[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,963 | -40.50 |

| Oil (WTI) | 78.79 | 0.43 |

| 10 year government bond yield | 3.48% | |

| 30 year fixed rate mortgage | 6.15% |

Stocks are lower as we kick off earnings season. Bonds and MBS are up.

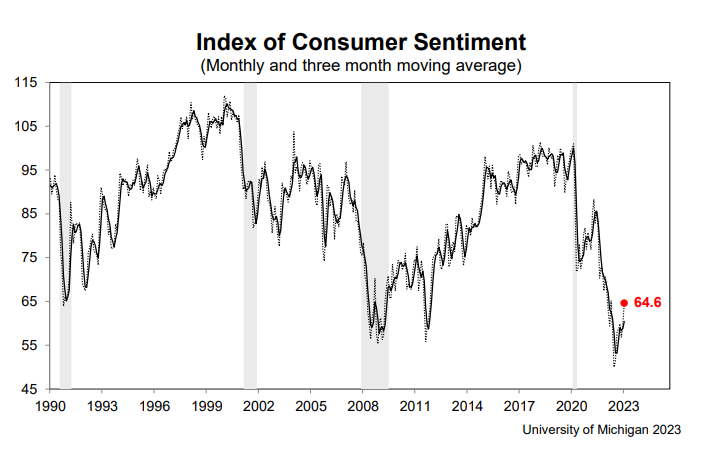

Consumer sentiment improved in January, according to the University of Michigan Consumer Sentiment Survey. The reading on personal finances drove the increase based on higher incomes and lower inflation. These consumer sentiment surveys are highly influenced by gasoline prices, and the decline at the pump is helping things.

Inflationary expectations fell from 4.4% to 4% which is good news for those who want the Fed to take its foot off the brake. Consumer sentiment is still awful overall, stuck at the levels we saw during the Great Recession.

Wells reported a decline in fourth quarter earnings, however there were a lot of special charges which makes a QOQ and YOY comparison difficult. Revenues rose 0.7% QOQ and EPS fell 21% to $0.67. The company took provisions for CFPB settlements, home lending severance, and impairments in its venture capital business.

Delinquencies are starting to tick up, with provisions for credit losses and charge-offs up QOQ and YOY. Credit cards drove the increase. Mortgage originations fell 32% QOQ and 70% YOY to $14.6 billion. The press release didn’t address the exit from correspondent lending, but I am sure it will come up on the conference call.

JP Morgan reported earnings per share climbed 14% QOQ and 7.2% YOY to $3.57 per share. Like Wells, the company built up its reserve for loan losses and increased charge-offs. Mortgage originations fell 45% QOQ and 72% YOY to $6.7 billion.

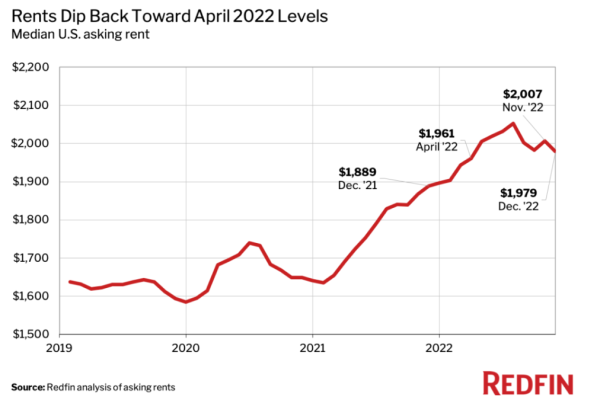

Apartment rental rates rose 5% YOY according to data from Redfin. They were down 1.4% MOM and off 3.6% from the peak set in August. Some of this is seasonality, however the massive growth we saw in 2021 is over, and rents will generally lag home prices by 21 months or so. “Rents have room to fall. While they’ve cooled significantly from their peak, it still costs the typical renter 20% more to take on a new lease than it did two years ago,” said Redfin Economics Research Lead Chen Zhao. “An increase in the number of rentals on the market should also cause rents to ease in the coming months. Rental supply is growing due to an influx of construction in recent years, ebbing household formation and a slow homebuying market, which is driving many homeowners to rent out their properties rather than sell.”

I launched my Substack over the weekend, where I took went over the market’s reaction to the jobs report and the main drivers. The Weekly Tearsheet will take a deeper dive into some of the happenings in the prior week, along with economic commentary. I hope you enjoy it and consider subscribing. If you use this professionally and can expense it, I hope you consider becoming a paid subscriber.

I am accepting ads for this blog as well, if you would like a mention. In addition, if you enjoy the content and would like a white label solution for your company, I would be interested in having a conversation.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.