[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,840 | -30.50 |

| Oil (WTI) | 86.21 | .87 |

| 10 year government bond yield | 4.06% | |

| 30 year fixed rate mortgage | 7.07% |

Stocks are lower this morning after disappointing numbers out of Google and Mr. Softee. Bonds and MBS are up.

Mortgage applications fell 1.7% last week, as purchases fell 2% and refis actually ticked up. “The ongoing trend of rising mortgage rates continues to depress mortgage application activity, which remained at its slowest pace since 1997,” said Joel Kan, MBA Vice President and Deputy Chief Economist. “Refinance applications were essentially unchanged, but purchase applications declined 2 percent to the slowest pace since 2015 – over 40 percent behind last year’s pace. Despite higher rates and lower overall application activity, there was a slight increase in FHA purchase applications, as FHA rates remained lower than conventional loan rates.” Mortgage rates increased 20 basis points, from 6.94% to 7.16%.

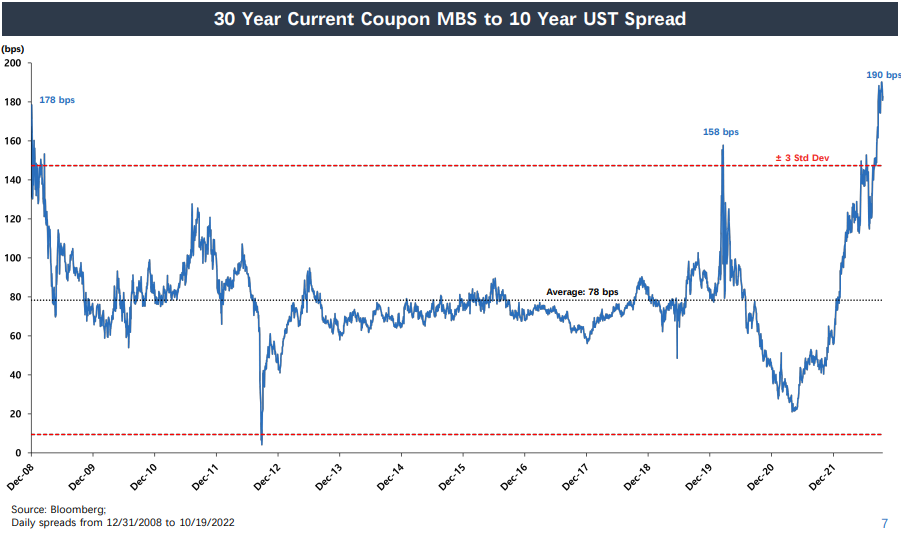

Mortgage REIT AGNC Investment reported earnings yesterday, and discussed the current market. Mortgage originators should think of mortgage REITs as the buyers of their production. Inside the investor presentation, they showed just how wide MBS spreads have become. Take a look at the chart below.

The MBS spread is the difference in yield between a 10 year Treasury and corresponding mortgage backed security. The yield that investors like AGNC demand for these securities are the basic input to determine mortgage rates in general. AGNC investment holds primarily agency securities (in other words, bonds backed by Fannie and Freddie loans).

On the conference call, the CEO described what is going on the MBS market. The first thing he said is that in the early stages of market downturns agency mortgage backed securities are the first ones sold. This is because agency mortgage backed securities are the most liquid fixed income market in the US after Treasuries. So there tends to be a “sell what you can” aspect to this. And certainly bond funds have seen outflows.

The hiccup in the UK bond market was a big catalyst for the widening of MBS spreads. Since agency mortgage backed securities have no credit risk (they are government-guaranteed) the widening is due to liquidity and volatility overall in the bond market.

MBS spreads right now are wider than they were in December 2008, when the financial crisis was peaking. They are wider than they were in early-mid 2020 when the MBS market froze and the mortgage REITs were beset by margin calls. Can they go wider? Sure. But we are seeing a historically unprecedented market and these spikes don’t last very long.

Over the past 10 years, MBS spreads have averaged about 78 basis points, and are at 190 bps now. Here is what that means. If the 10 year yield stays the same, there is a built-in improvement in mortgage rates of 112 basis points. In other words, we could see rates fall to the low 6% range over the next few months, even if the Fed continues raising rates and the 10 year stays where it is.

From the standpoint of MBS investors, a government-guaranteed 6% rate of return is pretty attractive, certainly compared to investment-grade corporate bonds or junk. And if the economy does enter a recession, investors will sell credit risk and hide out in Treasuries and MBS. I expect this to happen at the end of the year, when lots of asset managers revise their risk allocations.

During the call, one of the analysts asked about the dividend. AGNC currently pays a monthly dividend of $0.12, which works out to a 18.6% dividend yield. Mortgage REIT investors have been waiting for the other shoe to drop, which means a dividend cut.

The analyst asked point-blank if the portfolio can cover the dividend yield. ANGC’s CEO said, after the caveats about always re-evaluating the correct dividend yield “But what’s really, I think, critical to understanding, I think is the heart of your question is you have to understand what drove the decline in our book value. And if you look at the performance of mortgages and you look at that graph that we show, I think it’s clear to everybody when you look on Page 7, that mortgage spreads have gone in one direction only for the better part of the last 18 months, 65 basis points wider, if you will, from August to now. So the decline in our book value is driven primarily by wider spreads. So while it hurts your book value currently because the decline in book value came from wider spreads, it also enhances the go-forward return on our portfolio…So, going forward, I still believe that those two things are reasonably well aligned, and obviously, conditions change and markets are volatile and we’re going to continue to be diligent about monitoring that. But to go forward, the return on our portfolio still is consistent with our dividend.”

The mortgage space is about as popular as mask mandates right now, but the sentiment might be too dour.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.