[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,875 | 0.75 |

| Oil (WTI) | 79.59 | 0.04 |

| 10 year government bond yield | 3.82% | |

| 30 year fixed rate mortgage | 6.41% |

Stocks are flattish this morning on no real news. Bonds and MBS are down.

We should have a quiet week ahead as investors (and mortgage bankers) wrap up a year they would love to forget. We don’t have much in the way of market-moving data so any large movements in the markets should be read in the context of light holiday trading.

House prices were flat in October, according to the FHFA House Price Index. They increased 9.8% on a YOY basis. “U.S. house prices have seen two consecutive months of near-zero appreciation,” said Nataliya

Polkovnichenko, Ph.D., Supervisory Economist, in FHFA’s Division of Research and Statistics. “Higher mortgage rates continued to put downward pressure on demand, weakening house price growth. The U.S. house price index growth decelerated as it posted the first 12-month growth rate below 10 percent after 24 consecutive months of double-digit appreciation rates.” The Pacific Division had the lowest YOY home price appreciation, while New England had the highest.

The Case-Shiller Home Price Index fell 0.3% in October and was up 9.2% on a YOY basis. “October 2022 marked the fourth consecutive month of declining home prices in the U.S.,” says Craig J. Lazzara, Managing Director at S&P DJI. “For example, the National Composite Index fell -0.5% for the month, reflecting a -3.0% decline since the market peaked in June 2022. We saw comparable patterns in our 10- and 20-City Composites, both of which stand -4.6% below their June peaks after October declines of -0.7% and -0.8%, respectively. These declines, of course, came after very strong price increases in late 2021 and the first half of 2022. Despite its recent weakness, on a year-over-year basis the National Composite gained 9.2%, which is in the top quintile of historical performance levels.

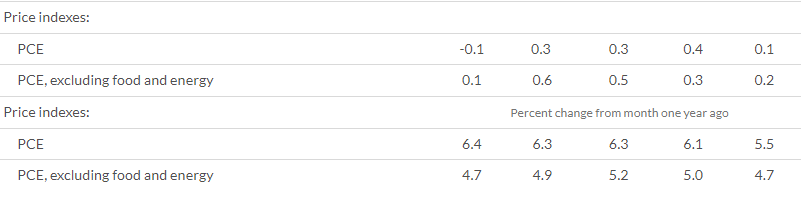

Personal Incomes rose 0.4% in November, while personal consumption rose 0.1%. The Personal Consumption Expenditures Index (the Fed’s preferred measure of inflation) rose 0.1%. Excluding food and energy, it rose 0.2%. The monthly numbers are back at levels that should make the Fed happy, although the annual increases are still too high.

The drop in consumption is a worry, and I suspect the narrative is going to shift quite rapidly from fears of inflation to fears of a recession. Another signal of the change: retail. Dollar Stores are back in fashion.

New Home Sales rose 5.8% to a seasonally-adjusted annual rate of 640,000. This was down about 16% compared to a year ago. Meanwhile, Lennar is looking to sell about 5,000 homes to single-family rental funds.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.