[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,818 | -1.25 |

| Oil (WTI) | 88.08 | -1.02 |

| 10 year government bond yield | 4.01% | |

| 30 year fixed rate mortgage | 6.95% |

Stocks are lower this morning after Amazon.com earnings missed expectations. Bonds and MBS are down.

Personal incomes rose 0.4% MOM in September, according to the BEA. Spending rose 0.6% MOM. The PCE Price Index rose 0.3% MOM, while it rose 0.5% if you exclude food and energy (i.e. the core rate). On an annual basis, prices rose 6.2% and the core rate rose 5.1%.

The highlighted numbers show the monthly changes in both indices. July certainly looks like an outlier, but I see no discernable downward trend in the core rate, which is what the Fed is targeting.

The employment cost index (in other words the cost of employees from an employer’s point of view) rose 5.2% YOY in September, according to BLS.

I sat down with Clear Capital’s Kenon Chen at the Nashville MBA and discussed interest rates, the housing market, and what to look for going into year end. Here is the podcast.

Consumer sentiment improved in October, according to the University of Michigan’s Consumer Sentiment Index. Inflation expectations continue to remain elevated, which is bad news for the Fed. “The median expected year-ahead inflation rate rose to 5.0%, with increases reported across age, income, and education. Last month, long run inflation expectations fell below the narrow 2.9-3.1% range for the first time since July 2021, but since then expectations have reverted to 2.9%. Uncertainty over inflation expectations remains elevated, indicating that inflation expectations are likely to remain unstable in the months ahead.”

Pending home sales fell 10.2% in September, according to the National Association of Realtors. “Persistent inflation has proven quite harmful to the housing market,” said NAR Chief Economist Lawrence Yun. “The Federal Reserve has had to drastically raise interest rates to quell inflation, which has resulted in far fewer buyers and even fewer sellers. The new normal for mortgage rates could be around 7% for a while,” Yun added. “On a $300,000 loan, that translates to a typical monthly mortgage payment of nearly $2,000, compared to $1,265 just one year ago – a difference of more than $700 per month. Only when inflation is tamed will mortgage rates retreat and boost home purchasing power for buyers.”

Let me geek out for a second about Yun’s comments. This is real inside-baseball stuff.

FWIW, I don’t see mortgage rates sitting at 7% for long. If the Fed hikes another 75 basis points in December, and that appears to be the end of the hiking process, then I could see the 10-year going nowhere as the yield curve inverts in anticipation of a recession.

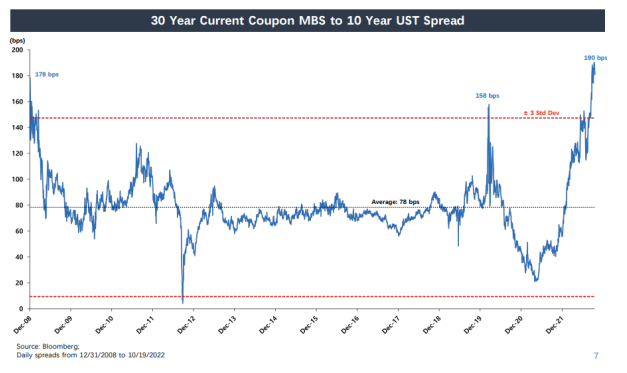

With MBS spreads at 15 year highs, if spreads revert to normal, then we should see a 110 basis point decrease in mortgage rates, even if the 10 year goes nowhere. This chart is from AGNC Investment, a mortgage REIT. Note that MBS spreads are wider than the depths of the financial crisis.

MBS spreads are simply the incremental yield that investors demand to hold mortgage backed securities versus Treasuries. If the spread is 180 basis points, (or 1.8%) and the 10 year yields 4%, that means MBS investors expect to receive a yield of 5.8%. Historically, they would have required 4.8%.

Mortgage rates are based on what MBS investors are willing to pay for these securities. If spreads are large (as they are now), you could say that MBS are cheap relative to Treasuries. If spreads are narrow (as they were in early 2021), you could say that MBS are rich. Right now, MBS are extremely cheap relative to Treasuries. Bond fund managers are always swapping in and out of different fixed income asset classes to find the best returns, and we should see them swap into MBS at some point, which should put some downward pressure on mortgage rates.

Bond funds have seen outflows, and when fund managers need to raise capital to fund redemptions, they generally sell the most liquid part of the portfolio. They do this because they can raise the most money with minimal impact on the price of the security. If they tried to raise funds by selling, say non-QM loans or junk bonds, they would crash that market, which would lower the net asset value of their portfolio. So, they raise capital first, then make the adjustments for the best returns later. So when we see a sell-off in fixed income as an asset class, MBS are the first to get whacked. And I think that is where we are now.

If the Fed’s dot plot in December indicates that the tightening cycle is largely done, I expect bond investors to flood into MBS since you can get a government-guaranteed rate of return far in excess of Treasuries. That will cause a furious rally in MBS, with a corresponding drop in mortgage rates. I suspect we will see a mortgage rate in the low 6s by mid 2023.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.