[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,775 | -77.25 |

| Oil (WTI) | 96.62 | 0.88 |

| 10 year government bond yield | 3.03% | |

| 30 year fixed rate mortgage | 5.78% |

Stocks are lower this morning after the consumer price index came in hotter than expected. Bonds and MBS are down.

The consumer price index rose 1.3% month-over-month and 9.1% year-over-year. This is the highest rate in over 4 decades. Energy prices (particularly gasoline) was a big driver of rising prices. Ex-food and energy the index rose 0.7% MOM and 5.9% YOY. On both indices, the monthly rates are rising, which means that inflation is accelerating, not decelerating. This will almost certainly raise alarm bells at the Fed and keep them on a path for increasing rates.

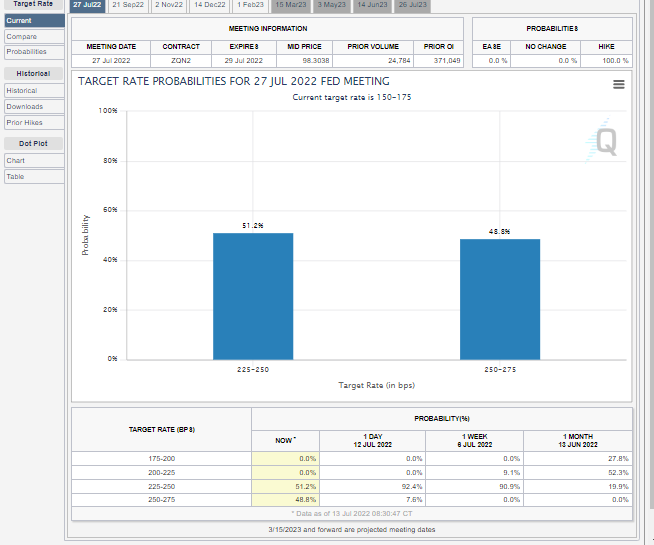

And just like that, the Fed Funds futures for July have a coin flip between a 75 basis point hike and a 100 basis point hike:

On the bright side, we are seeing some commodity prices fall. Oil and natural gas prices are falling, and we are seeing recent weakness in food such as corn, wheat and cattle. Finally, retailers are reporting that they are stuck with inventory they need to liquidate. This means falling prices for lots of finished goods. This has largely been a June phenomenon, so you won’t see it reflected in the the June CPI. It will filter through to the producer price index first, and then will be reflected in final goods.

The shoe that has yet to drop is the price of shelter. Rising home prices affect the CPI with a 12-18 month lag. So the torrid home price appreciation of the past two years is only beginning to impact the numbers. Shelter rose 5.6% YOY, and the monthly numbers are increasing. Given that all the home price indices show high teens increases, more inflationary pressure is coming there. Rents are only beginning to reset to higher levels.

The rapid increase in the Fed Funds rate is almost certainly going to cause a recession, and if the Atlanta Fed’s GDP Now index is correct, you could argue that we are in one already, though that determination is subjective and made by the NBER. The spread between the 2-year and the 10 year Treasury is now negative by 14 basis points, and this indicator is flashing red.

If we hit a recession, you know what is going to take a hit? Servicing values. The first shoe to drop will be rising delinquency rates, and then the second will be falling long-term rates as markets anticipate the Fed taking its foot off the brakes. I suspect this was the issue with First Guarantee and its backer PIMCO. While FGMC dabbled in the jumbo and NQM space, it was known primarily for being the home for low quality FHA loans. Since there are no LLPAs in GNMA securitization, the gain on sale margins for a low FICO FHA can be huge. But, there is a catch.

GNMA servicing rules are exceptionally harsh regarding advances and modifications. I suspect PIMCO pulled the plug on FG because they could see what was coming for that servicing book if the economy rolls over. For them, it was an unbounded liability given that lenders never fully recover servicing advances on GNMA loans. Also, I am hearing rumblings that loan mods are going to be problematic this time around due to the various CFPB rules that never anticipated a rapid increase in rates.

Mortgage Applications fell 1.7% last week as purchases fell 4% and refis fell 2%. The index includes an adjustment for the 4th of July holiday. “Mortgage rates were mostly unchanged, but applications declined for the second straight week,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “Purchase applications for both conventional and government loans continue to be weaker due to the combination of much higher mortgage rates and the worsening economic outlook. After reaching a record $460,000 in March 2022, the average purchase loan size was $415,000 last week, pulled lower by the potential moderation of home-price growth and weaker purchase activity at the upper end of the market.”

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.