[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,733 | -33.25 |

| Oil (WTI) | 79.82 | -3.76 |

| 10 year government bond yield | 3.71% | |

| 30 year fixed rate mortgage | 6.40% |

Stocks are lower as people adjust to the new reality of higher rates. Bonds and MBS are down.

Goldman has cut their target for the year-end S&P 500 from 4,300 to 3,600. Commodity prices are beginning to reflect the lower-growth forecast, with oil dropping below $80 a barrel. A stronger dollar is part of the explanation too, but this is a global growth story.

S&P Global’s flash PMI registered an improvement in September, however we are still in a weak environment. New orders improved and while pricing pressures were still present, the increase in prices was the lowest since January 2021. This gives us at least some evidence that the Fed’s rate hikes are gaining some traction.

“US businesses are reporting a third consecutive monthly fall in output during September, rounding off the weakest quarter for the economy since the global financial crisis if the pandemic lockdowns of early-2020 are excluded. However, while output declined in both manufacturing and services during September, in both cases the rate of contraction moderated compared to August, notably in services, with orders books returning to modest growth,

allaying some concerns about the depth of the current downturn.

There was also better news on inflation, with supplier shortages easing to the lowest since October 2020, helping take some of the pressure off raw material prices. These improved supply chains, accompanied by the marked softening of demand since earlier in the year, helped cool overall the rate of inflation of both firms’ costs and average selling prices for goods and services to the lowest since early-2021. Inflation pressures nevertheless remain elevated by historical standards and, with business activity in decline, the surveys continue to paint a broad picture of an economy struggling in a stagflationary environment.”

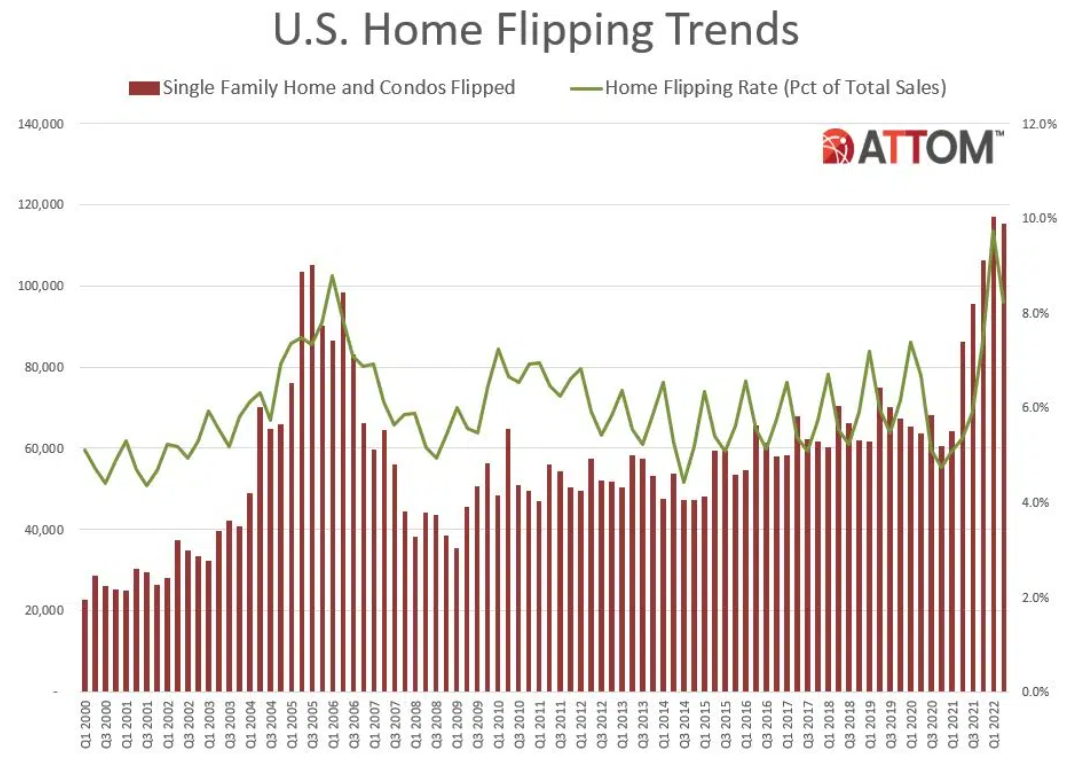

Home flipping volume decreased in the second quarter, according to ATTOM. A total of 115k homes were flip transactions, or about 8.2%. This is a decline from the first quarter, but is still an increase from the second quarter of 2021.

“The second quarter was another strong showing for fix-and-flip investors. The total number of properties flipped was the second-highest total we’ve recorded in the past 22 years, and the median sales price of a flipped property – $328,000 – was the highest ever,” said Rick Sharga, executive vice president of market intelligence for ATTOM. “The big question is whether the fix-and-flip market will begin to lose steam as overall home sales have declined dramatically over the past few months, and the cost of financing has virtually doubled over the past year.”

You can look at the iBuying experience of Zillow and Opendoor to see it can be hard to make money in this business even in the best of markets, let alone when rates are higher and the number of transactions are falling.

Despite recessionary fears, mortgage delinquencies remain near record lows, according to Black Knight. The national delinquency rate fell to 2.79%, which was just a touch above the May 2022 record low. Foreclosure starts did tick up 15% in August, but we are well below pre-pandemic levels.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.