[ad_1]

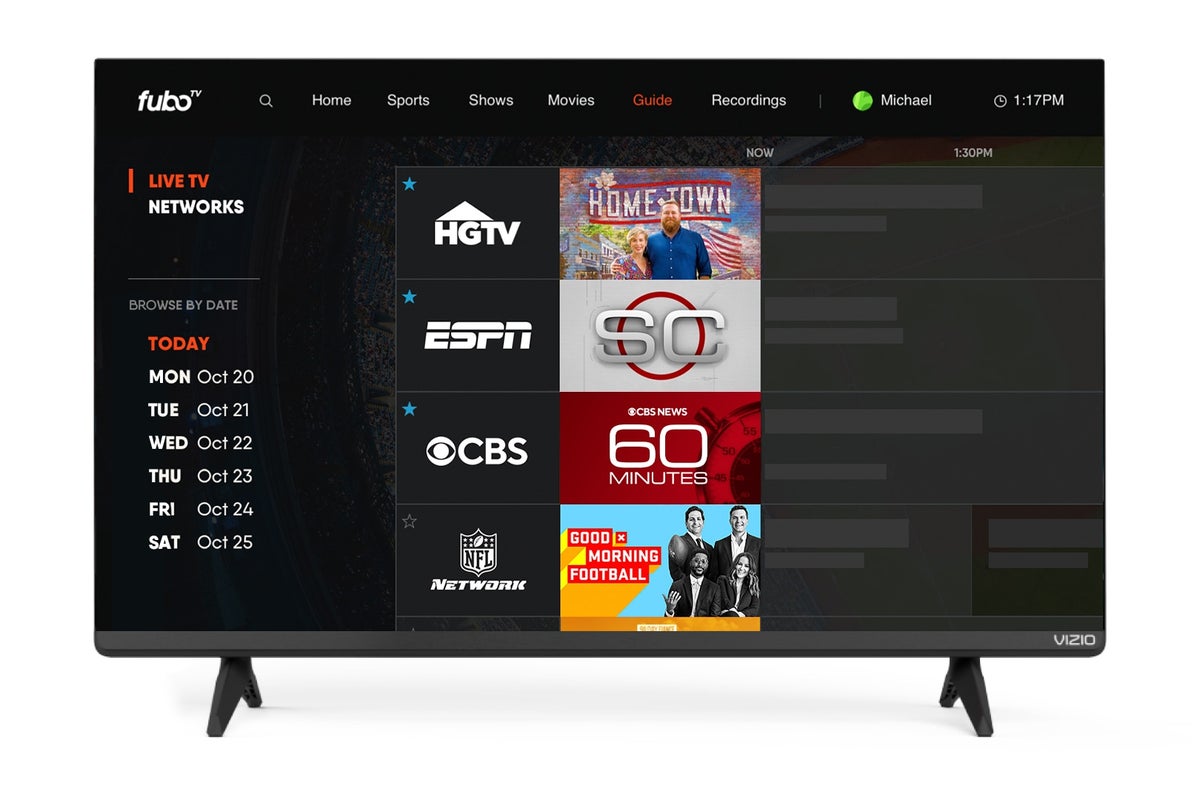

Fubotv Inc FUBO is a streaming platform primarily focusing on live sports. On Tuesday afternoon, the company hosted its Investor Day as shares traded up more than 40%.

What Happened: The stock traded higher on Tuesday on higher-than-normal volume ahead of Investor Day. It is possible traders were buying the stock for a potential positive catalyst to be announced at Investor Day. But other stocks, such as Bed Bath & Beyond Inc BBBY and GameStop Corp. GME, also shot up on Tuesday.

Henry Ahn, the chief business officer for FuboTV, told investors FuboTV’s mission has always been to be the premier streaming platform for live sports. In fact, at one point Walt Disney Co DIS, which owns ESPN, was invested in FuboTV.

The company also announced plans to make live betting odds available on its platform.

“We will give users a reason to stick around and pay for our steaming service,” Ahn said.

FuboTV affirmed its target of a positive cash flow by 2025 and expects to grow CAGR 20%+ from 2022-2025.

FuboTV’s stock was one of many stocks, like the aforementioned Bed Bath and Beyond and GameStop, that skyrocketed during the 2020-2021 bull run. FuboTV’s stock went from around $8 before the COVID-19 pandemic crash in 2020 to more than $50 at its highs in February 2021.

FUBO Price Action: Shares were trading around $4.40 at the open on Tuesday, but jumped up to around $8 before Investor Day started. Since the event started at 2:30 pm ET, the stock has traded slightly lower. At market close, the stock was up 44.98% at $6.35 and is up 2.05% at $6.48 after hours.

[ad_2]

Image and article originally from www.benzinga.com. Read the original article here.