[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,794 | 14.50 |

| Oil (WTI) | 92.59 | 0.02 |

| 10 year government bond yield | 4.17% | |

| 30 year fixed rate mortgage | 7.14% |

Stocks are higher this morning despite some disappointing news from some tech leaders like Meta and Apple. Bonds and MBS are down small.

The upcoming week will be dominated by the CPI print on Thursday. The Street is looking for a 0.7% MOM / 8% YOY on the headline number and 0.5% MOM / 6.6% on the CPI ex-food and energy. We will also get some Fed speak.

Midterm elections are on Tuesday, however I don’t see them as a market-moving event. Right now the story is all about the Fed.

Banks will be closed on Friday for the Veterans Day holiday.

Home prices fell 0.52% in September, according to Black Knight. This is of course pushing down home equity, which will probably have a negative effect on consumption going forward.

Underwater homes are a risk for those who bought at the top of the pandemic-driven peak (late 21 / early 22). That said, the number of underwater / under-equity properties is well below pre-pandemic levels. Black Knight estimates that roughly 3.6% of the 53MM mortgages outstanding in the US have 10% equity or less. Overall equity is still about $5 trillion above pre-pandemic levels, which works out to an average gain of $92,000 over that period.

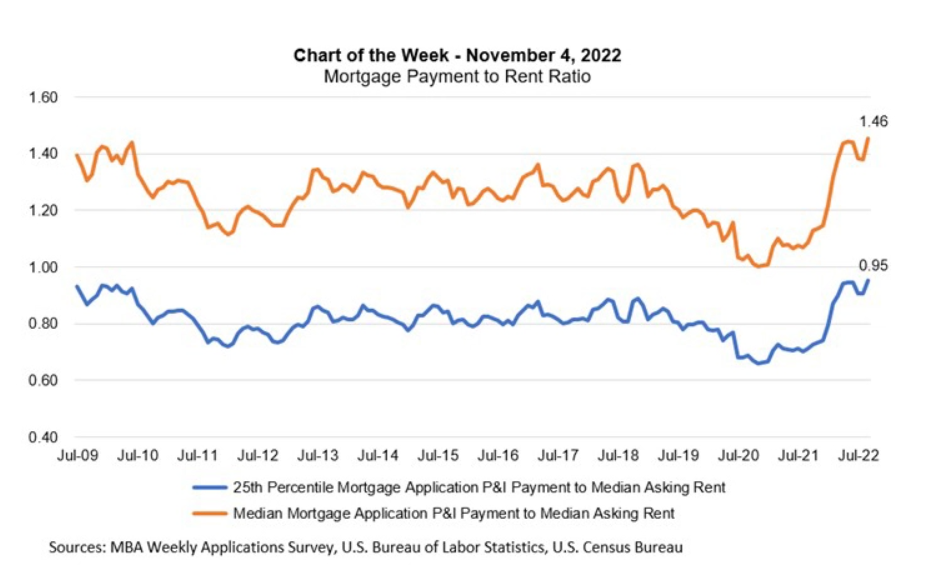

With rising rates, the median monthly payment on a mortgage has risen $558, or about 40% since the beginning of the year. The MBA’s mortgage payment to rent ratio has been on a tear since rates began rising.

If you look at this chart, the natural conclusion would be that the first time homebuyer should rent because that is a better deal. Here is why that isn’t the case. Rents tend to lag home prices by about 21 months. Landlords reset the rent for an apartment upon renewal, however the big chunks happen when the tenant moves and the apartment gets set to market rents. So if home prices rise for a year, rent stays the same until the lease expires. Time lags explain this chart.

Note that for a first time homebuyer, the monthly payment on a fixed rate mortgage will stay the same for the term of the loan. Plus the first time homebuyer can deduct taxes. While this chart seems to imply that renting is more economical than buying, I personally think that is penny wise and pound foolish.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.