[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,839 | 48.15 |

| Oil (WTI) | 98.31 | 2.58 |

| 10 year government bond yield | 2.95% | |

| 30 year fixed rate mortgage | 5.78% |

Stocks are higher this morning after a positive retail sales number. Bonds and MBS are flat.

The yield curve continues to invert, with the 2s / 10s spread at -20 basis points and the 2s / 30s spread at -5 basis points. The yield curve’s shape isn’t dispositive – there is an old joke that an inverted yield curve has predicted 12 of the last 5 recessions, but it flashing warning signs and we are getting confirmation elsewhere.

Retail Sales rose 1% MOM and 8.4% YOY. Note this number is not adjusted for inflation, which is running right about the same level. Ex-vehicles and gasoline sales rose 0.7%, which was much better that -0.2% Street expectation.

Wells Fargo reported earnings this morning. Earnings per share declined 47% on a YOY basis. Revenues were down 16% YOY, and earnings were mainly affected by provisions for credit losses. The credit losses should really have an asterisk nest to it. Most of the banks over-reserved for losses in the early days of COVID and when the losses never materialized, they reversed them in 2021. Now that we are back to normalcy, they are reserving for credit losses again. So you get a strange YOY comparison, which will be pretty common for all the banks, IMO.

The mortgage banking numbers were pretty lousy, as expected. Home lending earnings were down about 50% (as they telegraphed a month ago), as falling origination income was offset somewhat by increased servicing income. Originations fell 11% QOQ and 36% YOY to $34.1 billion.

Consumer sentiment improved in the preliminary July reading of the University of Michigan Consumer Sentiment Index. More importantly, the inflationary expectations of consumers began to moderate. As we learned from the FOMC minutes from the June meeting, the Fed pays close attention to this number.

Consumer sentiment indices are often nothing more than gasoline price indices – in other words high gas prices depress sentiment. Gas prices are off the highs from a month ago, so I guess it makes sense that inflationary expectations would fall. Regardless, this number is welcome news for everyone.

This highlights one of the big risks at the fed: by adjusting policy to inflationary expectations, the Fed risks chasing oil prices which is the wrong metric to use.

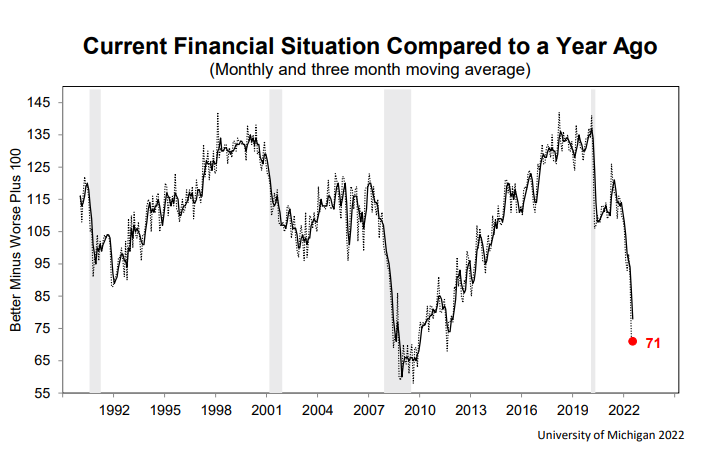

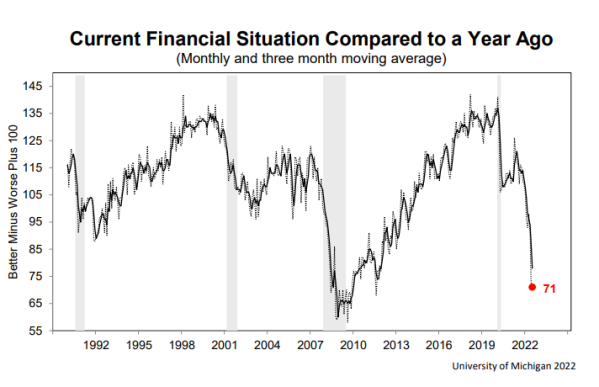

That said, consumers’ financial situation isn’t in the best of places. One of the metrics for this survey asks consumers about their current financial situation. You can see from the chart below, they are in a bad place:

A recent article in the New York Post shows the difficulty in measuring inflation. BMW is now requiring subscriptions to use heated seats or automatically adjusted high-beams. Access to CarPlay requires an up-front fee. It is the Spirit Airlines model – advertise a low price and then charge for the oxygen the passenger breathes.

Now, according to the government, the only relevant number is the price of the car, however if automakers are lowering prices by introducing a slew of add-on charges, then the price growth is understated. It is a different play on shrinkflation, which is evident again to anyone who eats a bagged salad for lunch.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.