[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,875 | 26.00 |

| Oil (WTI) | 77.84 | 1.74 |

| 10 year government bond yield | 3.64% | |

| 30 year fixed rate mortgage | 6.43% |

Stocks are higher this morning on no real news. Bonds and MBS are up.

Mortgage applications rose 0.9% as purchases rose 0.1% and refis rose 6%. “The Federal Reserve raised its short-term rate target last week, but longer-term rates, including mortgage rates, declined for the week, with the 30-year conforming rate reaching 6.34 percent – its lowest level since September,” said Mike Fratantoni, MBA SVP and Chief Economist. “Refinance application volume increased slightly in response but was still about 85 percent below year-ago levels. This is a particularly slow time of year for homebuying, so it is not surprising that purchase applications did not move much in response to lower mortgage rates.”

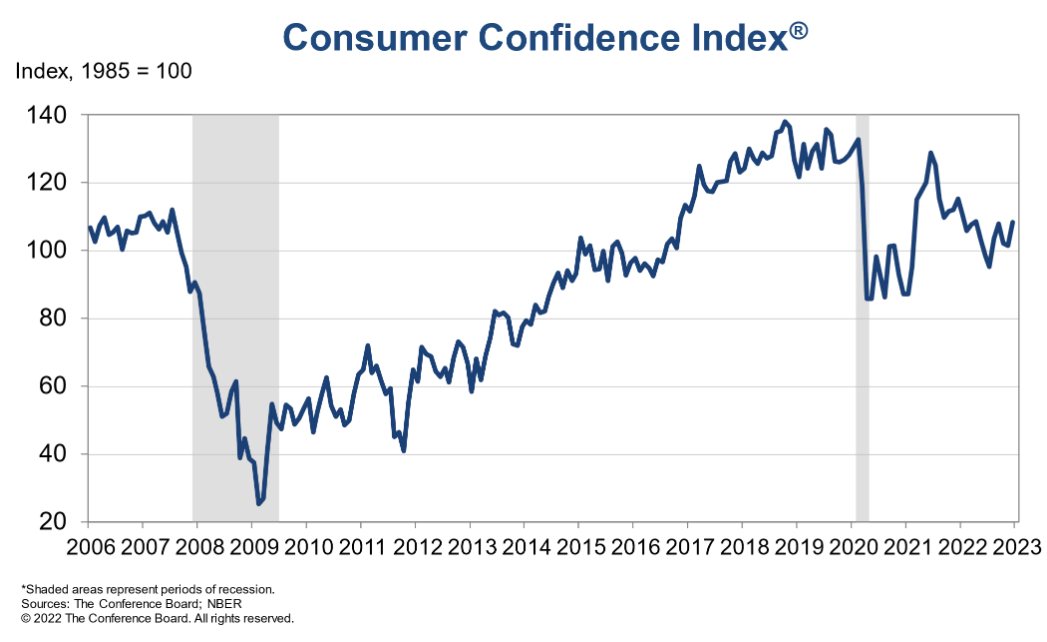

Consumer confidence improved in November, according to the Conference Board. “Consumer confidence bounced back in December, reversing consecutive declines in October and November to reach its highest level since April 2022,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation and Expectations Indexes improved due to consumers’ more favorable view regarding the economy and jobs. Inflation expectations retreated in December to their lowest level since September 2021, with recent declines in gas prices a major impetus. Vacation intentions improved but plans to purchase homes and big-ticket appliances cooled further. This shift in consumers’ preference from big-ticket items to services will continue in 2023, as will headwinds from inflation and interest rate hikes.”

Existing home sales fell 7.1% in November, according to the National Association of Realtors. “In essence, the residential real estate market was frozen in November, resembling the sales activity seen during the COVID-19 economic lockdowns in 2020,” said NAR Chief Economist Lawrence Yun. “The principal factor was the rapid increase in mortgage rates, which hurt housing affordability and reduced incentives for homeowners to list their homes. Plus, available housing inventory remains near historic lows.”

The median home price rose 3.5% on a YOY basis, which is more evidence that home price appreciation is slowing. Affordability has been a big issue, as the first time homebuyer accounted for 28% of sales, which is just above the series low of 26%. Historically, the first time homebuyer has been around 40%.

Yesterday’s bond market sell-off had some people asking about how Japan’s change in policy could cause such a seismic change in US rates. First of all, in the grand scheme of things, yesterday was really just noise. The moves in Japan will have little bearing on US rates longer-term. The move in Japan also caused yields to jump higher in Europe, with the German Bund and UK Gilt yields rising by 15 bps or so.

Sovereign debt markets tend to correlate. This makes sense since global economies are dependent on the health of each other. That said, the Japanese government bond market is different in that the Bank of Japan has a yield cap, which means the Bank of Japan (BOJ) won’t let the Japanese Government Bond (JGB) fall far enough to cause the yield to rise above the cap. It is the way the BOJ decided to conduct QE. This is different than the Fed and ECB’s version of QE, where they bought bonds to push down rates but didn’t draw any bright lines.

I suspect that Japanese bond fund managers (who invest all across the spectrum of sovereign yields) re-weighted their bond portfolios to increase exposure to Japan and sold off Treasuries, Gilts, and Bunds to raise the capital. And I suspect this adjustment will probably wrap up by the end of the year.

United Wholesale CEO Mat Ishbia is purchasing the Phoenix Suns. It would be wild to see a championship between the Cavaliers (which Dan Gilbert of Rocket owns) and the Suns.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.