[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,281 | -29.50 |

| Oil (WTI) | 86.66 | -0.67 |

| 10 year government bond yield | 2.85% | |

| 30 year fixed rate mortgage | 5.41% |

Stocks are lower this morning after bad inflation data out of the UK. Bonds and MBS are down.

The big event today will be the FOMC minutes which will be released around 2:00 pm. The bond market had been hoping for a Fed pivot, which has been at least partly behind the decrease in rates since mid-June. The minutes may shed some light the Fed’s thinking here, although the Fed-speak has poured a lot of cold water on that forecast.

Retail sales were flat MOM in July, according to Census. Ex-vehicles they rose 0.4% and ex-vehicles and gas they rose 0.7%. On a year-over-year basis, retail sales rose 10.2%. Note that retail sales are not adjusted for inflation, so on an inflation-adjusted basis they are really up small year-over-year.

Mortgage applications fell by 2.3%, according to the MBA. Refinances fell by 5%, while purchases fell by 1%. “Mortgage application activity was lower last week, with overall applications declining over two percent to their lowest level since 2000,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “Home purchase applications continued to be held down by rapidly drying up demand, as high mortgage rates, challenging affordability and a gloomier outlook of the economy kept buyers on the sidelines.”

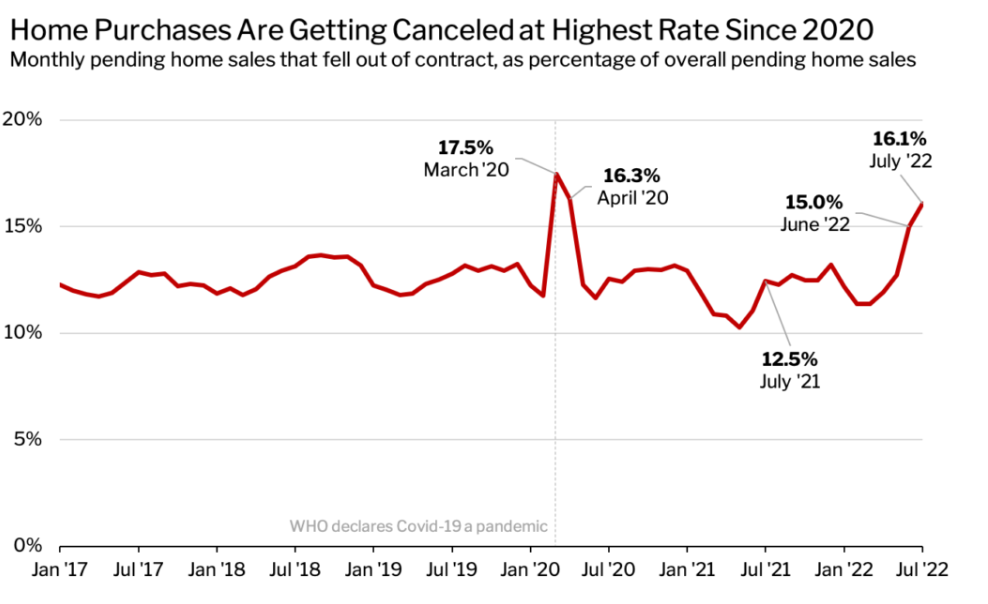

Homebuyers are beginning to get the negotiating leverage in deals, at least according to a new report from Redfin. Home purchase contracts were canceled at a 16.1% rate in July, which is almost as high as the early days of the pandemic, and much higher than pre-pandemic. “Homes are sitting on the market longer now, so buyers realize they have more options and more room to negotiate. They’re asking for repairs, concessions and contingencies, and if sellers say no, they’re backing out and moving on because they’re confident they can find something better,” said Heather Kruayai, a Redfin real estate agent in Jacksonville, FL. “Buyers are also skittish because they’re afraid a potential recession could cause home prices to drop. They don’t want to end up in a situation where they purchase a home and it’s worth $200,000 less in two years, so some are opting to wait in hopes of buying when prices are lower.”

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.