[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,010 | -10.50 |

| Oil (WTI) | 80.14 | 0.43 |

| 10 year government bond yield | 3.57% | |

| 30 year fixed rate mortgage | 6.19% |

Stocks are lower this morning after Goldman Sachs’s earnings disappoint. Bonds and MBS are down.

The week ahead won’t have much in the way of market-moving data, although we will get retail sales on Wednesday which will be a report on the holiday shopping season and will be a big input into Q4 GDP. We will also get housing starts and existing home sales. Earnings from the financials will be a lot of the main news flow. The World Economic Forum will meet in Davos as well.

The US will hit the debt ceiling this week as well, which promises some kabuki theater from Washington as people make dire predictions over what would happen if the US defaults on its debt. Of course it won’t default.

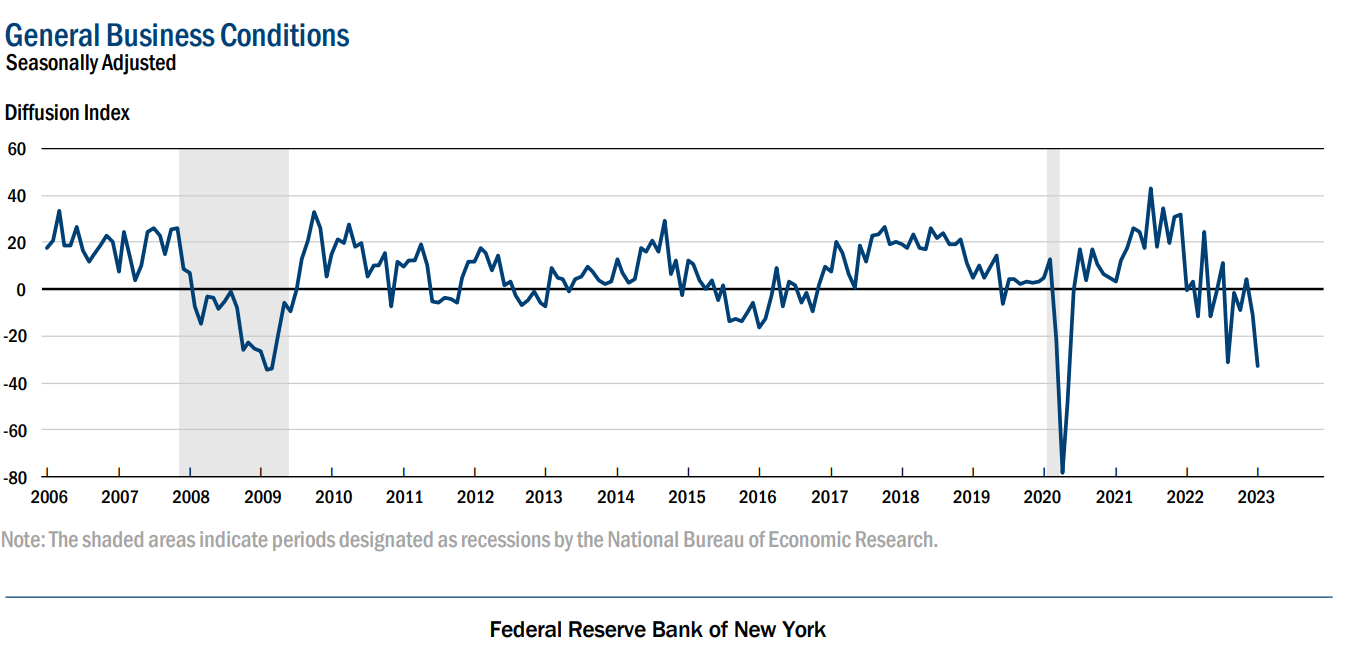

Business Activity contracted sharply in New York State, according to the Empire State Manufacturing Report. We are back at levels seen during the lockdowns and the depths of the Great Recession. This was the fifth worst reading in the index’s history.

On the positive side, the prices paid and prices received indices dropped sharply. Inventory levels are back to normal as well.

Make Arc Home your primary Non-QM and Non-Agency lending partner in 2023. Their dedicated and highly experienced Delegated and Non-Delegated Correspondent sales team can help you identify new prospects to grow your business. Backed by an industry leader, Arc Home offers the most diverse product suite, a smooth client experience, and aggressive pricing. Whether you have been in the Non-QM and Non-Agency market for years or are looking to explore the variety of opportunities, Arc Home has the strength and stability to help you navigate a changing market. Contact VP of Correspondent Sales David McPherson or Chief Production Officer Katherine Gardner to review the benefits of doing business and increasing your profits with Arc Home.

The FTC is looking to ban or severely restrict non-compete agreements. This could have some major reverberations in the mortgage banking business. These got overused in the past several years – low level employees in fast food restaurants were subject to them – but it will be interesting to see how industry reacts. Perhaps some LO comp will be deferred?

The economic effects of this will probably be to lift wage inflation, at least a little.

I published another article in my Substack last weekend, and talked about one statistic that jumped out at me. I didn’t mention it here. Check it out and please consider subscribing.

I am accepting ads for this blog as well, if you would like a mention. In addition, if you enjoy the content and would like a white label solution for your company, I would be interested in having a conversation.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.