[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,882 | -40.25 |

| Oil (WTI) | 73.64 | -2.54 |

| 10 year government bond yield | 3.54% | |

| 30 year fixed rate mortgage | 6.24% |

Stocks are lower as they continue their post-Fed sell-off. Bonds and MBS are down.

Retail sales fell 0.6% in November, which was lower than expectations. On a year-over-year basis they rose 6.5%. These numbers are not adjusted for inflation, so if you take into account the 7.1% CPI print from Tuesday, retail sales are more or less down on a year-over-year basis in real terms. Ex-vehicles and gasoline they fell 0.2%. Note October’s numbers were revised downward. This doesn’t bode well for this year’s holiday shopping season.

Industrial Production fell 0.2% in November, according to the Federal Reserve. Manufacturing output fell 0.6% and is up 1.2% compared to a year ago. Capacity Utilization ticked down 0.1% to 79.7%.

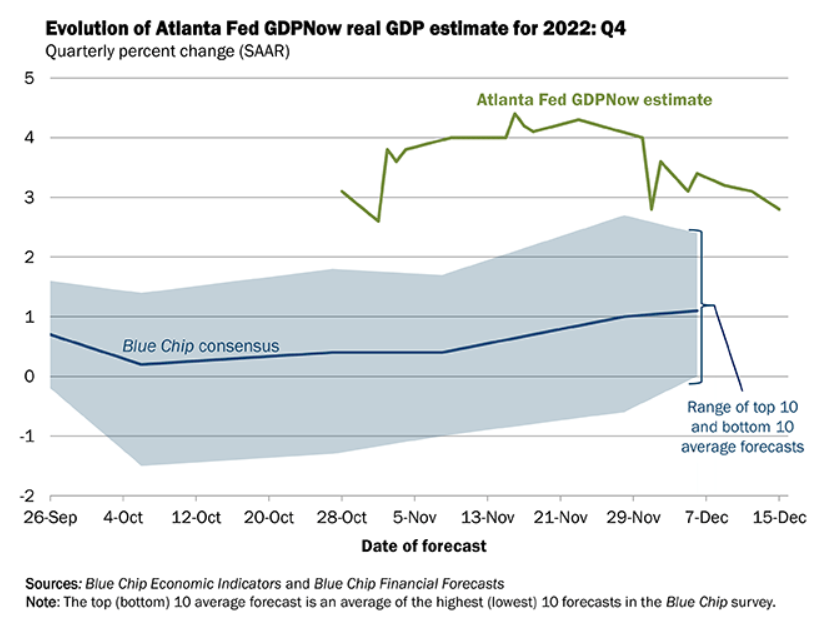

These two reports show the economy slowing. The Atlanta Fed’s GDP Now estimate now sees 2.8% growth in the fourth quarter, but that seems high given the other data out there.

A lot of attention has been placed on the issue of home affordability and how it is impacting potential buyers. This is a fair point, but affordability is also an issue for sellers too, and this helps explain the dearth of home sales. According to one study, many people who would like to move consider themselves stuck.

High home prices are one issue – the home seller would presumably be looking in the same picked-over market that everyone else is in for a new home. Second higher mortgage rates are a problem. So many homeowners who would like to move will probably hunker down with their 3.5% mortgage and wait it out while homebuilding squares the circle.

I imagine this problem is most acute for downsizers – people who’s kids are grown and no longer need a 3,000 square foot house. The other side of the trade – the move up homebuyer – isn’t really there. The move-up homebuyer is a smaller group (less people are having families) and affordability constraints have been a double-whammy.

That said, I think the respondents are too pessimistic, at least on rates. When the study was conducted, the mortgage rate was between 7% and 7.5%. Over 2/3 of respondents though rates would be higher in 12 months. Since then, we have seen mortgage rates fall about a percentage point. As MBS spreads revert to the mean and the Fed wraps up its tightening cycle rates should stay the same or move lower.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.