[ad_1]

Issue 034, 21 Nov 2021

Do Dividends matter ?

“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in”- John D. Rockefeller

This quote from John Rockefeller, one of the wealthiest people in modern history, beautifully articulates an investor’s love for receiving dividends. Little surprise then that dividend investing remains a very popular investment strategy.

On the other end, you have investing luminaries like Philip Fisher who in his seminal book “Uncommon Stocks and Uncommon Profits” had devoted an entire chapter on how dividends play an insignificant part in an investor’s quest for maximizing returns and finding outstanding companies.

The views of Rockefeller and Philip Fisher represent two diverse views on dividends in the investing world. Dividends and Investors have a strange relationship. Some investors actively seek dividend stocks, some completely ignore them and many are in between.

The short answer to the question “Do Dividends Matter?” : Yes.

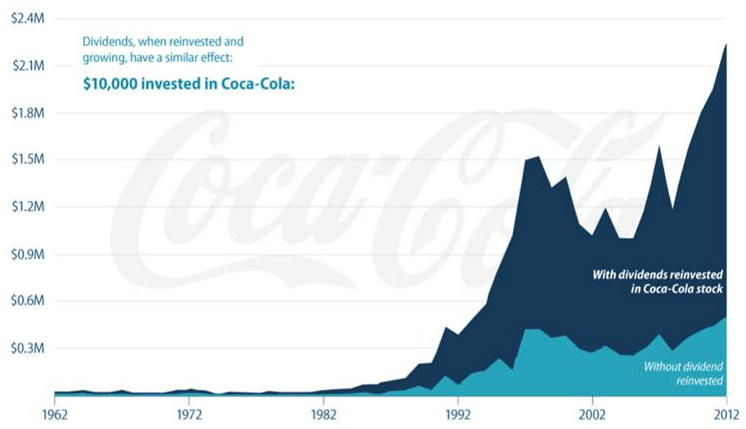

Check out this infographic about USD 10000 of Coca-Cola stock invested in 1962 under two scenarios:

a) Dividends reinvested in the same Coca-Cola stock

b) Dividends not reinvested

The difference: 2 Million USD !!!

For a longer answer, please read the remaining post.

Why Dividends matter

Let’s say you are in the sugar industry crushing sugar canes. The main product is no doubt the “sugar” but there are also useful by-products like Bagasse and Molasses which too have economic value and is used in electricity production, making of paper boards and paper among other things.

So, if you are a sugar factory owner then you should consider your Total returns (both sugar and its by-products). As an investor please remember this example.

You should focus on the holistic returns from the investment activity that means both the capital gains from the sale of securities as well as the dividend income from the securities.

Total Returns = Capital Gains + Dividend Income

There are tons of studies which have shown that Dividends are very crucial for an investor. Research has shown that portfolios with high quality dividend stocks have performed very well over long periods of time. Also, the companies that regularly pay dividends have relatively rewarded the investors handsomely.

Geraldine Weiss

In our earlier issue, we had covered about the Dividend Diva and superinvestor Geraldine Weiss and her dividend value strategy.

The importance of dividend In her own words:

Dividends are the most reliable measures of value in the stock market. Earnings are figures on a balance sheet that can be manipulated for income tax purposes. Earnings can be the product of a clever account’s imagination. Who knows what secrets lie in the footnotes of an earnings report?

Dividends, however, are real money. Once a dividend is paid, it is gone forever from the company. There can be no subterfuge about a cash dividend. It is either paid or it is not paid. When a dividend is declared, you know that the company is in the black. And when a company increases its dividend, you don’t have to read a balance sheet to know that the company has made profitable progress.

In short, dividends don’t lie.”

If you are still skeptical and believe in the saying “Trust in God but everyone else should bring in Data”. Then here are 3 absolutely wonderful insights from three research studies that should make it absolutely clear for all.

Key research on Dividends

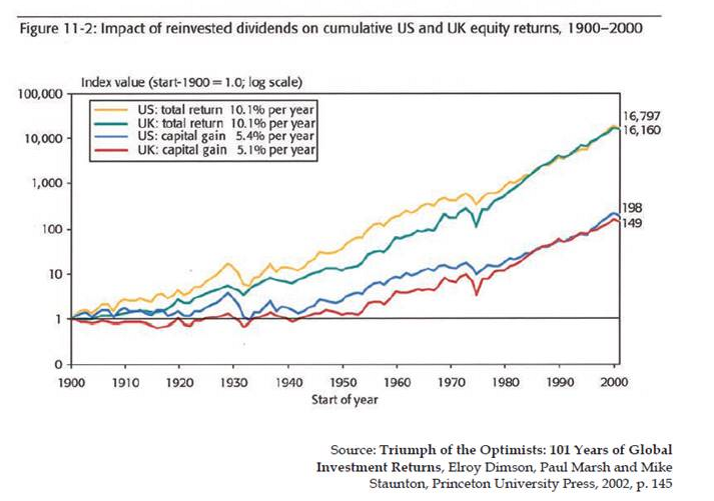

Triumph of optimist – Impact of reinvested dividends

The below chart shows the cumulative contribution of both capital gains and dividends to return of capital in both the US and the UK. It was found that over 101 years a portfolio which included reinvested dividends would have generated nearly 85 times the wealth generated by the same portfolio without reinvesting dividends (only capital gains).

200 years study

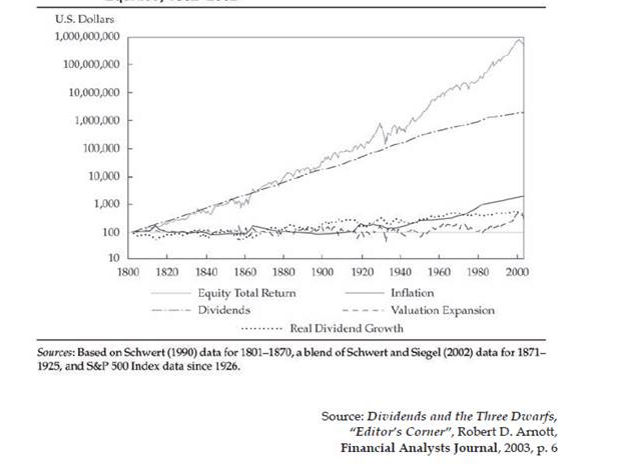

In a seminal paper, Dividends and the Three Dwarfs, Robert Arnot analysed the equity returns for 200 years rom 1802 to 2002 and found that dividends are the main source of returns we can expect from stocks.

The total annualized return for the 200 years was 7.9% out of which 5% was just from dividends. The remaining 2.9% came from inflation, valuation and others.

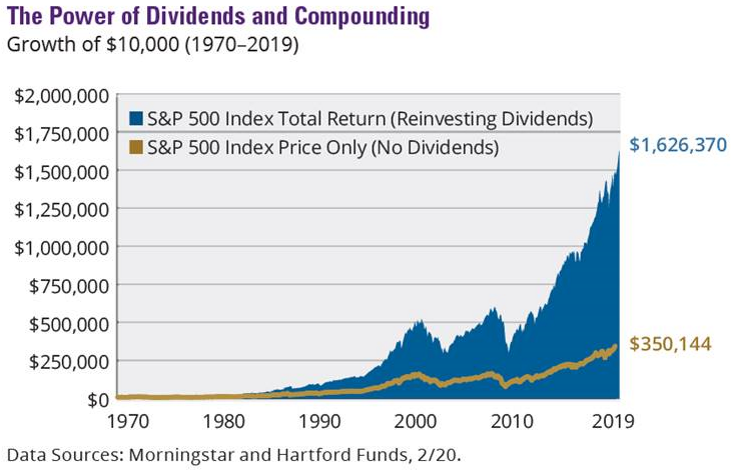

Power of Dividends and Compounding

The below research studied returns of S & P 500 Index from the 1970’s. It found that out of the total return 78% can be attributed to reinvested dividends and the power of compounding.

Final thoughts

The answer to the questions “Do Dividends Matter“ is a resounding “Yes”. As numerous studies have shown that dividends play a significant part in the investor’s portfolio return and sufficient thought should be given about the role dividends in your portfolio.

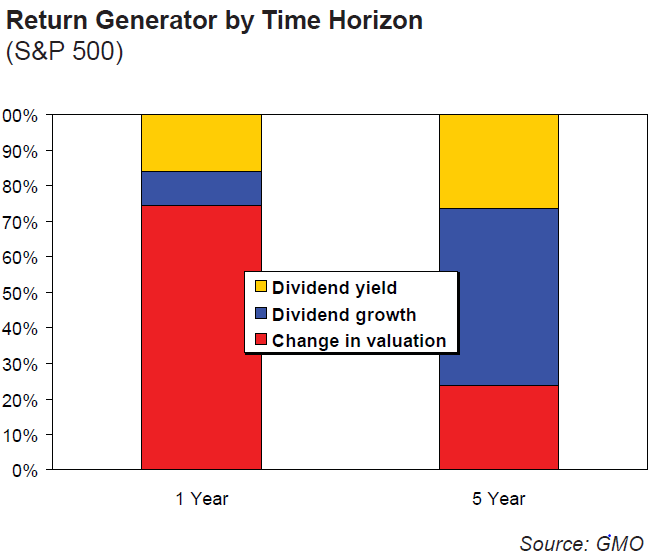

If you are an investor, with a time horizon of more than 1 year then dividends do REALLY matter. Here is an excellent data point from James Montier – for a 5 year horizon dividend yield and growth account for almost 80% of the return.

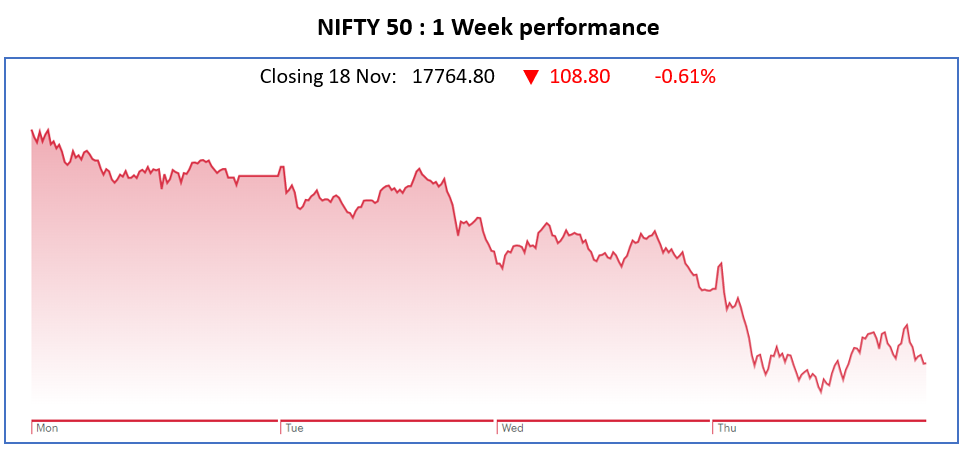

Nifty50 Last Week

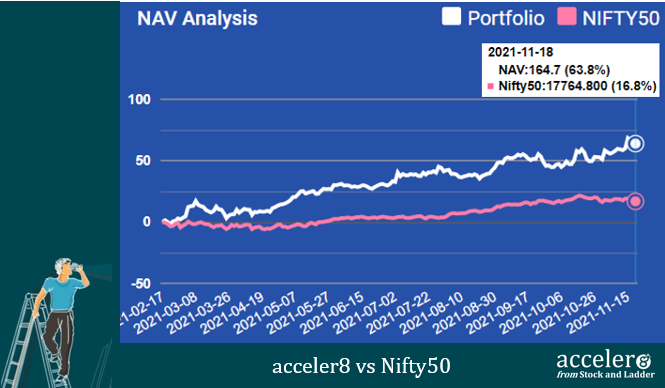

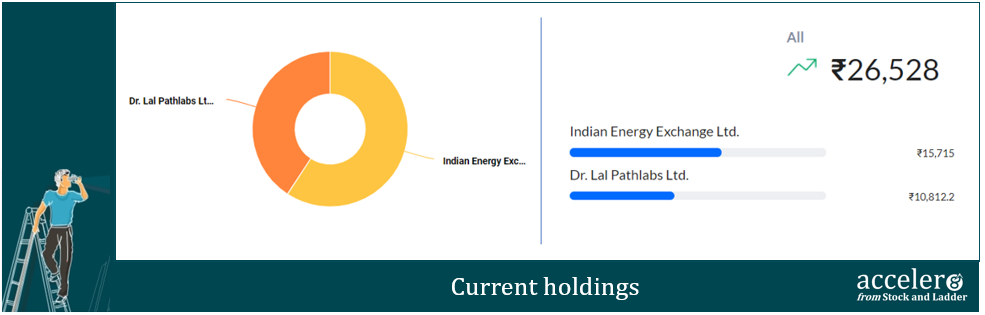

acceler8 Portfolio NAV

#acceler8 continues its strong performance and the portfolio has 47 % outperformance against NIFTY 50.

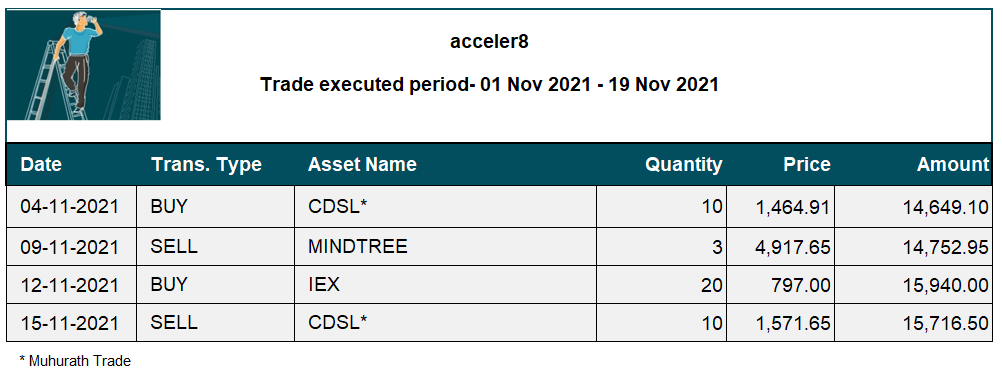

Trades done in November

Current position

We are at 74 % cash reflecting the high valuations.

We will look around for opportunities and will only bite the bullet when a clear opportunity arises. No trades for trade sake.

Happy investing !

Until next week, take care and stay safe.

Do you love Reading?

Check out the best books to read at the Superinvestors Bookshelf

Let’s stay connected, Follow me on Twitter @Stocknladdr

[ad_2]

Image and article originally from stockandladder.com. Read the original article here.