[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,701 | 17.75 |

| Oil (WTI) | 87.26 | -1.84 |

| 10 year government bond yield | 3.86% | |

| 30 year fixed rate mortgage | 6.98% |

Stocks are higher this morning after yesterday’s dramatic turnaround. Bonds and MBS are up.

Yesterday’s turnaround was quite dramatic. The S&P 500 briefly broke below 3,500 on its way to a close around 3,670. The 10 year briefly touched 4.05% and this morning yields are back where they were before yesterday’s hot CPI print. The yield curve continues to invert, with 2s-10s now negative 53 basis points.

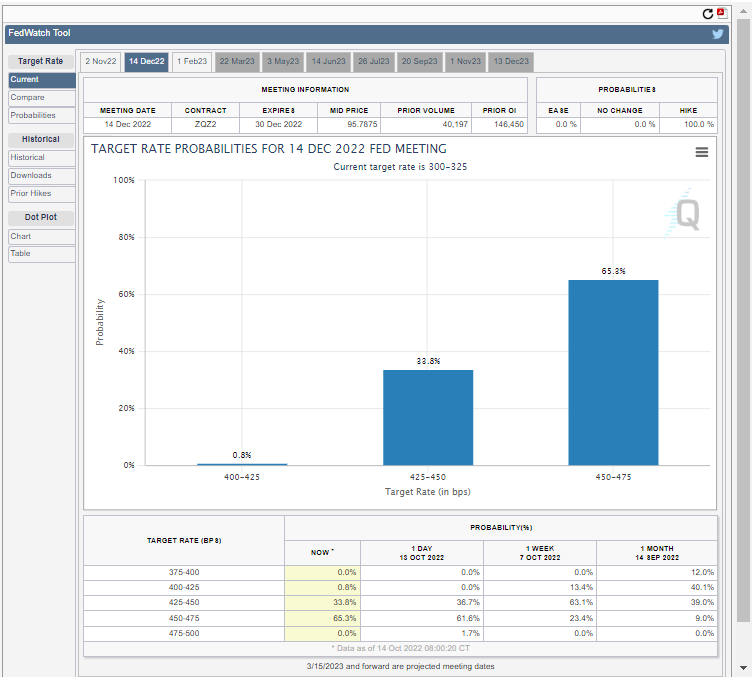

The strong CPI print from yesterday caused the December Fed Funds futures to price in another 25 basis points in tightening. Pre-report, the consensus was a 75 basis point hike in November and 50 in December. Now we are looking at 75 at both meetings.

JP Morgan reported better-than-expected earnings this morning as third quarter earnings season begins. Mortgage volume declined 45% on a quarter-over-quarter basis to $12.1 billion. A year ago, the company did $41.6 billion in originations in the third quarter, which means JPM’s volumes are down 70% YOY.

Overall revenues rose 7% QOQ and 10% YOY, while earnings per share increased 13% QOQ but fell 17% YOY. JPM is up about 2% pre-open.

Wells reported weaker-than-expected numbers, however there are some special items (litigation expense) that are making comparisons difficult. Q3 mortgage origination volume came in at $21.5 billion, which was down 37% QOQ and 59% YOY.

Despite the miss, Wells is up 5% pre-open.

Retail sales were flat in September, according to the Census Bureau. These numbers are not adjusted for inflation. On a year-over-year basis they rose 8.2%, which more or less matches yesterday’s CPI report.

Consumer sentiment improved in October, according to the University of Michigan Consumer Sentiment Survey. Unfortunately, expectations for the year-ahead inflation rate rose to 5.1%. The Fed pays close attention to this number, so this will encourage the Fed to keep pumping the brakes.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.