[ad_1]

- The price of bitcoin failed to hold at the $23000 level.

- The price of Ethereum fell below the $1800 level this morning.

- Gold has withstood the test of previous economic meltdowns, rising against the decline in the dollar’s value.

Bitcoin chart analysis

The price of bitcoin failed to hold at the $23000 level, and a break below followed, and the price stopped at the $21280 level. We have a minor recovery up to the $21550 level, but overall the bearish pressure seems to be too much for Bitcoin. For a bullish option, we need a new positive consolidation and a return above the $22000 level. If we manage to hold above, then we could try further price recovery. Potential higher targets are $22500 and $23000 levels. For the bearish option, we need a continuation of the negative consolidation and a price drop to the $21,000 level. The break below opens the door to lower levels. And the potential targets are $20,500 and $20,000 levels.

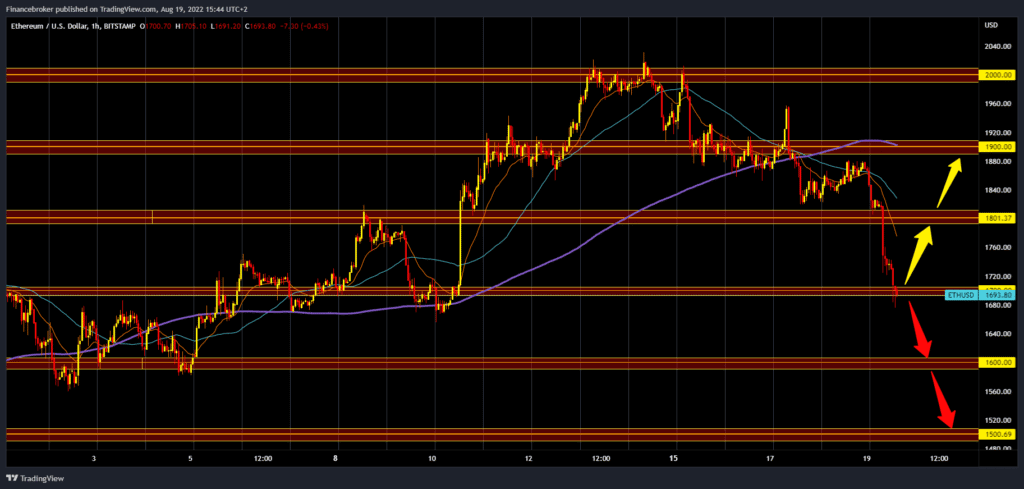

Ethereum chart analysis

The price of Ethereum fell below the $1800 level this morning. The bearish trend continued during the day, and the price is now $1700. Bearish pressure is intensifying, and a continuation of the decline in the price of Ethereum could occur. Today’s minimum was at the $1680 level. We need another positive consolidation and hold above $1700 to start for a bullish option. After that, the price should gather strength for a new bullish impulse. Potential higher targets are $1750 and $1800 levels. We need a continuation of today’s negative consolidation for a bearish option. The price is now testing the previous low at $1650; if we see a break below, we will likely continue to the $1600 support level. The August minimum is at the $1560 level.

Market Overview

Gold has withstood the test of previous economic meltdowns, rising against the decline in the dollar’s value. Despite the war between Ukraine and Russia, US inflation hitting a 40-year high, and concerns about an impending recession, the price of gold fell by only 7.07% in the previous six months. Gold has a market capitalization of about 11 trillion dollars. But over 50% of its demand is for jewelry, while 25% goes to investments, and central banks hold about 11.33%. Despite its volatility, Bitcoin has all the qualities that make it the best long-term hedge against inflation. It is anonymous and decentralized, so it is not prone to manipulation. The value of BTC has increased 407% compared to 35% of gold. Meanwhile, the value of the US dollar rose 15% against other currencies, but inflation reduced its purchasing power.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.