[ad_1]

After entering our covered call writing and put-selling trades, we can calculate the current status of our trades mid-contract with a few simple entries into our Trade Management Calculator. In this article, a real-life covered call writing example with BMY will be highlighted. Hypothetical examples of closing winning and losing trades mid-contract will be detailed utilizing the spreadsheet.

BMY initial trade details

- 7/5/2022: Buy 100 x BMY at $76.84

- 7/5/2022: STO 1 x 7/22/2022 $78.00 call at $0.98

- 7/12/2022: BMY trading at $80.00; $78.00 call option has an ask price of $2.40 (winning trade)

- 7/12/2022: BMY trading at $74.00; $78.00 call has an ask price of $0.25 (losing trade)

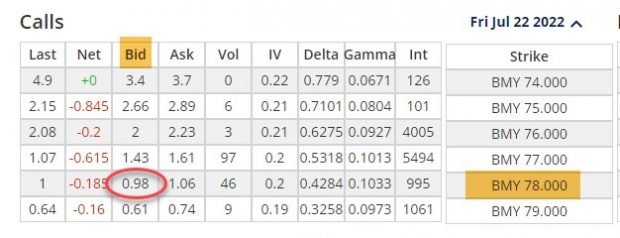

Option-chain for BMY on 7/5/2022

BMY Option-Chain on 7/5/2022

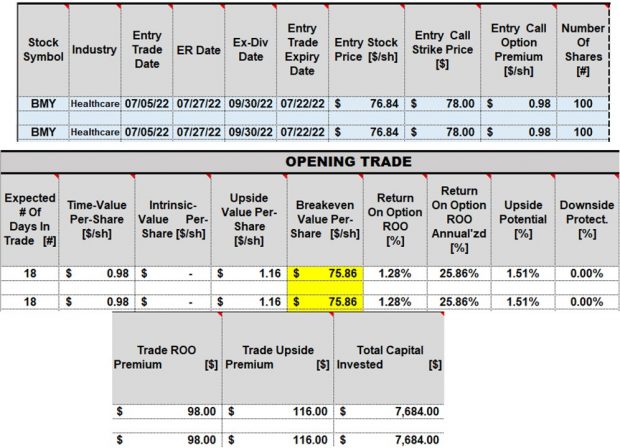

Initial trade entries and calculations

BMY: Initial Trade Entries and Calculations

- Initial time-value return is 1.28%

- Annualized initial return is 25.86% based on an 18-day trade

- Additional upside potential of 1.51% if BMY moves up to or beyond the $78.00 strike

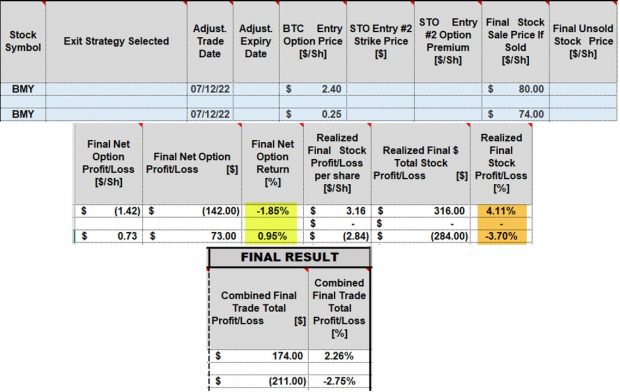

Mid-contract status of winning and losing positions

BMY: Mid-Contract Calculations

When BMY moves to $80.00 (top rows)

- Net option loss of 1.85%

- Net stock gain of 4.11%

- Total $ gain of $174.00 per-contract

- Total % gain of 2.26% from 7/5/2022 to 7/12/2022

When BMY moves to $74.00 (bottom rows)

- Net option gain of 0.95%

- Net stock loss of 3.70%

- Total $ loss of $211.00

- Total % loss of 2.75% from 7/5/2022 to 7/12/2022

Important to note

- Be sure the mid-contract status calculations are deleted and final closing entries made to assess actual final contract calculations

- Mid-contract status calculations can be computed multiple times during the contract with no limitations

- The mid-contract share price can also be entered into the “Final Unsold Stock Price [$/Sh]” column. The calculations will be the same

Discussion

The current status of our option-selling trades can easily be determined with a few simple entries into the BCI Trade Management Calculator. Based on these calculations, we can make decisions regarding the need for trade management implementation.

Holiday discount coupon

holiday15-1

Good for all items in the BCI store and for our Best Discounted Packages

Premium Member Benefits Video

This is a great time to join our premium member community with its stock screening and educational (over 200 videos) benefits. We offer more benefits than ever before. For information, click here.

For video explanation, click here.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan:

I stumbled across BCI about a year ago and purchased The Complete Encyclopedia for Covered Call Writing and it clearly shaped some changes in my buy writing strategies. I also have executed a number of PMCC and too have been refined from a video or two. You have educated and enhanced my processes as I am always looking for an edge.

Sandy

Upcoming event

To request a private webinar for your investment club, hosted by Alan & Barry: [email protected]

Long Island Stock Traders Meetup Group (Private webinar)

Analyzing a 1-Month Covered call Writing Portfolio from Start to Finish

Thursday February 16,2023

7:30 PM ET- 9 PM ET

A real-life example with a $100k ETF Select Sector SPDR portfolio

Covered call writing is a low-risk option-selling strategy that generates weekly or

monthly cash flow. This presentation will demonstrate how to implement this

strategy using a database of only 11 exchange-traded funds for a 1-month option

contract cycle. These are real-life trades taken directly from one of Dr. Ellman’s

portfolios with screenshots verifying each trade. A final monthly contract result

compared to the performance of the S&P 500 will be calculated.

Topics included in this webinar:

What are the Select Sector SPDRs?

How to establish a covered call writing portfolio

What is the role of diversification?

What is the role of cash allocation?

Calculating initial returns

Analyzing each trade in the monthly contract

Final results

Next steps

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************

[ad_2]

Image and article originally from www.thebluecollarinvestor.com. Read the original article here.