[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,097 | 13.25 |

| Oil (WTI) | 82.61 | 2.83 |

| 10 year government bond yield | 3.61% | |

| 30 year fixed rate mortgage | 6.54% |

Stocks are higher after welcome news on spending and inflation. Bonds and MBS are flat after yesterday’s furious rally.

Jerome Powell signaled that the Fed would be ready to begin slowing the pace of rate hikes as early as December. That was taken as blaring signal that the Fed was going to hike 50 basis points instead of 75 basis points. The December Fed Funds futures now handicap an 80% chance of a 50 bp hike and a 20% chance of a 75 bp hike.

While the market had been leaning towards a 50 basis point hike to begin with, this caused a massive rally in the 10 year, especially towards the close. Some of this might have been month-end rebalancing however the 10 year bond yield dropped about 12 basis points in 15 minutes and the S&P 500 ended up about 125 points on the day.

He characterized the housing market during the pandemic years as a bubble, which was strange to my ears. I would say the housing market in some MSAs got over heated, but the bubble mentality wasn’t there as far as lenders, regulators etc. are concerned. Still it signals the Fed sees weaker home prices going forward.

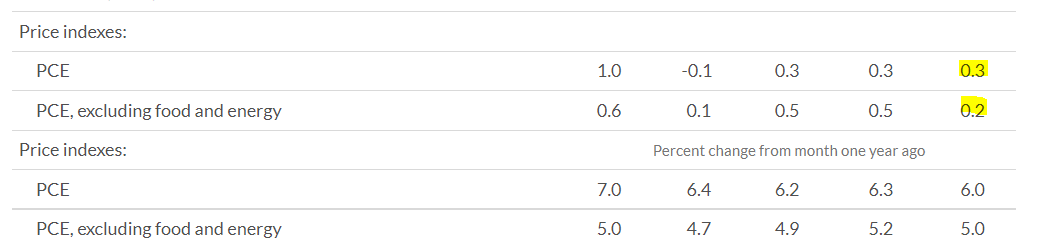

Personal incomes rose 0.7% in October, which was better than expectations. Spending continues to remain robust, rising 0.8% MOM. The PCE Price Index, which is the Fed’s preferred measure of inflation came in lower than expectations. The core rate decelerated substantially on a MOM basis while the headline number stayed steady.

Powell talked about the three components of core inflation in his speech yesterday – core goods, housing services, and core services ex-housing. Core goods has been a supply chain issue, and that has improved a lot. Housing services are essentially rent and house prices, and that has been a big driver over the past year, however there is evidence this is subsiding. Finally core services ex-housing has been fluctuating, but this will be driven by the labor market and wage increases. Powell said that the Fed’s inflation forecasts envision housing being a driver of inflation through mid year 2023.

The manufacturing economy contracted for the first time since May of 2020, according to the ISM Manufacturing Survey. New Orders and exports are in contraction territory, while inventory is about where it should be. Prices are falling, which is good news on the inflation front.

“Manufacturing contracted in November after expanding for 29 straight months. Panelists’ companies continue to judiciously manage hiring, other than October 2022, the month-over-month supplier delivery performance was the best since February 2012, when it registered 47 percent and material lead times declined approximately 9 percent from the prior month, approximately 18 percent over the last four months. Managing head counts and total supply chain inventories remain primary goals. Order backlogs, prices and now lead times are declining rapidly, which should bring buyers and sellers back to the table to refill order books based on 2023 business plans.”

Construction spending fell 0.3% MOM in October, according to the Census Bureau. Residential construction declined, while public construction increased.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.