[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,792 | -16.50 |

| Oil (WTI) | 84.22 | -1.89 |

| 10 year government bond yield | 4.16% | |

| 30 year fixed rate mortgage | 7.16% |

Stocks are lower this morning as earnings continue to come in. Bonds and MBS are up.

The FHFA House Price Index declined 0.7% in August. Prices were up 11.9% from a year ago. “U.S. house prices declined in August at a similar pace to the previous month. This is the first time since March 2011 that the index has seen two consecutive months of decline.” said Will Doerner, Ph.D., Supervisory Economist in FHFA’s Division of Research and Statistics. “The recent monthly decline solidifies the deceleration of 12-month house price growth that began earlier this year. Higher mortgage rates continued to put pressure on demand, notably weakening house price growth.”

The index value for August was 392.03. The 10/1/21 index value was 357.59. This works out to be a 9.63% increase over the past 11 months. This would put the 2023 conforming loan limit around $709,500, with one last data point needed.

Separately, the S&P CoreLogic Case-Shiller Index reported a 0.3% monthly decline in July (it is a month behind FHFA). Prices rose at a 15.8% annual clip, with the Southeast showing the biggest growth. The leading cities were Miami and Tampa.

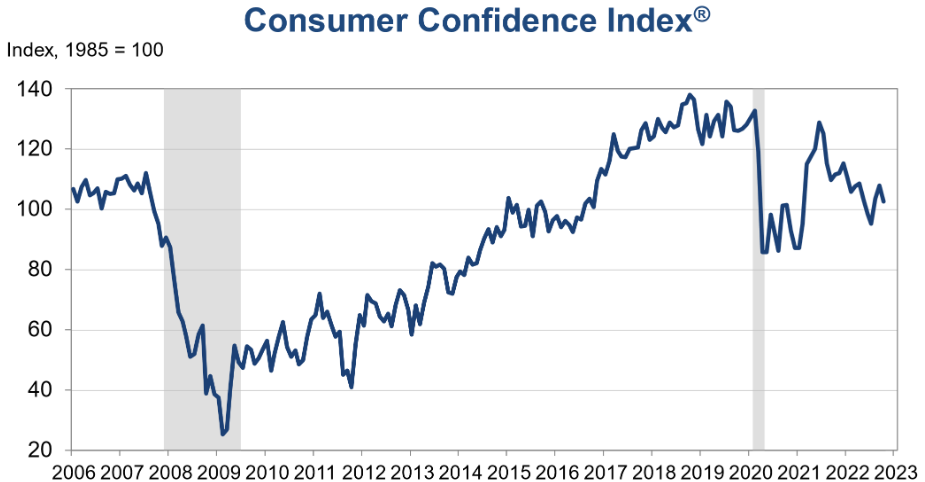

Consumer confidence declined in October, according to the Conference Board.

“Consumer confidence retreated in October, after advancing in August and September,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation Index fell sharply, suggesting economic growth slowed to start Q4. Consumers’ expectations regarding the short-term outlook remained dismal. The Expectations Index is still lingering below a reading of 80—a level associated with recession—suggesting recession risks appear to be rising.”

“Notably, concerns about inflation—which had been receding since July—picked up again, with both gas and food prices serving as main drivers. Vacation intentions cooled; however, intentions to purchase homes, automobiles, and big-ticket appliances all rose. Looking ahead, inflationary pressures will continue to pose strong headwinds to consumer confidence and spending, which could result in a challenging holiday season for retailers. And, given inventories are already in place, if demand falls short, it may result in steep discounting which would reduce retailers’ profit margins.”

Note that we will be getting the first estimate of Q3 GDP on Thursday. The Atlanta Fed’s GDP Now index sees a gain of 2.9%. This seems out of step with the majority of the economic reports, but perhaps the comment about retailer inventories, specifically inventories in place, explains it.

If retailers built up inventory for the holiday shopping season, that would bump up Q3 GDP, but if the sales don’t materialize it would mean Q4 is looking rough. And if retailers are forced to discount in order to move the merchandise, then that will dampen inflation.

I suspect that this will push the Fed to begin to slow the rate hikes, and we could see the Fed signal that with its December projections. Don’t forget that all of these summer and fall rate hikes haven’t had time to impact the economy yet.

The MBA issued a statement supporting Fannie and Freddie’s steps to widen credit scoring and appraisals to open credit to underserved borrowers.

“Given the ongoing affordability challenges facing homebuyers, FHFA’s targeted adjustments to the GSEs’ pricing framework announced by Director Thompson at MBA’s 2022 Annual Convention are well-timed and will improve access to credit for low- and moderate-income households, first-time buyers, and minority buyers.

“The announced updates on credit scoring models should help broaden the scope of eligible borrowers and expand access to homeownership for underserved communities. MBA supports competition in the credit scoring space, and we will work with FHFA to ensure costs and the implementation process are monitored to mitigate unintended consequences to lenders and borrowers.

“FHFA’s increased focus on appraisal transparency – a years-long recommendation by MBA – will help the industry work together on data collection, with a shared goal of providing more accurate and equitable appraisals for borrowers.”

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.