- The price of gold yesterday stopped at $1765 and failed to climb to the $1770 resistance level.

- The silver price continues its sideways consolidation in the $19.00-$19.25 range.

- St. Louis Fed President James Bullard agreed that interest rates are still on the rise.

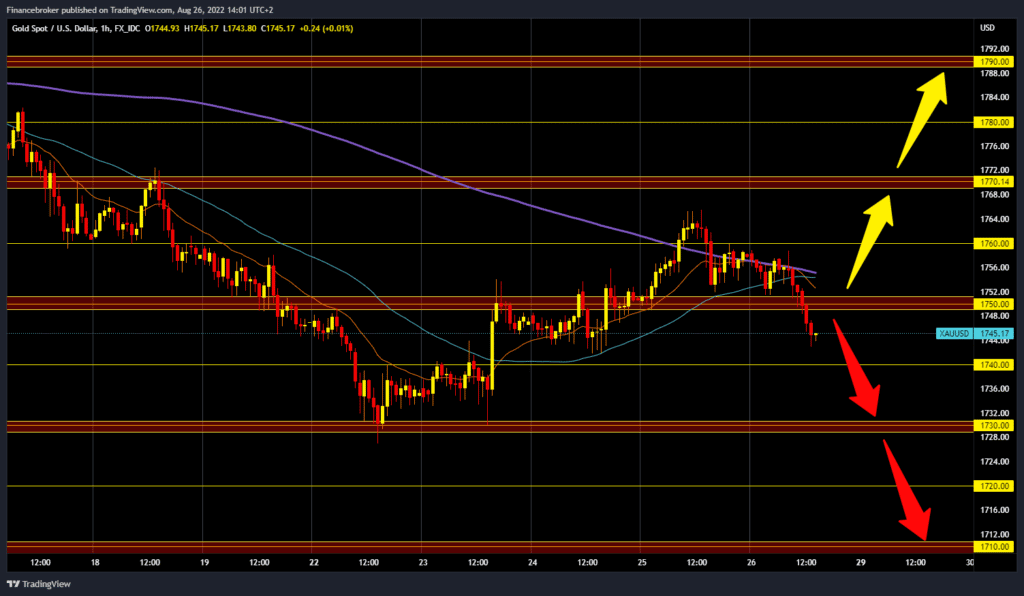

Gold chart analysis

The price of gold yesterday stopped at $1765 and failed to climb to the $1770 resistance level. This drop was followed by a pullback of the price below $1760 and today below the $1750 level. The moving averages are again on the bearish side, and we can now see a continuation of the bearish trend. We need a negative consolidation and descent to the $1740 level. And if we do not find support there, we will see a break below and the continuation of the fall in the price of gold to $1720, this week’s support zone. For a bullish option, we need a new positive consolidation and a return above the $1750 level. Then we need to make another step to the $1760 level, to be above the moving averages. Potential higher targets are $1770 and $1780.

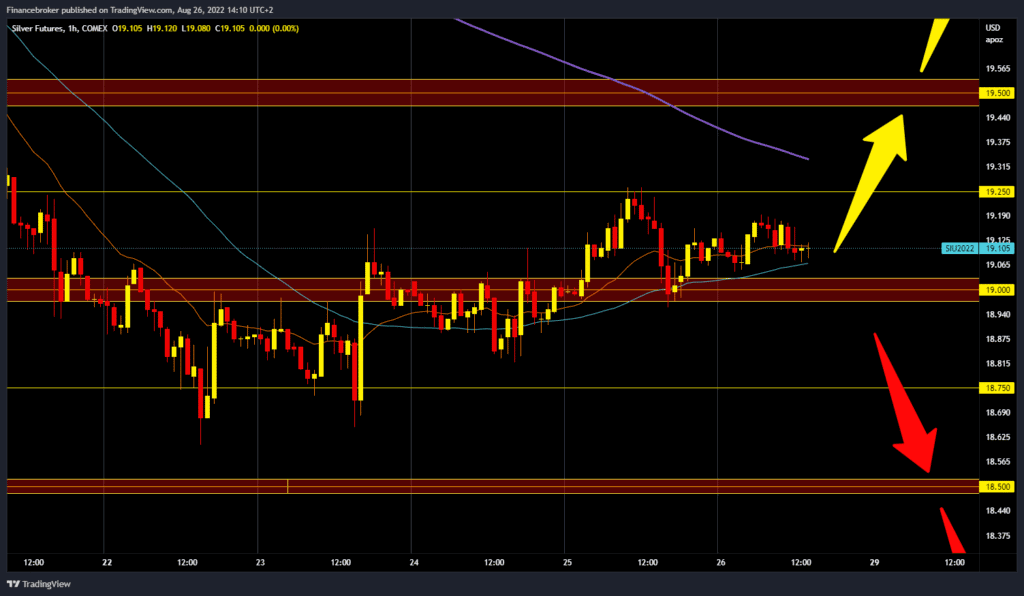

Silver chart analysis

The silver price continues its sideways consolidation in the $19.00-$19.25 range. There are no significant price movements during the Asian trading session. We are in a mild bullish trend since the beginning of the week when the price dropped to $18.62. By the end of the day, if this trend continues, the price could rise to the $19.25 level. For a bullish option, we need a continuation of this positive consolidation to the upper resistance level. A price break above would be a positive step. The first potential resistance is at $19.30 and the MA200 moving average. If we manage to climb above, the potential higher target is the $19.50 level. For a bearish option, we need a negative consolidation and a drop in the price of silver below the $19,00 support level. With increased bearish pressure, the price would likely continue to move lower. Potential lower targets are $18.75 and $18.50 levels.

Market Overview

St. Louis Fed President James Bullard agreed that interest rates are still on the rise. And Kansas City Fed President Esther George said the Fed has not yet raised interest rates to levels that would have a stronger impact on the economy and that we may see the rate above 4% for a while. The focus still remains on Fed Chairman Jerome Powell at today’s symposium in Jackson Hole.

BONUS VIDEO: Weekly news summary from the markets

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.