[ad_1]

- During the Asian trading session, the price of gold again fell below the $1,700 level and stopped at the $1,690 level.

- During the Asian trading session, the price of silver fell to support at the $17.75 level.

- Price pressures in the US economy at +8.5% in July indicate that the inflation rate has now peaked and a downward cycle has begun.

Gold chart analysis

During the Asian trading session, the price of gold again fell below the $1,700 level and stopped at the $1,690 level. After that, we saw an attempt to recover, but only up to the $1708 level. Then there was a new pullback, and the price of gold is again looking for support at the $1700 level. We need a continuation of this negative consolidation and a retest of support at the $1690 level for a bearish option. A break below would mean that we will form a new lower low and continue the bearish trend. Potential lower targets are $1680 and $1670 levels. We must first hold above the $1700 level for a bullish option. After that, with bullish consolidation, the price of gold could continue its recovery. Our main target is the $1720 level. If we succeeded in going higher, we would get additional support in the MA200 moving average. Potential higher targets are $1730 and $1740 levels.

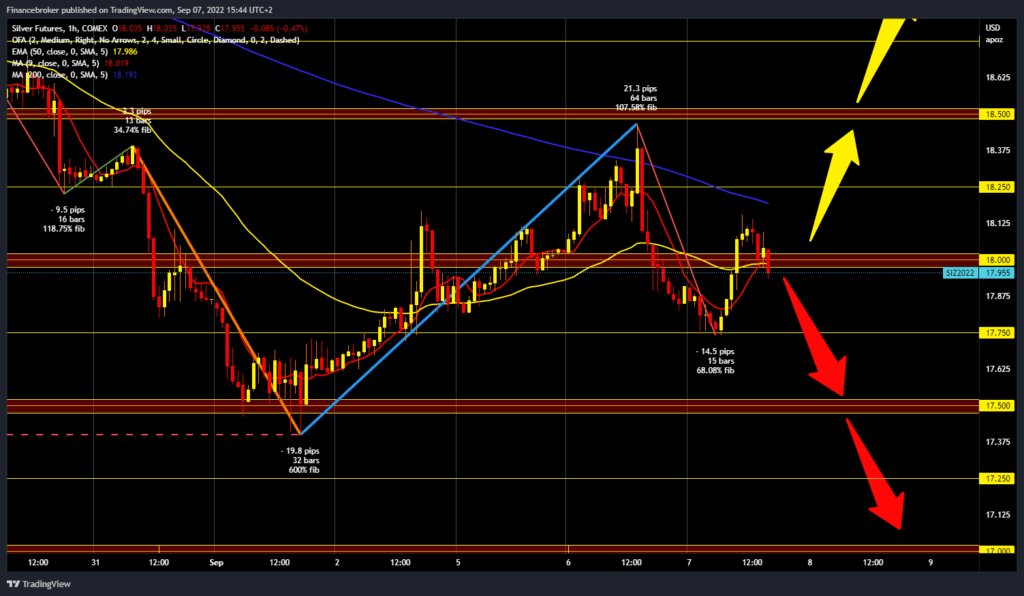

Silver chart analysis

During the Asian trading session, the price of silver fell to support at the $17.75 level. Then followed a recovery to the $18,125 level, where we encountered resistance. The MA200 moving average provides additional resistance at that level. To continue the bearish option, we need further negative consolidation and a break below this morning’s support at $17.75. Then we would go down again to the $17.50 support level. And if the pressure on the price were to continue, a break would be likely, and the potential lower targets are $17.25 and $17.00 levels. For a bullish option, we need a new positive consolidation and a return to a safer zone above the $18.25 level. After that, we could expect further price recovery. Potential higher targets are $18.50, yesterday’s high, and the $18.75 level.

Market Overview

Price pressures in the US economy at +8.5% in July indicate that the inflation rate has now peaked and a downward cycle has begun. The figure of 8.5% is far from the desired rate of 2%. This is why the Fed cannot stop the rate hike cycle until the CPI shows a significant decline.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.