[ad_1]

- The price of gold continues its bearish trend from last week, dropping from $1750 to the $1730 level.

- The price of silver is also in a bearish trend due to the strong dollar.

- Tomorrow, S&P Global will release preliminary surveys of manufacturing and services PMIs for August.

Gold chart analysis

The price of gold continues its bearish trend from last week, dropping from $1750 to the $1730 level. The dollar index continues to strengthen, which affects all commodities denominated in dollars. Currently, the price has stopped at the $1730 level, and for now, it is making a short recovery to the $1734 level. We need a minimum price jump to the $1740 level to move away from this morning’s low. At the $1740 level, a potential additional resistance can be the MA20 moving average. The MA50 is in the zone around the $1750 level, our initial position this morning. For a bearish option, we need a continuation of the negative consolidation and a return of the price below the $1730 level. Potential lower targets are $1720 and $1710 levels.

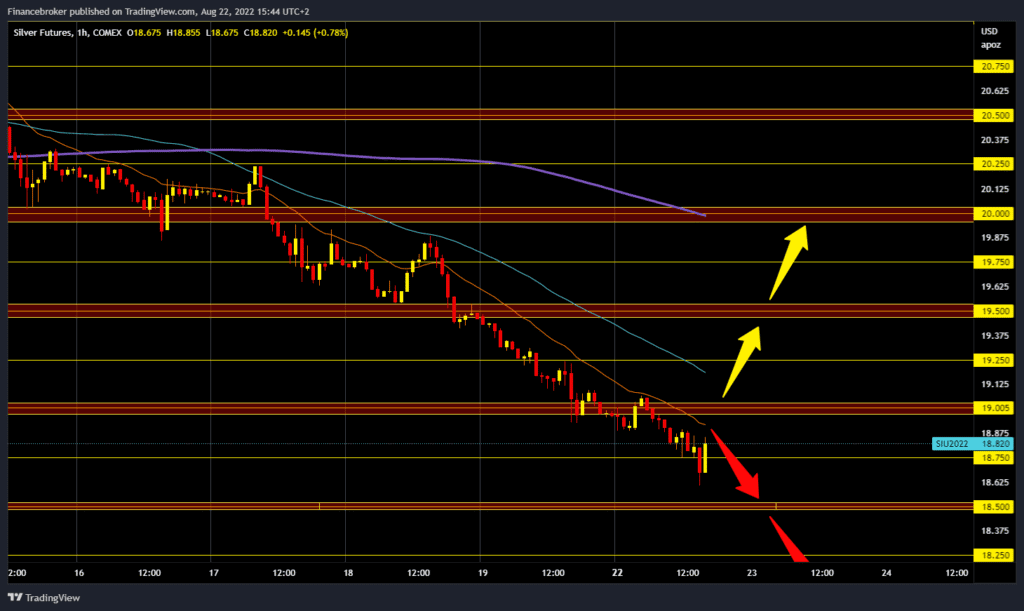

Silver chart analysis

The price of silver is also in a bearish trend due to the strong dollar. During the Asian trading session, the price pulled back below $19.00. Today’s low is at $18.62, and we are now testing the $18.75 level. There is a high probability that we will see a further pullback to the $18.50 level. The price is in retreat after it climbed to the $20.80 level last week. For a bullish option, we now need a new positive consolidation and a return above the $19.00 level. If we were to succeed, the price of silver would find support in the MA20 moving average. Potential higher targets are $19.25 and $19.50 levels. We need a negative consolidation to the $18.50 support zone for a bearish option. Continuing the strong dollar and increasing bearish pressure would push the price below this support level. Potential lower targets are $18.25 and $18.00 levels.

Market overview

Tomorrow, S&P Global will release preliminary surveys of manufacturing and services PMIs for August. If the polls point to subdued inflation, the dollar may find it difficult to maintain its strength, which could push the price of gold into positive territory.

BONUS VIDEO: Weekly news summary from the markets

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.