[ad_1]

Dear Mr. Market:

It’s that time of year. Everyone has some stinkers in their portfolio and in a taxable account it’s a great time to evaluate whether one should offset that loss by taking some gains on your winners. If you followed any of Jim Cramer’s advice this past year you have some serious evaluating to do! The aim of this article is not a hit piece of Mr. Cramer but simply a word of caution and a reminder that (1) stock picking is often a futile endeavor and (2) If you are indeed going to follow someone’s picks it’s important to track them prior to blindly buying the next set of recommendations.

We begin by refreshing you on an “oldie but goodie” from the Dear Mr. Market archives. Please click here for some background on Jim Cramer and an article we wrote in 2013.

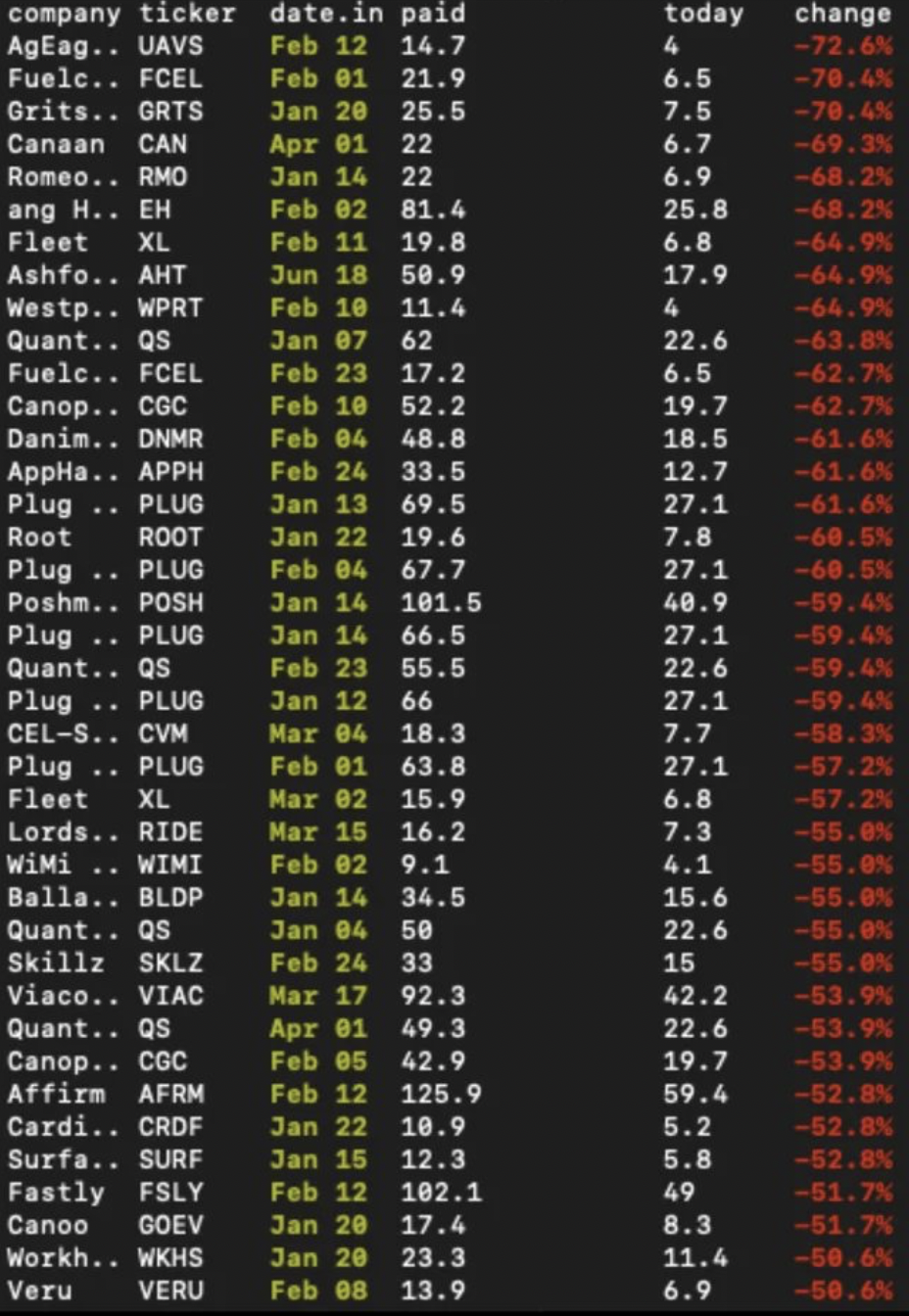

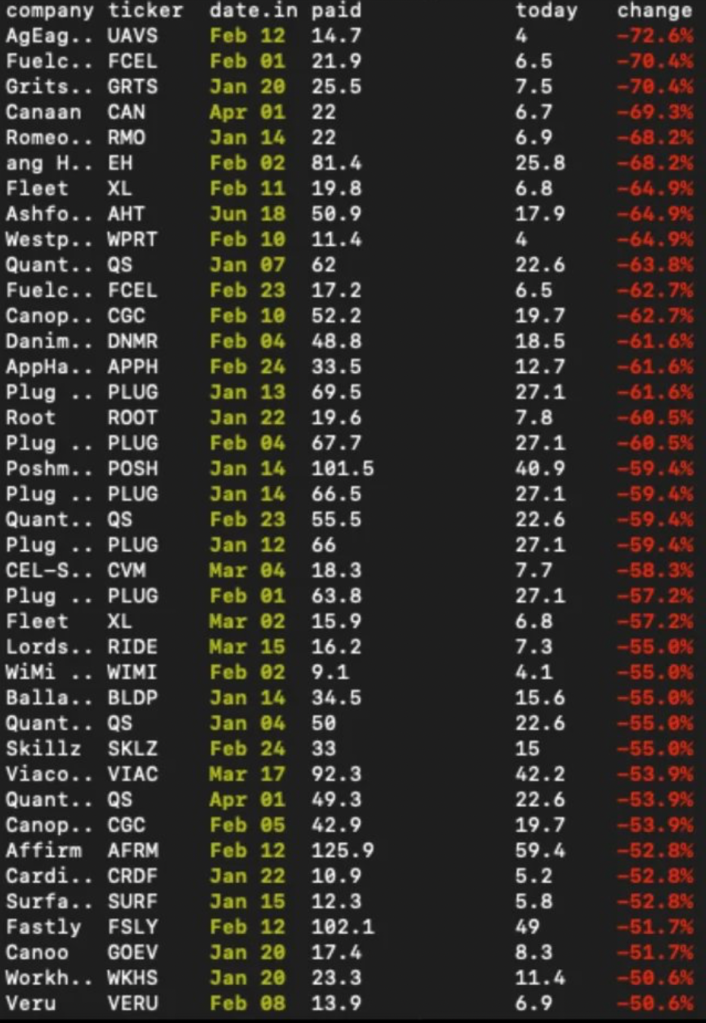

Below you will see a sample of his picks from the beginning of 2021 and how those picks have fared since. Yikes!

In fairness to Jim Cramer that could be either a small sample size (although it’s clearly not) or perhaps he recommended them as short-term plays and then sold? We’ll evaluate that later in this article as well as there are of course two sides to every story or parameters to what defines a “pick” or just a comment, since after all…he’s on air every day talking about a multitude of stocks. At first glance, however, it seems almost hard to pick that many stocks that are so far deep in the red. One could almost make the argument that it makes sense to go counter to Jim Cramer picks and actually short them. That’s a sharp jab but prove the thought wrong…

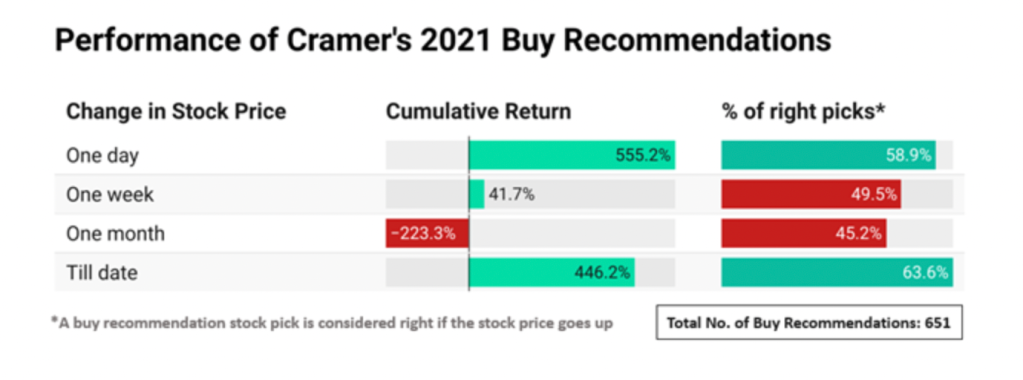

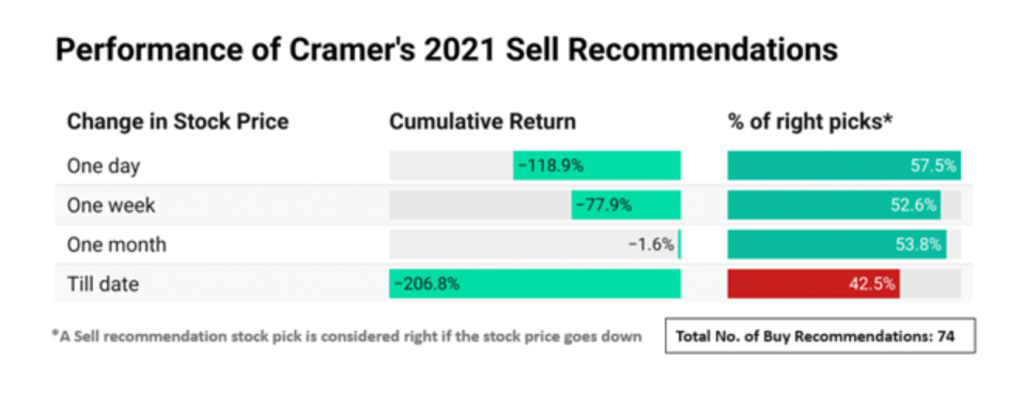

To that latter point, here’s something to chew on; do his picks only do well short-term but going any further out than a day or so become complete disasters? Out of 725 buy/sell picks he made throughout 2021, there were 651 marked as BUY and 74 as SELL. Here are a couple graphics we found on this which paint an interesting story:

One of our favorite (perhaps only) Jim Cramer quotes is “tips are for waiters“. Following his own advice, and without trying to wordsmith anything, you can clearly see that taking advice from an entertainer on TV also solidly falls into the “tips” category. Numerous people have tried to track Cramer’s picks over the years but the overall consensus remains the same; you’re better off listening to his show for entertainment value only and follow your own methodology or just buy an index for broad exposure to the stock market. If you’re curious on where this data can be found, we can’t take credit for it but that’s the beauty of the internet as people have already done the homework. You can click here for a link to track all his picks using different time frames and ticker symbols to see for yourself.

Lastly, one day we’ll dig into other stock picking self proclaimed geniuses such as the Motley Fool, where it seems as though they’re on to the next Amazon, Tesla, or Apple stock only to find that hidden amongst those potential gems are a lot of lumps of coal that you’ll want to stay clear from. A short study from listening to other investors and clients who have signed up for such services, is that at the end of the day it involves you having to sign up for additional services and screening through deeply embedded web pages only to realize that you now have a litany of stocks that nobody is really watching and it’s basically a garage sale of clutter on your account statement. Moral of the story…once again- Turn off your TV.

[ad_2]

Image and article originally from dearmrmarket.com. Read the original article here.