[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,014 | 4.50 |

| Oil (WTI) | 81.41 | 1.28 |

| 10 year government bond yield | 3.43% | |

| 30 year fixed rate mortgage | 6.20% |

Stocks are higher this morning on better-than-expected inflation data. Bonds and MBS are up.

Inflation at the wholesale level fell 0.5% month-over-month according to the Producer Price Index. This comes after a 0.4% increase in October and a 0.2% increase in December. The decline was driven primarily by a decrease in energy prices. The index was up 6.2% on a YOY basis.

Stripping out food, energy and trade services the index rose 0.1% MOM in January and 4.6% YOY. Overall, it looks like inflation is on the way down, however as far as the Fed is concerned it wants to see the labor market come more in balance.

Homebuilder sentiment rose slightly in January, according to the NAHB / Wells Fargo Housing Market Index. This is after a string of declines driven by rising interest rates. “It appears the low point for builder sentiment in this cycle was registered in December, even as many builders continue to use a variety of incentives, including price reductions, to bolster sales,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga. “The rise in builder sentiment also means that cycle lows for permits and starts are likely near, and a rebound for home building could be underway later in 2023.” Remember that home construction is a classic early-stage cyclical and is one of the first sectors to recover after a recession.

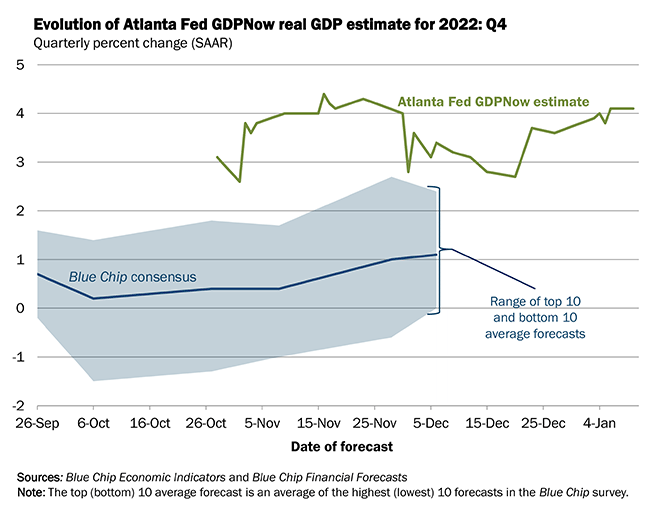

Retail sales fell 1.1% in December, according to the Census Bureau. This follows a decline in November. On a year-over-year basis, retail sales rose 6.0% YOY, which means it was down about 0.5% once you take into account the 6.5% rise in the CPI. This doesn’t bode well for Q4 GDP growth since consumption is about 70% of GDP. The Atlanta Fed’s GDP Now model sees 4.1% growth in Q4, though it will be updated sometime today. This just seems out of step with the data out there, but perhaps it is explained by inventory build.

Mortgage Applications rose 27% last week as purchases rose 25% and refis rose 34%. These numbers include an adjustment for the holiday-shortened New Year’s holiday however falling rates are helping things. That said we have a long way to go to get to some semblance of normalcy.

“Mortgage application activity rebounded strongly in the first full week of January, with both refinance and purchase activity increasing by double-digit percentages compared to last week, which included the New Year’s holiday observance,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Despite these gains, refinance activity remains more than 80% below last year’s pace and purchase volume remains 35% below year-ago levels. Mortgage rates are now at their lowest level since September 2022, and about a percentage point below the peak mortgage rate last fall. As we enter the beginning of the spring buying season, lower mortgage rates and more homes on the market will help affordability for first-time homebuyers.”

Industrial production fell 0.7% in December, and manufacturing production fell 1.3%. Capacity Utilization fell from 79.4% to 78.8%. Again, I have to look at the Atlanta Fed’s estimate and I don’t see how this data comports with 4.1% GDP growth.

I am accepting ads for this blog, if you would like a mention. In addition, if you enjoy the content and would like a white label solution for your company, I would be interested in having a conversation.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.