[ad_1]

- Gold prices rose during the Asian trading session.

- The price of silver has been falling for the fourth day in a row, and this morning it stopped at the $19.50

- Recession fears are weighing on investor sentiment and supporting the precious metal, while the hawkish policy is strengthening the US dollar.

Gold chart analysis

The price of gold rose during the Asian trading session as bond yields, and the dollar eased slightly. After the minutes from the US Fed meeting indicated that they may be less aggressive about future rate hikes. In minutes of their July meeting released Wednesday, Fed officials said the pace of future rate hikes would depend on economic data, as well as assessments of how the economy adjusts to higher rates already approved.

Currently, the price of gold manages to climb above the $1770 level and move away from the $1760 support zone. Additional support at this level is provided by the MA20 and MA50 moving averages. Potential higher levels are $1780 and $1790. We need negative consolidation and new pressure on the $1760 support zone for a bearish option. In the continuation, the price of gold could fall and test the $1750 support zone. Potential lower targets are $1740 and $1730 levels.

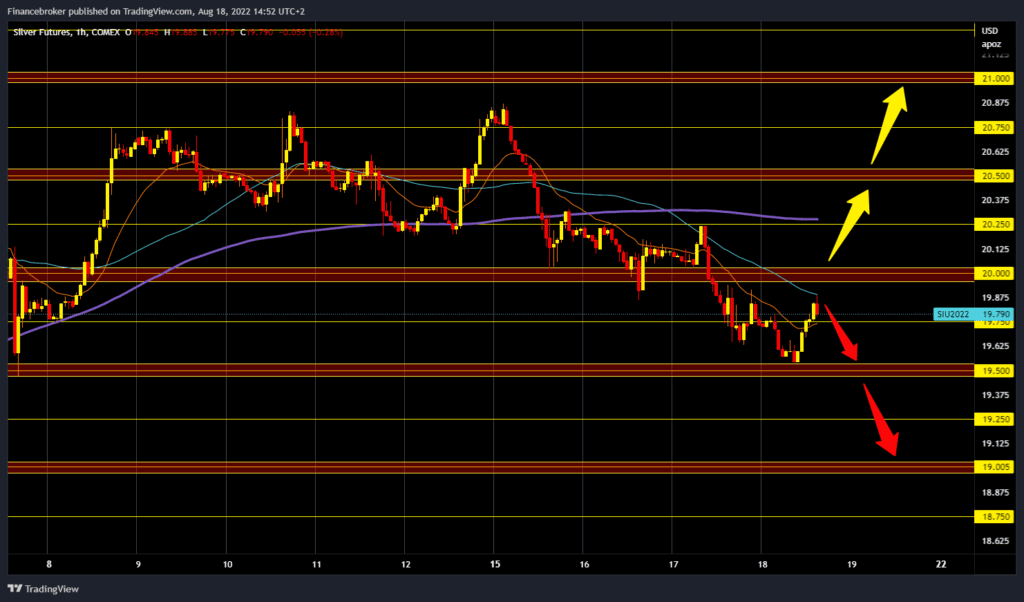

Silver chart analysis

The price of silver has been falling for the fourth day in a row, and this morning it stopped at the $19.50 level. We consolidated below, and a bullish impulse followed above the $19.75 level. By the end of the day, the price of silver could recover to the $20,000 level. If we were to succeed, we would get support in the MA20 and MA 50 moving averages. To continue the bullish option, we need a break above the $20.00 level and manage to stay above it. After that, further recovery of the price of silver could be expected. Potential higher targets are $20.25 and $20.50 levels. We need a negative consolidation and a drop to $19.50 in the bearish zone for a bearish option. Potential lower targets are $19.25 and $19.00 levels.

Market overview

Recession fears are weighing on investor sentiment and supporting the precious metal, while the hawkish policy is strengthening the US dollar, curbing gold price growth. Growing concerns about a global economic downturn continue to weigh on investor sentiment, which is evident in the stock market. Despite signs of a possible easing of inflationary pressures in the US, recent hawkish remarks by several Fed officials suggest the central bank will stick to its policy-tightening path.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.