[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,189 | 65.50 |

| Oil (WTI) | 90.19 | -0.53 |

| 10 year government bond yield | 2.74% | |

| 30 year fixed rate mortgage | 5.45% |

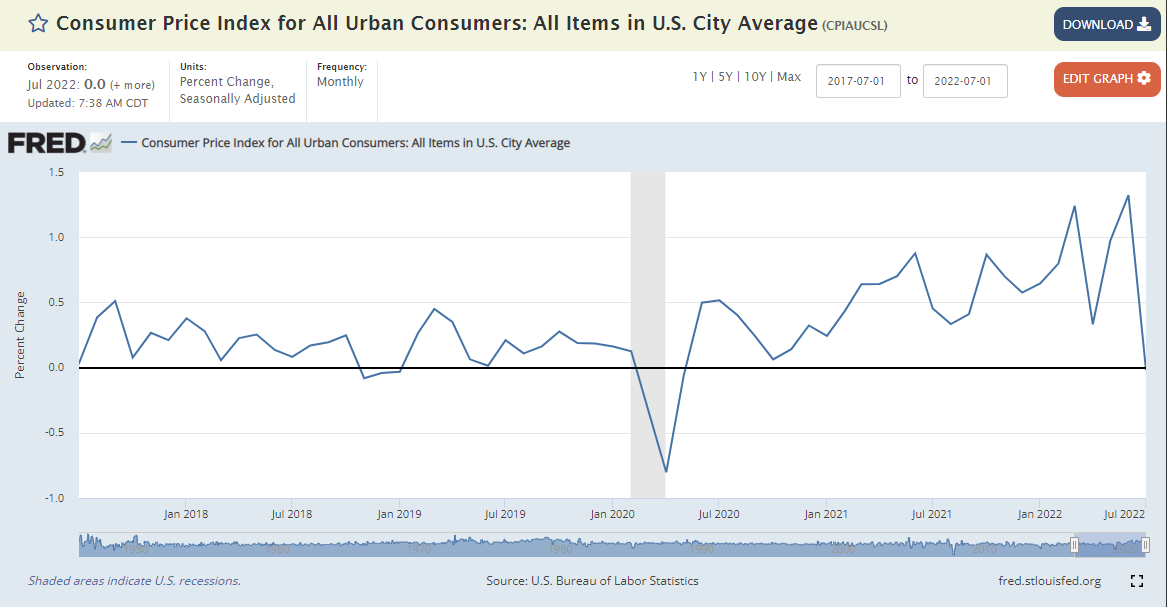

Stocks are higher this morning after the Consumer Price Index came in lower than expected. Bonds and MBS are up.

The consumer price index was flat month-over-month in July, according to BLS. On a year-over-year basis, prices were up 8.5%. Ex-food and energy, prices rose 0.3% MOM and 5.9% YOY. These numbers were below Street expectations, which triggered a rally in the stock and bond markets.

We saw decreases in energy, used cars and apparel. Overall, this is good news for the Fed, especially the decrease in the month-over-month rate. One data point does not mean the risk of inflation is over, however it does give the Fed comfort that inflation is moving in the right direction.

The immediate reaction in the bond market was a drop in the 2 year bond yield by 16 basis points to 3.11%. The 10-year bond yield dropped 6 basis points. This means the inversion of the yield curve has eased. Finally, the Fed Funds futures have gone to a 60% chance of a 50 basis hike from a 32% chance yesterday.

More good news on the inflation front: The Atlanta Fed’s Business Inflation Expectations index fell to 3.5% from 3.7%. This index peaked in March at 3.8% and has been moving down ever since.

Mortgage applications rose by 0.2% as purchases decreased 1% and refis rose 4%. “Mortgage rates remained volatile last week – after drops in the previous two weeks, mortgage rates ended up rising four basis points,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

“Mortgage applications were relatively flat, with a decline in purchase activity offset by an increase in refinance applications. Kan noted the purchase market continues to experience a slowdown, despite the strong job market. “Activity has now fallen in five of the last six weeks, as buyers remain on the sidelines due to still-challenging affordability conditions and doubts about the strength of the economy,” he said. “Refinance applications increased over three percent but remained more than 80 percent lower than a year ago in this higher rate environment.”

Loan Depot is getting out of the wholesale business. Volumes were down 26% QOQ and 54% YOY. “We have already made significant progress by consolidating management spans to create operating efficiencies and reducing headcount from approximately 11,300 at year-end 2021 to approximately 8,500 at the end of June, 2022, to approximately 7,400 at the beginning of August 2022. We are accelerating our execution of the plan and expect to end the third quarter of 2022 with headcount below our previously stated year-end goal of 6,500. In addition we are exiting our wholesale channel consistent with our strategy of becoming a more purpose-driven organization with direct customer engagement throughout the entire lending process. Our exit from wholesale will also enable us to direct resources to other origination channels, reduce operational complexities and increase margins.”

Western Asset Management – a small mortgage REIT – is stuck with a bunch of non-QM loans that it wasn’t able to move before NQM rates moved up violently a couple of months ago. Some 60% of the loans on its balance sheet are at rates of 5% or lower, with par rates now around 6% – 7%. It will probably have to sell them in the 90s in order to get rid of them.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.