[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,993 | 36.25 |

| Oil (WTI) | 78.68 | -3.02 |

| 10 year government bond yield | 3.77% | |

| 30 year fixed rate mortgage | 6.59% |

Stocks are higher this morning on no real news. Bonds and MBS are flat.

Existing home sales fell for the ninth month in a row, according to the National Association of Realtors. Sales fell 5.9% MOM to a seasonally-adjusted annual rate of 4.43 million. This is down 28.4% from a year ago. Blame high prices and high mortgage rates, which are negatively affecting affordability.

“More potential homebuyers were squeezed out from qualifying for a mortgage in October as mortgage rates climbed higher,” said NAR Chief Economist Lawrence Yun. “The impact is greater in expensive areas of the country and in markets that witnessed significant home price gains in recent years.”

Yun is talking about California and some of the Western MSAs like Boise Idaho, which experienced rapid price appreciation since the pandemic began. Essentially, people in California sold homes and used the cash to purchase properties in places like Phoenix or Boise. These cash buyers drove up prices higher than could be supported by the local economy.

Now, these cash-rich buyers are disappearing as they cannot sell their homes at the prices they want in California, which means that prices in Boise are falling to what the local economy can support. If Tanner the Tech Bro wants to sell his Casper, Wyoming property, he is going to have to cut the price.

“Inventory levels are still tight, which is why some homes for sale are still receiving multiple offers,” Yun added. “In October, 24% of homes received over the asking price. Conversely, homes sitting on the market for more than 120 days saw prices reduced by an average of 15.8%.“

The median price rose 6.6% YOY to $379,000, which is a 128 month winning streak, the longest on record. This is shutting out first time homebuyers, who only accounted for 26% of sales. This is a record low, and speaks to the affordability issue. Historically that number has been around 40%.

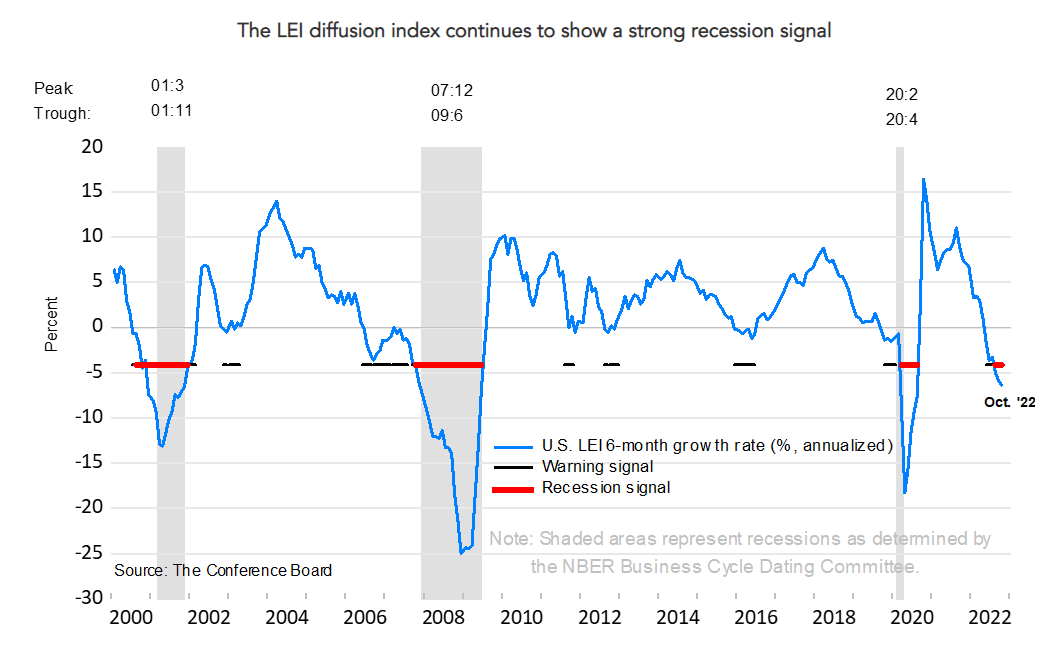

More recessionary indicators: The Conference Board’s Index of Leading Economic Indicators fell 0.8% in October, following a 0.5% decrease in September.

“The US LEI fell for an eighth consecutive month, suggesting the economy is possibly in a recession,” said Ataman Ozyildirim, Senior Director, Economics, at The Conference Board. “The downturn in the LEI reflects consumers’ worsening outlook amid high inflation and rising interest rates, as well as declining prospects for housing construction and manufacturing. The Conference Board forecasts real GDP growth will be 1.8 percent year-over-year in 2022, and a recession is likely to start around yearend and last through mid-2023.”

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.