[ad_1]

Dear Mr. Market:

Everyone following the markets is aware that we’re dealing with global economic stresses, a bottle necked supply chain, geopolitical tensions, 40 year highs with inflation, rising rates, and literally the worst start to a stock market year since 1970. It’s got the entire crowd nodding their heads in agreement that these are some brutal times. We’re also clearly in an environment with much groupthink and division…but more on that later.

Have you ever been in a meeting or group setting where everyone is nodding their heads in agreement (even if you or multiple people silently may think otherwise)? We all have and while it’s natural to disagree it’s often uncomfortable to voice it. As this phenomena relates to investing we’re seeing a heavy dose of recency bias right now in how it seeps into our respective mindsets. How likely would you be inclined to take a long ocean swim immediately after watching the movie Jaws? Although your odds are incredibly small of anything happening, the idea that it will is prevalent in your mind and as humans that’s natural. As an investor, however, it can be even more crippling.

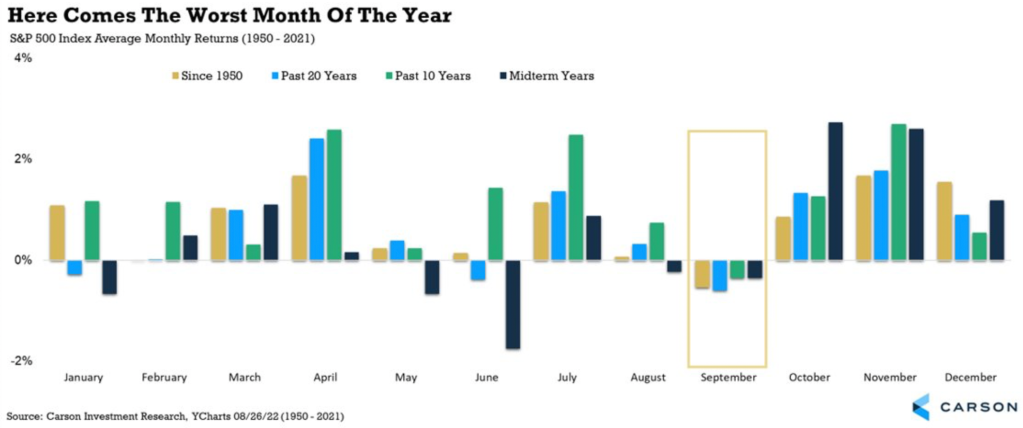

We are in no way trying to “put lipstick on a pig” and insinuate that this is the best of times or there aren’t serious headwinds to deal with. It should also be noted that September happens to be worst month for the stock market and that is especially the case when already in a downtrend. (click the chart below to expand)

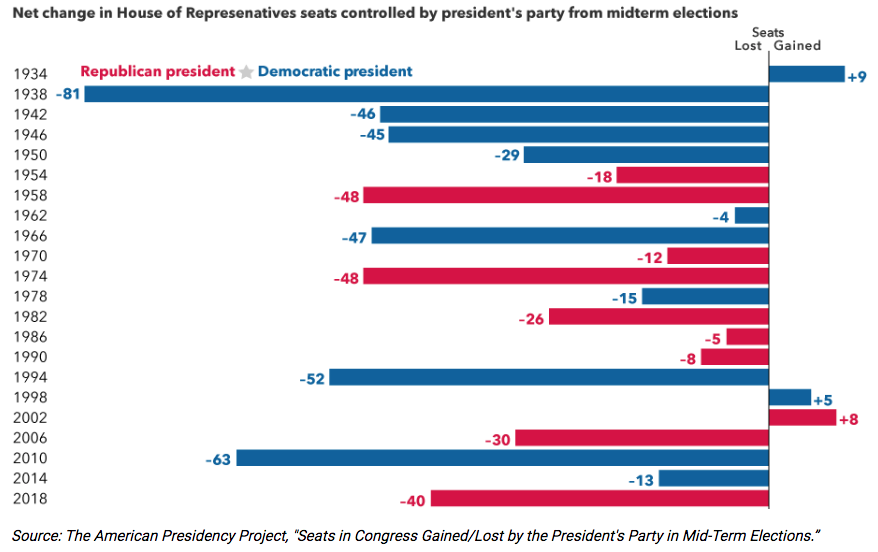

Looking at the chart above also leads us into another aspect of market history and seasonality that in our opinion is not getting enough notice. Couple the fact that the market tends to digest all available information (most of it bad lately) with the pendulum of negative news having swung quite far to one direction, with the overwhelming outperformance that occurs after a midterm election…and you have what we think sets up to be a potentially very surprising Q4. No, we’re not out of the woods by any means, but don’t be caught off guard by succumbing to recency bias that this year will portend to get even worse. We’re going to see more volatility, but while division in politics is frustrating at home, it’s often great for markets. The stock market likes certainty and after the first two years of a presidency there is almost always a change in Congress as the current leadership tends to lose ground. This isn’t a cheering section for the Red or the Blue team…rather just facts to take into account.

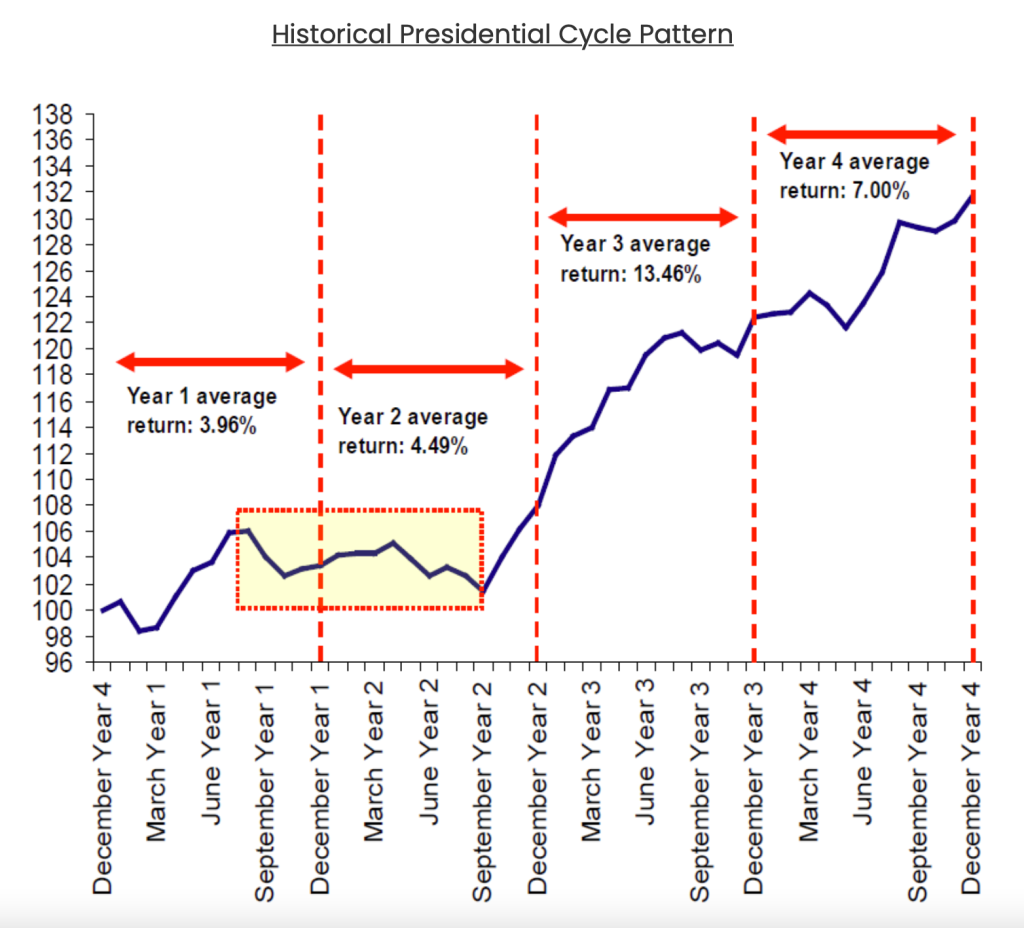

After a President enters office, they tend to work on pushing through their main policy proposals that they campaigned on. As the next election looms, however, the focus always centers on the economy in order to get re-elected. As a result, the stock market historically gains the most value during this stretch. The results are fairly consistent, regardless of the president’s political leanings or the party in charge of Congress.

The chart above is a bit dated and only takes into account years up until 2012. For a more current set of data, here’s what we have now:

- Year after the election: +6.7%

- Second-year: +5.8%

- Third-year: +16.3%

- Fourth-year: +6.7%

Even if we get a strained and muted third year, having a potentially divided Congress could bode well for stocks. Remember, the market loves certainty and hates uncertainty. Political gridlock basically leads to certainty that nothing will get done (at least nothing extreme). The stock market simply loves a divided government and gridlock so as bizarre and intuitively wrong it may seem to root for that…your portfolio wants it! Additionally the market does tend to sell off leading into the midterm election year but the bounce and following two quarters can be quite pronounced.

Lastly, here’s a pro tip to avoid falling prey to recency bias as you head into the weekend. Turn off your television and avoid Twitter, Facebook or whatever social media platform somebody can share an eye grabbing doom and gloom video or podcast with you.

Enjoy your family, friends, or pets instead.

[ad_2]

Image and article originally from dearmrmarket.com. Read the original article here.