[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,981 | 20.00 |

| Oil (WTI) | 89.49 | 3.03 |

| 10 year government bond yield | 3.81% | |

| 30 year fixed rate mortgage | 6.73% |

Stocks are higher on follow-through after yesterday’s inflation print. Bonds and MBS are closed for the Veteran’s Day holiday.

Yesterday’s lower-than-expected consumer price index ignited a powerful rally in stocks and bonds yesterday. Now that we have had a day to settle in, let’s take a look at the Fed Funds futures.

The December 2022 FF futures now see a 85% chance of a 50 basis point hike and a 15% chance of a 75 basis point hike. If we hike 50 basis points, then the Fed Funds target rate will be between 4.25% and 4.5%. The December 2023 Fed Funds futures have a wide range of possibilities, however the central tendency is for the final Fed Funds rate to be between 4.25% and 4.5%. The second most common bet is between 4.5% and 4.75%.

Assuming these forecasts are correct, it would mean that the Fed should signal that its dramatic series of rate hikes is finished, and it will wait to see how the data shakes out. We will get one more PCE report and one more CPI report before the December meeting.

Mortgage related stocks were elated on the news yesterday. Mortgage REITs like Annaly Capital jumped 10%. AGNC Investment rose by a similar amount. Originators like Rocket rose 11%. Don’t forget that MBS spreads are extremely wide compared to historical levels. MBS spreads have been pushing 2%, while the historical norm has been around 80 basis points. This means that if the 10 year stays here, at say 3.8%, and MBS spreads return to normal, that would mean mortgage rates can fall another 100 basis points from here, which would imply a sub 6% mortgage rate.

A sub 6% mortgage rate probably won’t move the needle on the refi market, but it will do a lot on the affordability front. That said, there is a psychological anchoring effect going on, where people remember rates above 7% and will think a rate with a 5% handle is low. Given that HELOCs are still not being offered by a lot of big lenders, the cash-out debt consolidation loan could become in vogue again.

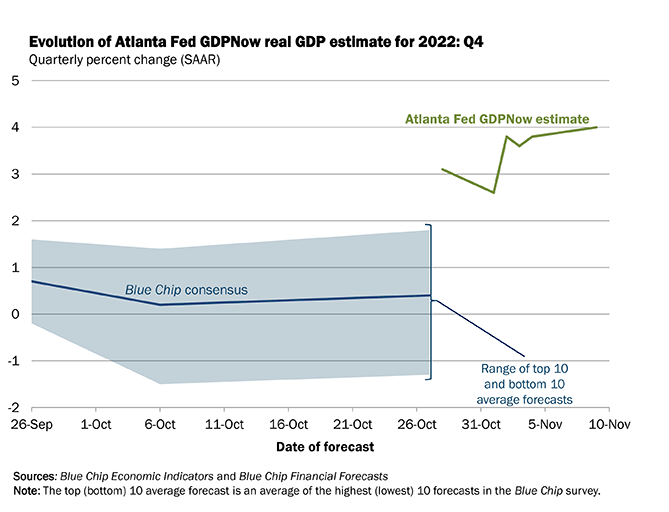

While there is lots of talk about a potential recession, the Atlanta Fed’s GDP Now forecast sees 4% growth in the fourth quarter. This would be extremely rapid growth, however it seems out of step with other forecasts.

This seems surprising given that we are seeing layoff announcements from companies like CH Robinson, which is a logistics company that is sort of a barometer of overall growth. Amazon is looking at cutting costs, which seems strange given that we are heading into the holiday shopping season. I am wondering if the Atlanta Fed is getting some sort of strange reading based on the dollar or inventory build and this will get revised downward later.

Consumer sentiment fell in November, according to the University of Michigan Consumer Sentiment Index. Sentiment for durable goods fell pretty dramatically. Inflationary expectations were unchanged, which is good news for the market, with short run expectations coming in around 5% and longer-term expectations at 3%. Sentiment fell 8.7% compared to October and 19% from a year ago. This is yet another data point that doesn’t square with the Atlanta Fed forecast.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.