[ad_1]

Rolling-down is one of our frequently used covered call writing exit strategies. During the January 2022 contracts, there was a 5% market decline due to COVD-19, inflation and interest rate concerns. This article will highlight a rolling-down strategy I implemented with Healthcare Select Sector SPDR (NYSE: XLV) in one of my portfolios where a 4.68% share loss was mitigated down to a 2.8% loss. The BCI Trade Management Calculator will show trade entry, initial calculations, trade adjustments and final results.

Rolling-down trade overview

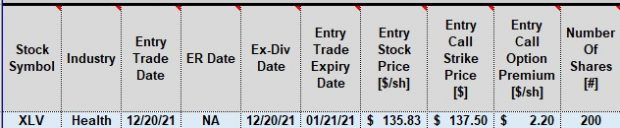

- 12/20/2021: Buy 200 x XLV at $135.83

- 12/20/2021: STO 2 x $137.50 1/21/2022 calls at $2.20

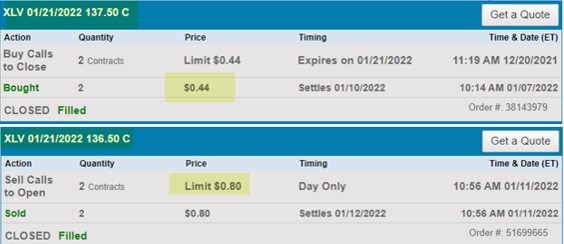

- 1/7/2022: BTC 2 x 1/21/2022 $137.50 calls at $0.44 (20% guideline)

- 1/11/2022: STO 2 x 1/21/2022 $136.50 calls (rolling-down) at $0.80

- 1/21/2022: XLV shares worth $129.47 (a loss of 4.68%)

BCI Trade Management Calculator: XLV trade entry

XLV: Covered Call Trade Executed

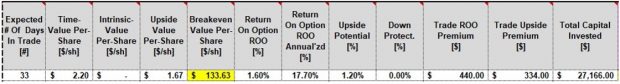

BCI Trade Management Calculator: XLV initial calculations

XLV: Initial Covered Call Writing Calculations

Rolling down with XLV (broker screenshots)

XLV Roll-Down Trade

BCI Trade Management Calculator: XLV adjustment entries

XLV: Rolling-Down Trade Entries

BCI Trade Management Calculator: XLV final results

XLV: Rolling-Down Final Calculations

Discussion

Writing covered calls and then mitigating losses by rolling-down decreased a 4.68% loss in share value down to an unrealized loss of 2.80% due to an option net credit of $512.00 or 1.88%. Position management is the 3rd of the 3 required skills (along with stock and option selection) that must be mastered before risking even one penny of our hard-earned money.

New Rolling-Out with the Trade Management Calculator video

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Dear Alan,

I just wanted to thank you for all your practical lessons, videos and books. I have used much of your information as a reference many times. It is clear, concise, and put in a way I can comprehend! And best of all profitable advice for me. No other Investing Guru has explained investing the way you and your team have! Thank you! I look forward to learning more!

Sincerely;

Kevin

Upcoming events

1. Wealth365 Summit

Tuesday July 12th, 2022

4 PM ET – 5 PM ET

Selling Cash-Secured Puts

Exit Strategy Choices After Exercise of Cash-Secured Puts

Selling cash-secured puts is a low-risk option-selling strategy which generates weekly or monthly cash flow by agreeing to buy shares at a price we determine, by a date we determine. In return for undertaking this obligation, we are paid a cash premium. We only sell puts on shares we would otherwise want to own and, if exercised, and shares are put to us, they are purchased at a discount from the price when the put trade was initiated.

This presentation includes an introduction to option basics, defines selling cash-secured puts and provides real-life examples. The focus of the webinar details the steps available to put sellers should the put be exercised, and we now own the discounted stock or ETF shares. The seminar includes a discussion of the PCP (put-call-put or wheel) Strategy and the Stock Repair Strategy among other exit strategy opportunities.

2. Money Show Orlando live event

October 30th – November 1st, 2022

OMNI ORLANDO RESORT AT CHAMPIONSGATE

Visit Alan, Barry and members of the BCI team at Booth # 415

Masters Class

Comprehensive Course on Selling Cash-Secured Puts

Detailed start-to-finish 6-part program

This presentation will provide all the information, with real-life examples, necessary to master the strategy of selling cash-secured puts. The program is divided into 6 sections:

- Section I:

- Section II

- Section III

- Section IV

- Buy a stock at a discount instead of a limit order

- Section V

- Ultra-low-risk put/Delta strategy

- Section VI

- Ultra-low-risk put/Implied volatility strategy

This presentation was developed to benefit both beginner and experienced option traders and will provide all the information needed to initiate the strategy and elevate returns to the highest possible levels.

45-minute presentation

Covered Call Writing: Multiple Applications Based on Current Market Conditions

Real-life examples with Invesco QQQ Trust (Nasdaq: QQQ)

Covered call writing is a low-risk option-selling strategy geared to generating cash flow with capital preservation a key requirement. This presentation will demonstrate how the strategy can be crafted to benefit in all market environments. Market situations highlighted are:

- Normal to bull markets

- Bear and volatile markets

- Low interest-rate environments

A popular large-cap technology exchange-traded fund, Invesco QQQ Trust, will be used to establish rules and guidelines to benefit in these market circumstances.

Registration link and more details to follow.

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************

[ad_2]

Image and article originally from www.thebluecollarinvestor.com. Read the original article here.