[ad_1]

- Yesterday, the price of gold managed to form a new August maximum at $1795.

- The price of silver manages to stay above $20.00 for now.

- The US dollar regained strength on the last day of the week, which turned out to be the critical factor exerting downward pressure on the price of gold.

Gold chart analysis

Yesterday, the price of gold managed to form a new August maximum at $1795. During the Asian session, the price of gold hovered around $1790. In the EU session, the price was a pullback to the support at the $1785 level. We need a negative consolidation to continue the bearish pullback to $1780. Additional support at that level is in the MA50 moving average. Our biggest support zone is at $1770, and our MA200 is in the zone at around $1760. For a bullish option, we need to consolidate again above the $1790 level. If we were to succeed, we would probably climb up to the $1,800 level. Potential higher targets are $1810 and $1820 levels.

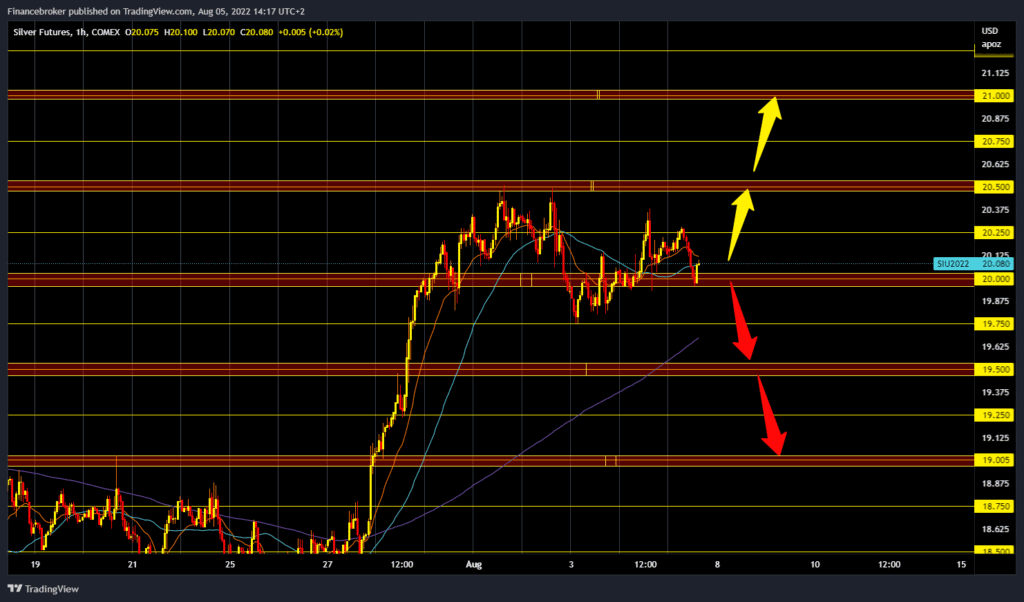

Silver chart analysis

The price of silver manages to stay above $20.00 for now. In the first part of the day, we had an attempt to climb above $20.25 but without success. We saw a pullback to $19.75, where the MA20 moving average awaits us. A break below that level would form a double top on the chart, and the silver price would likely continue the pullback. Potential lower targets are $19.50, $19.25 and $19.00 levels. We need a new positive consolidation and up to $20.50 of this month’s resistance zone for a bullish option. Breaking above the price of silver would form a new higher high. This would open up space for the next targets. Potential higher targets are $20.75 and $21.00 levels.

Market Overview

The US dollar regained strength on the last day of the week, which turned out to be the critical factor exerting downward pressure on the price of gold. Despite sharp remarks from several Fed officials this week, investors continue to resist the idea of a bigger rate hike at the FOMC’s September meeting. Rising recession fears, along with China-Taiwan tensions over US House Speaker Nancy Pelosi’s visit to the island, should support the gold price. China carried out missile strikes in the Taiwan Strait on Thursday. Five missiles landed in Japan’s exclusive economic zone, raising regional tensions.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.