[ad_1]

- During the Asian session, the price of gold rose to $1780.

- Yesterday, the price of silver jumped to the $20.50 level.

- Despite the latest surge in the US dollar, interest in buying the yellow metal remains undiminished.

Gold chart analysis

During the Asian session, the price of gold rose to $1780. This was followed by a pullback to $1770. Where we saw a retest and support in the MA20 and MA50 moving averages. The price of gold once again climbs to $1780, and now we can see a break above and progress to $1790. This week’s main target would be the $1800 level. The dollar is retreating, which is skillfully used by investors investing in golden metal. We need a new negative consolidation and a pullback below the $1770 level for a bearish option. After that, we could see a price drop first to $1760 and then to the $1750 level. The Ma200 moving average is lower in the zone, around $1740.

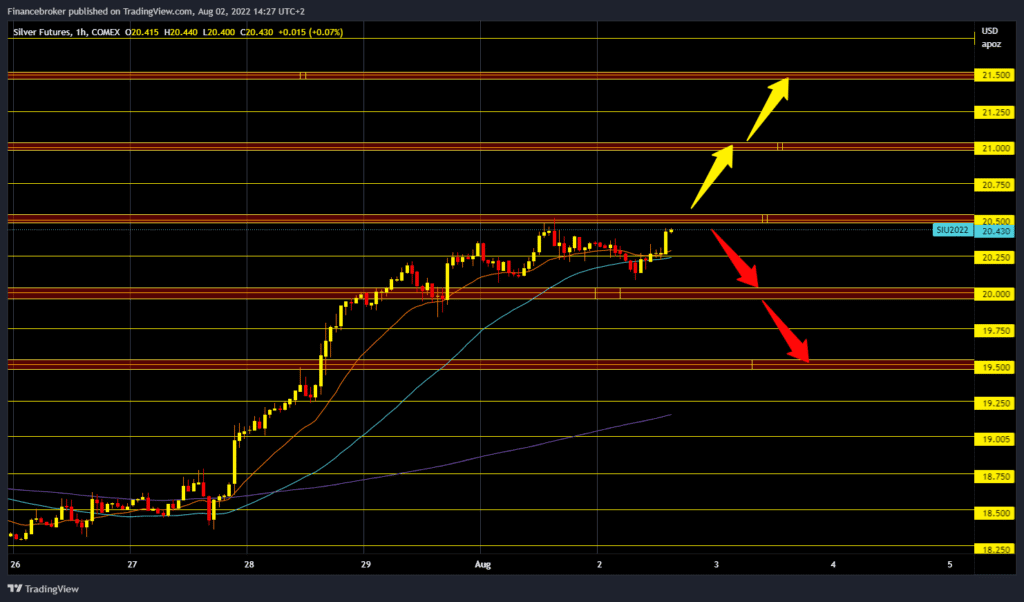

Silver chart analysis

Yesterday, the price of silver jumped to the $20.50 level. During the Asian session, we see a short pullback to $20.10, followed by a new bullish impulse. The price of silver is now at $20.40, and we are once again approaching the $20.50 level. We could now see a break above and a continuation of the bullish trend to $21.00, the next major resistance zone. We need negative consolidation and pressure on the $20.00 level for a bearish option. A break below could reverse last week’s bullish trend. Potential lower targets are the $19.75 and $19.50 levels, and the MA 200 moving average is in the zone around the $19.25 level.

Market Overview

Tensions around Taiwan

Despite the latest surge in the US dollar, interest in buying the yellow metal remains undiminished. Investors prefer to hold gold as a store of value amid escalating tensions between the US and China over Taiwan. Speaker of the US House of Representatives Nancy Pelosi is scheduled to arrive in Taiwan at 14:20 GMT. Both China and Taiwan have strengthened their military resources. The intensification of geopolitical tensions increased the flow of risk into traditional safe-havens, such as bullion and US government bonds, which negatively affected Treasury yields. The ongoing decline in yields will likely continue to weigh on the dollar.

According to Win Thin, global head of currency strategy at BBH, the US dollar received some support from haven flows on Tuesday amid rising diplomatic tensions following US House Speaker Nancy Pelosi’s planned visit to Taiwan. This week, he continues to stick to his medium-term bullish outlook on the dollar ahead of Fed speakers and important US macro data.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.