[ad_1]

- The price of gold fell to the $1790 level.

- During the Asian trading session, the price of silver retreated from the $20.75 level.

- The release of disappointing macroeconomic data from China led investors to believe that a slowdown in the economy could significantly affect the outlook for demand for gold as a safe haven.

Gold chart analysis

The price of gold retreated from the $1800 level, and during the Asian trading session, the price fell to the $1790 level. In the European session, we see the continuation of the retreat of the gold price to the $1772 level. Chances are increasing that this week will be very bearish for the price of gold. We need a continuation of the negative consolidation and a further pullback below the $1770 level for a bearish option. Below, the potential targets are the $1760 and $1750 levels. For a bullish option, we need a new positive consolidation and return in the price above the $1790 level. After that, we could try to climb up to the $1800 resistance zone. Potential higher targets are $1810 and $1820 levels.

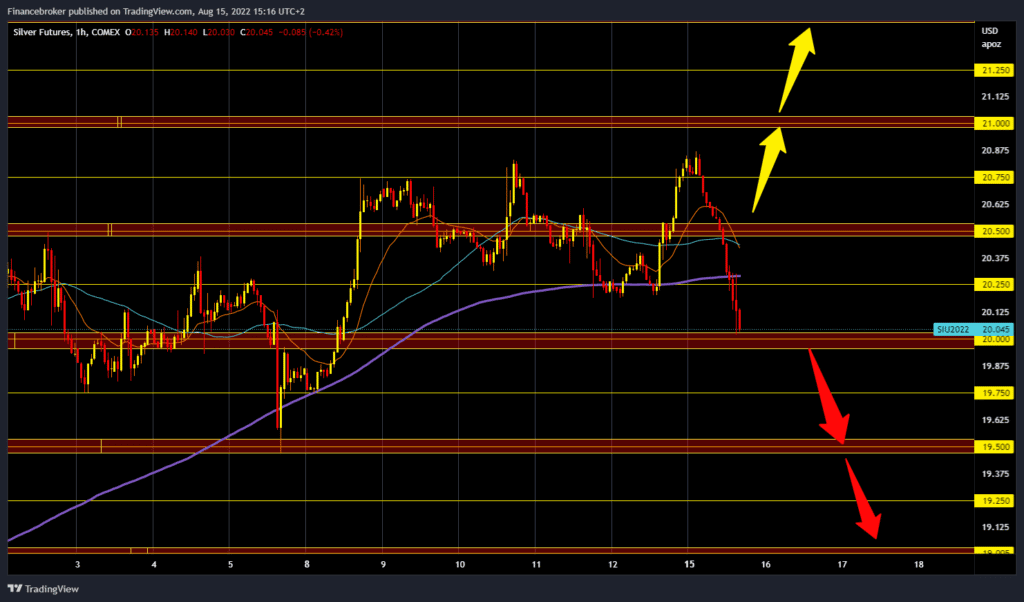

Silver chart analysis

During the Asian trading session, the price of silver retreated from the $20.75 level. The price has already fallen to the $20.00 level and is now looking for potential support here. The support of the MA200 moving average at the $20.5 level was also broken. If we do not find support at the current level, the price of silver could continue the current trend and fall below the $20.00 level. Potential lower targets are $19.57 and $19.50 levels. We need a new positive consolidation and a new bullish impulse for a bullish option. The first target and obstacle is at the $20,25 level due to the MA200 moving average. A break above would help the silver price to release bearish pressure and continue its recovery. After that, we reach the $20.50 level of last week’s consolidation. Potential higher targets are $20.57 and $21.00 levels.

Market Overview

The release of disappointing macroeconomic data from China led investors to believe that a slowdown in the economy could significantly affect the outlook for demand for gold as a safe haven. The increase in risk caused the dollar to strengthen on Friday, and such a trend continued today, the first day of the new week.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.