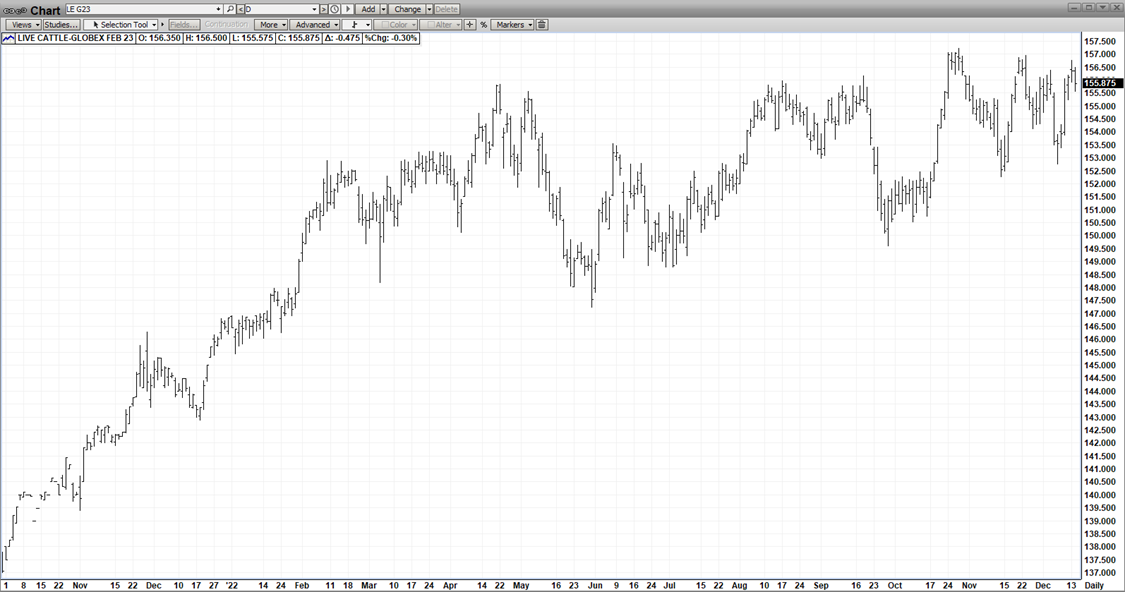

FEB CAT

Feb Cat has been the beneficiary of very favorable supply/demand fundamentals which has yielded a bullish looking chart – with the mkt challenging its contract highs as recently as yesterday as a severe winter storm – moving west to east – ravaged the country’s mid-section! Holiday demand is still in place with Christmas & New Years dead ahead, exports have been robust & production is slated to be lower in the first 2 quarters of 2023! And the outsides have supported with a buoyant DJI & a plummeting US Dollar!

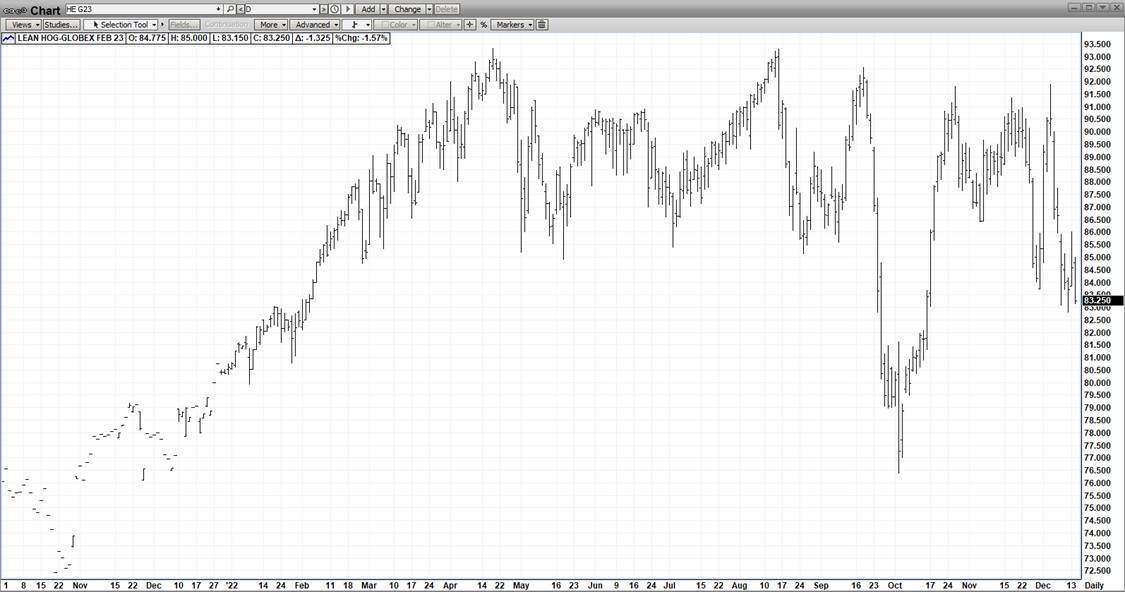

FEB HOGS

There is quite a dichotomy in the meats with Feb Cat knocking on new contract highs while Feb Hogs are languishing some $10 off contract highs! The difference appears to be in the upcoming production – predicted to be quite robust in early 2023 & exports which, Sans China, have been meager! Hopefully, holiday demand will rejuvenate the oversold pork mkt – going into year-end!

[ad_2]

Image and article originally from blog.pricegroup.com. Read the original article here.