Vital Statistics:

| Last | Change | |

| S&P futures | 3,651 | -5.25 |

| Oil (WTI) | 80.76 | 0.55 |

| 10 year government bond yield | 3.71% | |

| 30 year fixed rate mortgage | 6.68% |

Stocks are lower this morning after the personal incomes and outlays release disappointed on the inflation front. Bonds and MBS are up.

Personal Incomes rose 0.3% in August, which was more or less in line with expectations. Personal consumption expenditures rose 0.4% which was better than expected.

The PCE Price Index (which is the Fed’s preferred measure of inflation) rose 0.3% MOM and 6.3% YOY. Both numbers were .1% higher than expectations. Same for the core rate (ex-food and energy) which rose 0.6% MOM and 4.9% YOY.

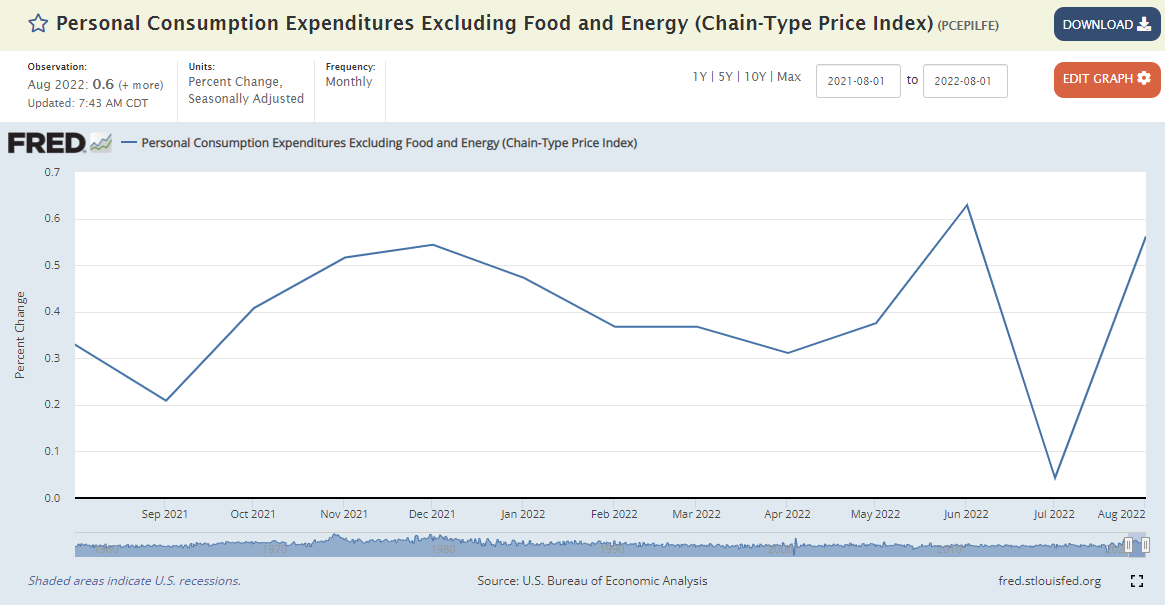

The core PCE Index is the inflation indicator the Fed prefers to use when making policy. The monthly changes tell the story and are the market’s focus. Does this chart of the monthly core numbers look like a deceleration? IMO, not yet. It looks like the July reading was an outlier, so it doesn’t really hint at a deceleration, at least not yet.

Consumer sentiment decreased in September, according to the University of Michigan Consumer Sentiment Index. The bright spot in the report was the readings on inflationary expectations:

The median expected year-ahead inflation rate declined to 4.7%, the lowest reading since last September. At 2.7%, median long run inflation expectations fell below the 2.9-3.1% range for the first time since July 2021. Inflation expectations are likely to remain relatively unstable in the months ahead, as consumer uncertainty over these expectations remained high and is unlikely to wane in the face of continued global pressures on inflation.

It turns out that the Fed pays close attention to this number, and the 2.7% expected long-run inflation is approaching the Fed’s 2% goal.

Angel Oak laid off about 20% of its workforce and replaced its CEO. The layoffs were mainly in operations in order to get capacity down to the new normal of reduced mortgage origination volume. Non-QM is highly sensitive to dramatic moves in interest rates since TBAs don’t correlate as tightly with this product as they do with other mortgage rates. This means that these loans are unhedgeable, or at least the hedges are imperfect. So when the market makes a dramatic move the market for them sort of dries up.