[ad_1]

S&P 500 recovered from the inial bout of selling, and so did bonds. Whether the risk-on upswing stalls today or next week only, it still looks set to stall as the 50-day moving average would stop stock market bulls before the July Fed. Nothing too striking in the sectoral view yesterday – it‘s though positive that financials had a good day, and oil stocks also did a good job recovering from the early setback. But there is no escaping the earnings downgrades ahead, and the coming move lower can‘t be explained by the adjustment in P/E ratio really. I am cautiously optimistic about yesterday‘s heavy volume in gold as the yellow metal defended $1,680 – waiting for miners to kick into a higher gear. More thoughts are reserved for premium subscribers.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article features good 6 ones.

S&P 500 and Nasdaq Outlook

S&P 500 is looking fine, and the question remains whether it reverses from 4,020s or a bit higher – that‘s still my leading scenario at the moment. Taking a careful look at market breadth next – whether the positive developments discussed in the opening part of today‘s analysis, get stronger or not.

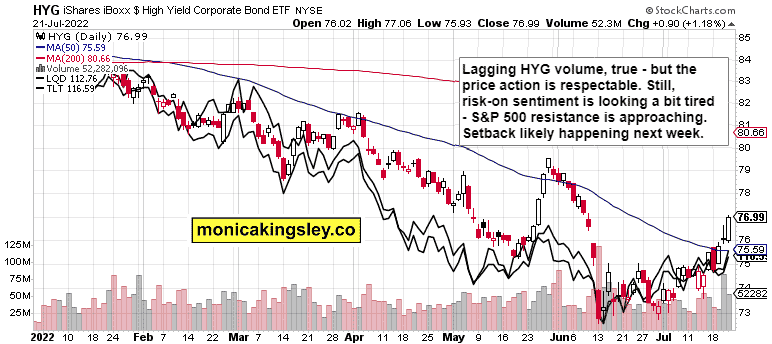

Credit Markets

HYG is still leaning the bullish way, hasn‘t run out of steam yet. Dollar being unable to keep yesterday‘s modest gains, played a role. Bond markets are likely to stall today, and it would be indicative whether HYG makes further progress or not.

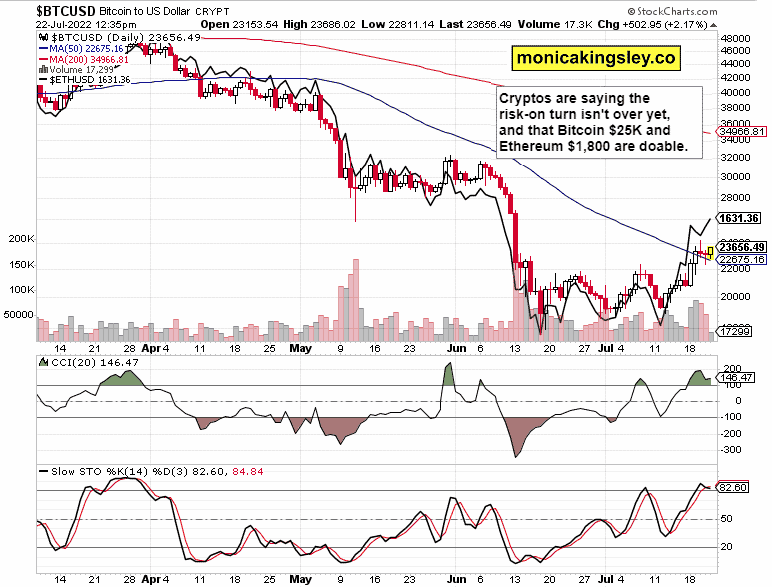

Bitcoin and Ethereum

Cryptos want to rise, the weekend ahead looks quite fine, which is in line with the idea that stocks wouldn‘t roll over to the downside sharply today.

Thank you for having read today‘s free analysis, which is a small part of the premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, oil, copper, cryptos), and of the premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates. While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves. Thanks for subscribing & all your support that makes this endeavor possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

BONUS VIDEO: Weekly news summary from the markets

-

Support

-

Platform

-

Spread

-

Trading Instrument

Get the latest economy news, trading news, and Forex news on Finance Brokerage. Check out our comprehensive trading education and list of best Forex brokers list here. If you are interested in following the latest news on the topic, please follow Finance Brokerage on Google News.

[ad_2]

Image and article originally from www.financebrokerage.com. Read the original article here.