- The price of gold is in a bearish trend for the second day.

- The price of silver continues its bearish trend for the second day, and now we have fallen below the $20.00 level.

- Despite last week’s softer US CPI report, Fed officials stressed that it was too early to declare victory over inflation and maintained a hawkish tone.

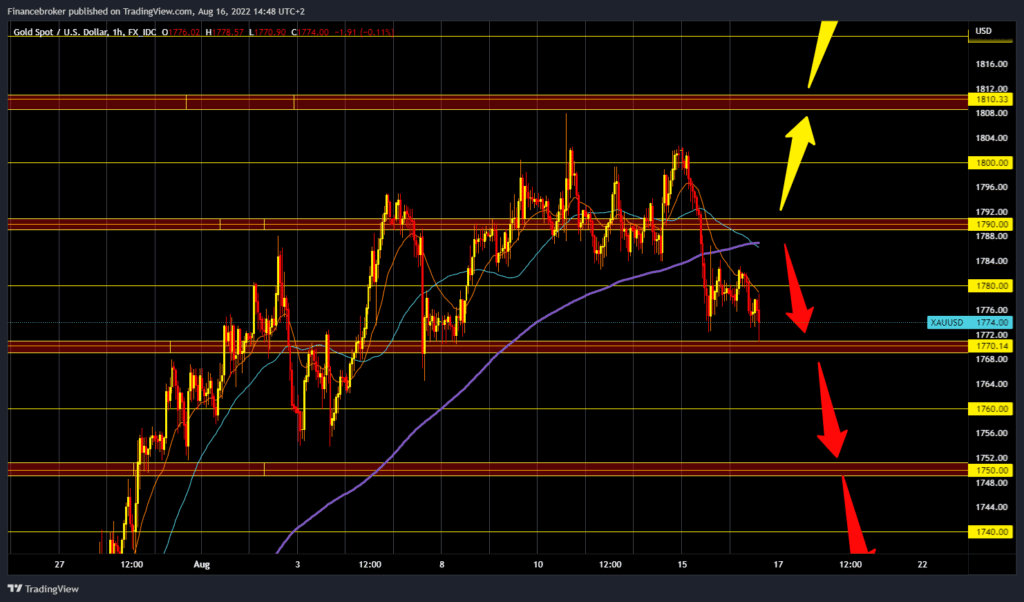

Gold chart analysis

The price of gold is in a bearish trend for the second day. Yesterday we encountered resistance at the $1800 level, and during the Asian session, the price continued to pull back below the $1780 level. Today’s low is at the $1770 level. At that level, we have some support. The dollar is in a bullish trend this week, and such a scenario is very bad for the price of gold. We need a continuation of today’s negative consolidation and a further pullback below the $1770 level for a bearish option. After that, the price of gold could make a deeper pullback. Potential lower targets are $1760 and $1750 levels. We need a new positive consolidation and a return above the $1780 level for a bullish option first. After that, the price could move to the next resistance zone at the $1790 level. Potential higher targets are $1800 and $1810 levels.

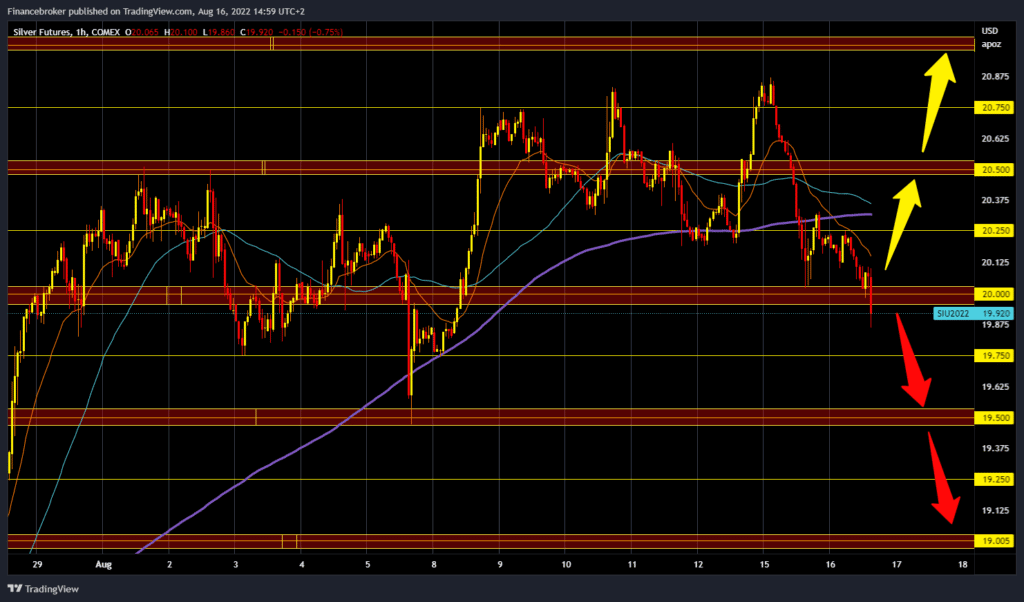

Silver chart analysis

The price of silver continues its bearish trend for the second day, and now we have fallen below the $20.00 level. A strong dollar could push the price even lower. We must continue the negative consolidation and stay below the $20.00 level. Potential lower targets are $19.75 and $19.50 levels. The moving averages are now on the bearish side, and they further complicate and direct the movement of the silver price. For a bullish option, we need a new positive consolidation and a return above the $20.00 level. After that, the price of silver could continue to the $20.25 level, then to the $20.50 higher resistance level. A break above could once again take us up to the $20.75 level.

Market overview

Despite last week’s softer US CPI report, Fed officials stressed that it was too early to declare victory over inflation and maintained a hawkish tone. This suggests that the Fed will stick to its policy-tightening path and continue to support the dollar. Investors will likely look for clues on the possibility of a larger rate hike of 0.75% in September. This could affect the short-term price dynamics of the USD and commodities denominated in dollars.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.