[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,978 | 14.25 |

| Oil (WTI) | 96.31 | 1.65 |

| 10 year government bond yield | 2.83% | |

| 30 year fixed rate mortgage | 5.60% |

Stocks are higher this morning as we head into a big week of tech earnings. Bonds and MBS are down as we enter Fed week.

This week is packed with economic data, and the Fed will announce its decision on Wednesday. Aside from the Fed decision, we will get some important data including the first estimate of second quarter GDP, the employment cost index, personal incomes / outlays and house price data. We also get earnings from market heavyweights such as Apple and Amazon.

The Chicago Fed National Activity Index (sort of a meta-index of various economic indicators) was flat in June compared to a downward-revised May. Production and incomes were growing below trend, while the labor force and orders are above trend. Overall, the economy is growing below trend, which means the actions taken by the Fed are beginning to have an effect. One of the The CFNAI was flashing inflationary signs a few months ago, however we are back to normal.

There seems to be a growing consensus that inflation and interest rates have peaked for the year. While the Fed Funds rate is the most visible indicator of Fed tightening, two other levers are acting as well – quantitative tightening (or the reduction of asset purchases) and the stronger dollar. Quantitative tightening has more or less taken the wind out of the sails for the housing market and the dollar is helping on the commodity front. Supply chain issues remain a problem.

The Fed Funds futures are becoming more dovish, with the market now firmly handicapping a 75 basis point increase this month, and then another 100 basis points over the rest of the year. If you look at the far-out futures (basically summer of 2023), the Fed funds forecast is looking lower. In other words, the market thinks the Fed will be cutting rates in 2023.

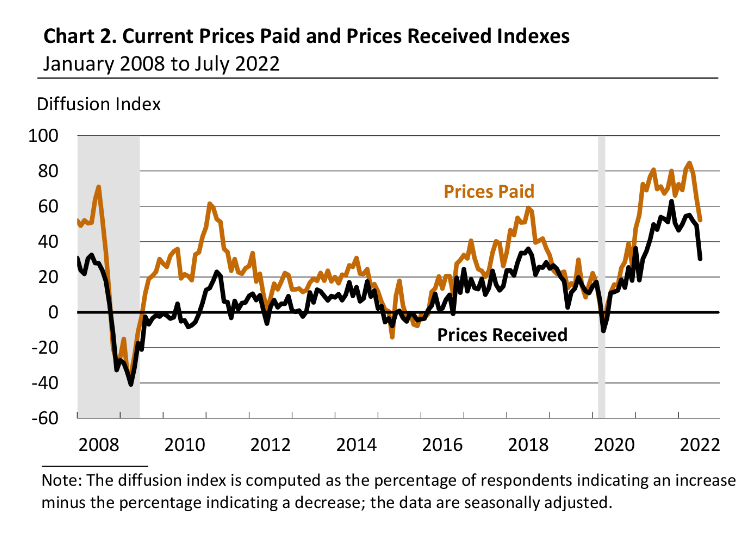

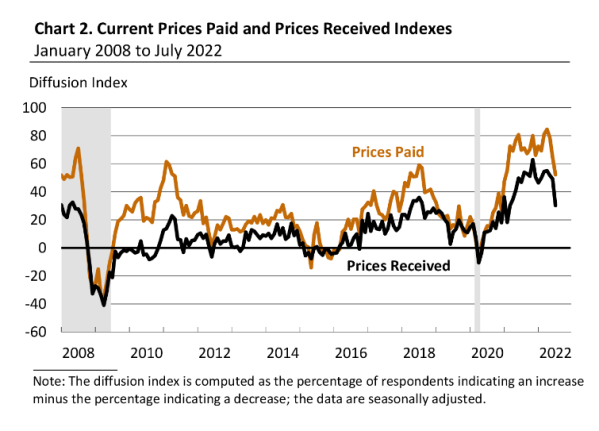

You can hear the change in sentiment from Wall Street strategists as well. The emerging consensus is that the peak for rates and inflation happened in June, and inflation is beginning to subside as gas prices fall. Note the Philly Fed manufacturing index from last week showed inflation beginning to subside as well, as both the “prices paid” and “prices received” sub-indices fell substantially.

Housing Wire has a good piece on the pain in the non-QM market. Non-QM loans are mortgages which can’t be guaranteed by the government or Fannie / Freddie. These loans have been beaten up in the market due to the rapid rise in interest rates and the inability for dealers to hedge interest rate risk.

When FGMC shut its doors, it had about $418 million in loans on its warehouse lines, with Customers Bank, Flagstar, JVB and Texas Capital having the exposure. Many of these non-QM loans have low coupons and are now trading at “scratch and dent” prices.

John Toohig, a trader with Raymond James said: [There’s] a lot of underwater coupons due to rapidly rising rates,” Toohig said. “The problem with non-QM is that most banks won’t be the liquidity source for those loans in whole-loan form [purchasing] vs. the aggregators putting them into RMBS [private label securitization deals] — which doesn’t work right now [either]. “So, I wouldn’t be surprised that there is some pain coming at the warehouse-line level [revolving lines of credit used to fund mortgage originations] as loans start to age. The good news for prime jumbo [is] banks want to own those loans and balance-sheet them. The same cannot necessarily be said for non-QM.”

Note that the National Financial Conditions Index seems to be reversing, which is good for riskier assets. Some junk spreads are tightening as well. This is part of what is driving the improving sentiment.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.