Vital Statistics:

| Last | Change | |

| S&P futures | 3,893 | 20.15 |

| Oil (WTI) | 99.51 | 1.95 |

| 10 year government bond yield | 2.99% | |

| 30 year fixed rate mortgage | 5.78% |

Stocks are higher this morning as earnings season begins. Bonds and MBS are flat.

The upcoming week will be dominated by housing data, with housing starts, existing home sales, and the NAHB Housing Market Index. There will be no Fed-speak as we are in the quiet period ahead of the FOMC meeting next week.

The yield curve remains inverted, with 2s / 10s trading at -17 basis points. 2s / 30s is negative as well. The Chinese real estate market is going critical as well, which should provide support of US bonds.

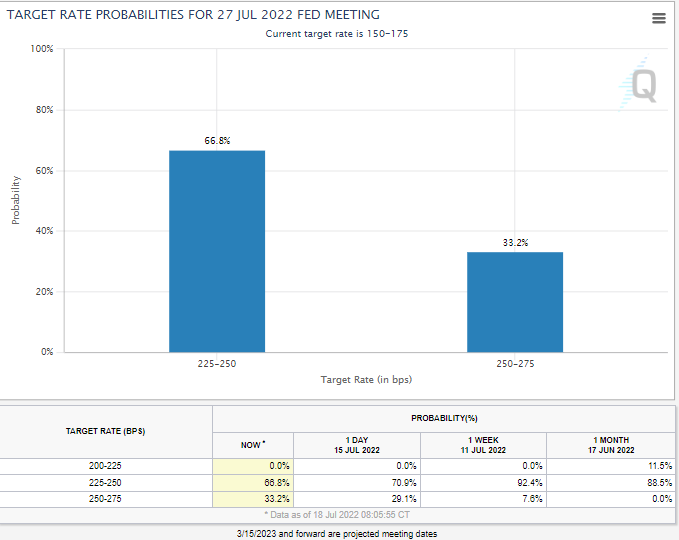

Investors are paring back their hawkish bets on next week’s meeting. The current handicapping is a 33% chance for 100 basis points and 66% chance for 75.

Bank of America reported better-than-expected earnings this morning. Mortgage volumes were down 29% on a YOY basis, and we are seeing a big increase in HELOC activity. The stock is up 7% pre-open.