- Bitcoin price loses another battle with the dollar.

- The price of Ethereum has retreated from the $2000 level to the $1900 level and is currently consolidating at that level.

- Australian regulators are concerned about investing in risky crypto assets.

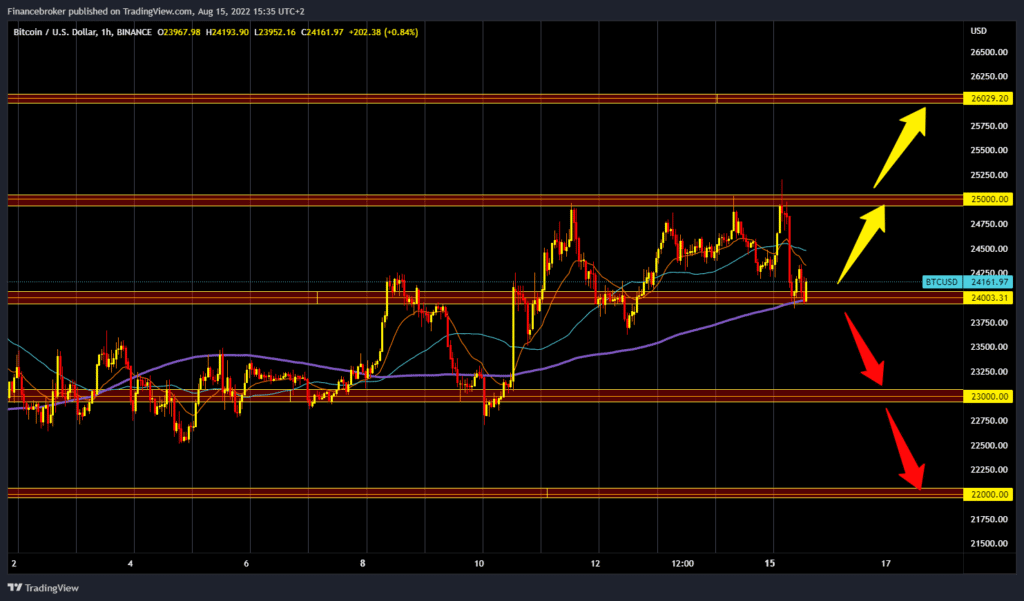

Bitcoin chart analysis

Bitcoin price loses another battle with the dollar. Today, the price managed to climb up to $25250, but a brutal pullback to the $24000 support zone occurred. We are now trying to hold above that level with the help of the MA200 moving average. We need a new positive consolidation of bitcoin price for a further attempt to break above the $25000 level. If we were to manage to climb to the top level, we need to stay up there. After that, we need a break above to continue towards the 260004 level. We need continuation of negative consolidation and break price below the $24000 support zone for the bearish option. A price drop below would increase the bearish pressure, and the following potential targets are $23500 and $23000, the previous higher low.

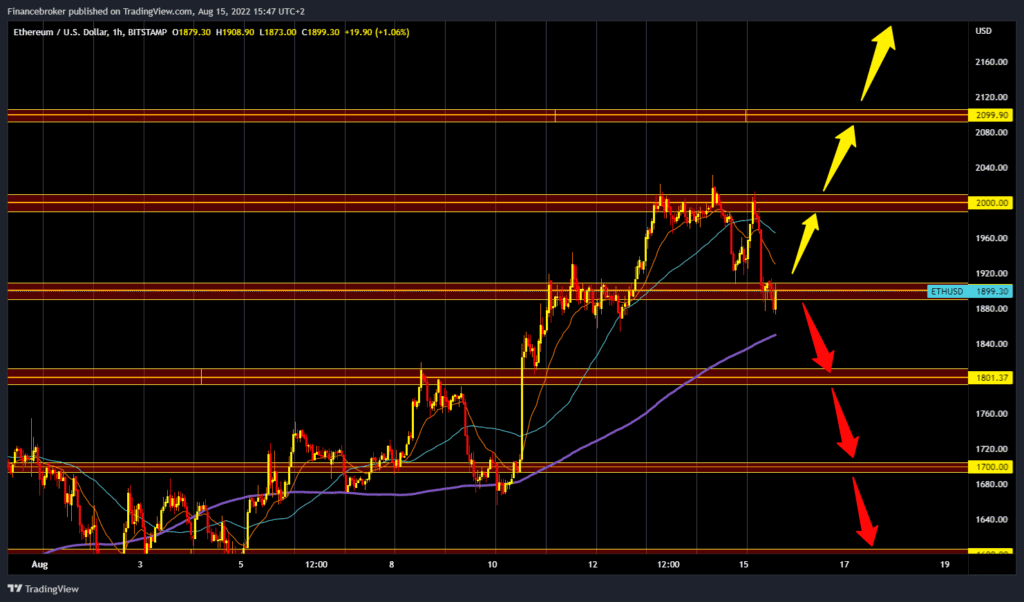

Ethereum chart analysis

The price of Ethereum has retreated from the $2000 level to the $1900 level and is currently consolidating at that level. The strengthening of the US dollar had an impact on this price move. We are now looking for support for a new bullish impulse.

We need consolidation to keep us above $1900 in order to attempt a recovery to the $2000 resistance zone. A break of the Ethereum price above could push the price first to $2100, then to the $2200 level. We need a continuation of the negative consolidation and a pullback to the $1850 level for a bearish option. Additional support at that level is in the MA200 moving average. If the price cannot sustain above that level, we will see a continuation of the decline to the $1800 support zone. Here we could expect more support because it was a big obstacle for us toward the $2000 level in the previous bullish rally. Potential lower targets are $1750 and $1700 levels.

Market Overview

Australian regulators are concerned about investing in risky crypto assets. What is evident is that the number of cryptocurrency investors continues to grow dramatically. The chairperson of the Australian Securities and Investments Commission has said that investors now have little or no protection by holding their funds in digital assets. The establishment of digital currency regulations is necessary and will provide the necessary security for current and future investors.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.