[ad_1]

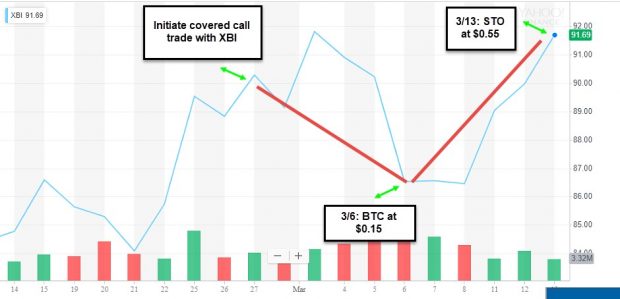

“Hitting a double” involves buying back the short call using our 20%/10% guidelines and then re-selling that same option when share price recovers. On 3/13/2019, Mario was kind enough to share with us his trades with SPDR S&P Biotech ETF (NYSE: XBI) where he astutely applied this exit strategy.

Hitting a double trade overview

- 2/26/2019: 300 shares XBI purchased at $90.25

- 2/26/2019: Sell-to-open 3 contracts of the April 21, 2019 $92.00 calls at $1.50

- 3/6/2019: Buy-to-close the $92.00 calls at $0.15 (10% guideline)

- 3/13/2019: Sell-to-open the $92.00 calls at $0.55

- 3/21/2019: XBI price is $91.69 at expiration

- 3/21/2019: $92.00 calls expire worthless

XBI: Classic V-Shaped Chart Pattern

XBI: Chart Pattern When “Hitting a Double”

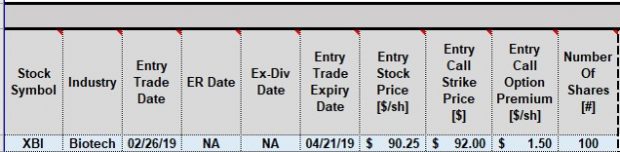

BCI Trade Management Calculator: XBI trade entry

XBI: Enter Initial Trade Stats

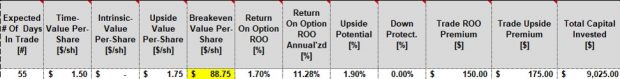

BCI Trade Management Calculator: XBI initial calculations

XBI: Initial Trade Structuring

The spreadsheet shows an initial time-value return of 1.70%, 11.28% annualized based on a 55-day trade with an additional upside potential profit of 1.90% if share price moves up to the $92.00 out-of-the-money call strike.

BCI Trade Management Calculator: XBI adjustment entries

XBI: Hitting a Double Trade Adjustments

Hitting a Double generated a new credit of $40.00 per-contract ($55.00 – $15.00); $120.00 for the 3 contracts (less tiny trade commissions).

BCI Trade Management Calculator: XBI final results

XBI: Final Results at Expiration

The final trade result after trade adjustments is 3.70%%

Discussion

The Hitting a double exit strategy improved an initial time-value return of 1.70% to a final return of 3.70%. This includes an unrealized share appreciation of 1.60%.

For information on the BCI Trade Management Calculator, click here.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

I’ve been trading options since June of last year and have been looking for more technical training and more details on accounting and loss, so I found your material especially helpful. I’m interested in your trade management approach as I don’t find other resources cover these important topics very well, if at all.

Thank you,

John

Upcoming events

Tuesday July 12th, 2022

4 PM ET – 5 PM ET

Selling Cash-Secured Puts

Exit Strategy Choices After Exercise of Cash-Secured Puts

Selling cash-secured puts is a low-risk option-selling strategy which generates weekly or monthly cash flow by agreeing to buy shares at a price we determine, by a date we determine. In return for undertaking this obligation, we are paid a cash premium. We only sell puts on shares we would otherwise want to own and, if exercised, and shares are put to us, they are purchased at a discount from the price when the put trade was initiated.

This presentation includes an introduction to option basics, defines selling cash-secured puts and provides real-life examples. The focus of the webinar details the steps available to put sellers should the put be exercised, and we now own the discounted stock or ETF shares. The seminar includes a discussion of the PCP (put-call-put or wheel) Strategy and the Stock Repair Strategy among other exit strategy opportunities.

2. Money Show Orlando live event

October 30th – November 1st, 2022

OMNI ORLANDO RESORT AT CHAMPIONSGATE

Visit Alan, Barry and members of the BCI team at Booth # 415

Masters Class

Comprehensive Course on Selling Cash-Secured Puts

Detailed start-to-finish 6-part program

This presentation will provide all the information, with real-life examples, necessary to master the strategy of selling cash-secured puts. The program is divided into 6 sections:

- Section I:

- Section II

- Section III

- Section IV

- Section V

- Ultra-low-risk put/Delta strategy

- Section VI

This presentation was developed to benefit both beginner and experienced option traders and will provide all the information needed to initiate the strategy and elevate returns to the highest possible levels.

45-minute presentation

Covered Call Writing: Multiple Applications Based on Current Market Conditions

Real-life examples with Invesco QQQ Trust (Nasdaq: QQQ)

Covered call writing is a low-risk option-selling strategy geared to generating cash flow with capital preservation a key requirement. This presentation will demonstrate how the strategy can be crafted to benefit in all market environments. Market situations highlighted are:

- Normal to bull markets

- Bear and volatile markets

- Low interest-rate environments

A popular large-cap technology exchange-traded fund, Invesco QQQ Trust, will be used to establish rules and guidelines to benefit in these market circumstances.

Registration link and more details to follow.

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************

[ad_2]

Image and article originally from www.thebluecollarinvestor.com. Read the original article here.