[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 4,169 | 22.25 |

| Oil (WTI) | 87.64 | -1.36 |

| 10 year government bond yield | 2.79% | |

| 30 year fixed rate mortgage | 5.45% |

Stocks are higher this morning on no real news. Bonds and MBS are up small.

Ordinarily the week after the jobs report is often a snoozer economically, but that has changed as inflation now takes center stage. We will get some big numbers this week with the Consumer Price Index on Tuesday, Productivity and Costs on Wednesday and the Producer Price Index on Thursday.

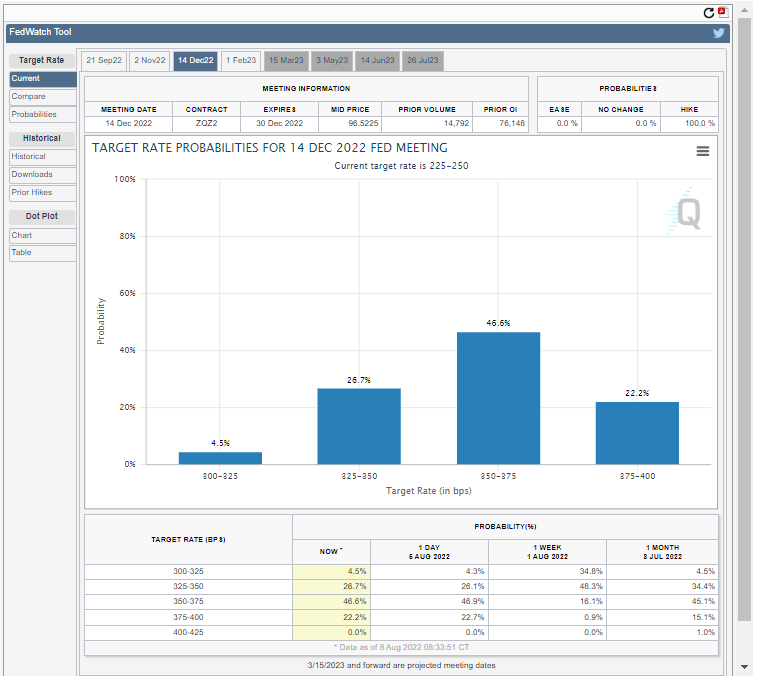

Friday’s strong jobs report caused a hawkish shift in the Fed Funds futures contracts. The September meeting now has a 2/3 probability of a 75 basis point hike and a 1/3 probability of a 50 basis point hike. The December futures are centering around a Fed Funds range of 3.5% to 3.75%, which is up 25 basis points from before the report.

Former Treasury Secretary Larry Summers made some hawkish comments about inflation over the weekend. On the jobs report, he said: “Everything in this number says to me overheating, not yet under control, not yet on a path to being under control,” said Summers, a Harvard University professor and paid contributor to Bloomberg TV. “My concern was actually magnified,” he said.

He also pointed out that core inflation is running at about 5%, which is higher than it was when Nixon put on wage and price controls in the 1970s.

On the assessment that the Fed is close to a neutral policy, he said: “I don’t think the Fed has the thread right now,” Summers said. Without significantly boosting real interest rates — which are adjusted for some gauge of inflation — “then we’re just setting the stage for stagflation”

His point about real interest rates is important, since the real interest rate is a moving target. The Fed Funds rate is a nominal interest rate which doesn’t take into account inflation. By any measurement, with core inflation running around 5% and the Fed Funds rate at 2.25%, real interest rates are still negative.

Even Paul (Dr. Cowbell) Krugman had to admit that the Fed needs to do more to get inflation under control.

Meanwhile, the Atlanta Fed’s GDP Now index predicts Q3 GDP will come in 1.4%, though this was before the jobs report. While 1.4% is still positive, it is by no means strong. The Fed would characterize 1.4% GDP growth as “modest.” And this is before all of the tightening we have just experienced gets felt by the market. We won’t see the economic effects of this tightening begin until after Labor Day at the earliest.

Rithm Capital aka New Residential reported that origination volume was down 29% QOQ to $19.1 billion. This is down 19% from a year ago, but I suspect last year’s numbers don’t include Caliber. Gain on sale margins increased to 1.95%, however the company said on the earnings call that it was de-emphasizing origination going forward because the gain on sale margins weren’t there. 1.95% was the highest number over the past year, so I found that interesting.

Like every originator out there, MSR valuations saved the day, and the strategy is all about cost cutting. Rithm sees the mortgage company operating at roughly breakeven for the foreseeable future.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.