[ad_1]

Vital Statistics:

| Last | Change | |

| S&P futures | 3,960 | 37.25 |

| Oil (WTI) | 94.53 | -0.55 |

| 10 year government bond yield | 2.78% | |

| 30 year fixed rate mortgage | 5.59% |

Stocks are higher this morning as we await the Fed de Bonds and MBS are up.

The Fed decision is slated to come out at 2:00 pm today. The Fed Funds futures implied probability graph shows about a 3/4 chance of a 75 basis point hike and a 25% chance of a 100 basis point increase.

Retail inventories rose 2%, (higher than expected) in June, which probably bodes well for the advance estimate of second quarter GDP which comes out tomorrow. Wholesale inventories rose 1.9% as well. These numbers suggest that the supply chain issues of the past two years are working themselves out. Note that WalMart is cutting prices to deal with excess inventory.

“The increasing levels of food and fuel inflation are affecting how customers spend, and while we’ve made good progress clearing hardline categories, apparel in Walmart U.S. is requiring more markdown dollars. We’re now anticipating more pressure on general merchandise in the back half; however, we’re encouraged by the start we’re seeing on school supplies in Walmart U.S.” said Doug McMillon, Walmart Inc. president and chief executive officer.

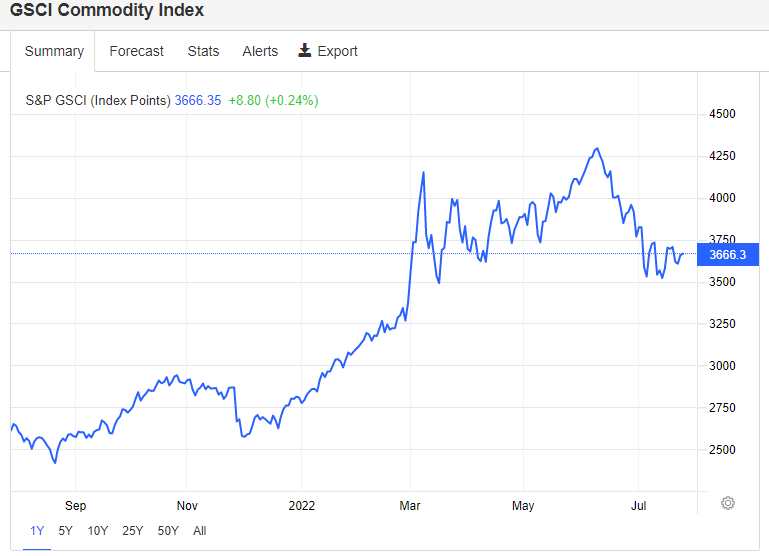

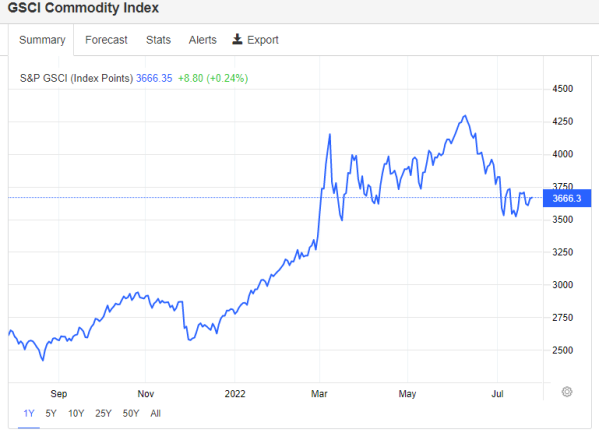

Food and fuel price inflation seems to be turning the corner however. The GSCI commodity index is heading back downward, although we are still well above levels seen last year:

As the old saying goes, the cure for high prices is high prices. Eventually demand falls and supply increases. Case in point: corn, which is down 26% from its April highs.

Mortgage Applications fell 1.8% last week as purchases fell 0.4% and refis fell 2%. “Mortgage applications declined for the fourth consecutive week to the lowest level of activity since February 2000,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “Increased economic uncertainty and prevalent affordability challenges are dissuading households from entering the market, leading to declining purchase activity that is close to lows last seen at the onset of the pandemic.”

Homebuilder Pulte reported second quarter earnings yesterday. Demand remains strong for housing, however increasing mortgage rates are having an impact. One thing that stood out to me was the increase in gross margins, which rose to 30.9%, an increase of 430 basis points compared to last year and 190 basis points from the first quarter. Whatever cost increases that Pulte is dealing with (labor and material costs) are more than covered by rising prices.

The other thing I notices was a decent uptick in the cancellation rate, from 7% to 15%, as well as the 8% drop in orders. Backlog decreased slightly on a unit basis, but rose 18% on a dollar basis. It is strange to think that housing starts remain low when building homes seems to be pretty profitable and the demand is there. Perhaps it is nothing more than a skilled labor shortage, although the company didn’t mention it.

The fallout from Sprout continues. California lender New Wave is suing the company for defaulting on a purchase agreement for $32.8 million worth of loans. New Wave ended up selling the loans to a different buyer and Sprout is refusing to return the holdback amount.

Pending Home Sales fell 8% last month, according to NAR. Year-over-year, transactions are down 20%. This (along with the end of rate / term refis) explains why mortgage originators are struggling compared to the past two years.

“Contract signings to buy a home will keep tumbling down as long as mortgage rates keep climbing, as has happened this year to date,” said NAR Chief Economist Lawrence Yun. “There are indications that mortgage rates may be topping or very close to a cyclical high in July. If so, pending contracts should also begin to stabilize.”

Mortgage rates may indeed be stabilizing, as the yield curve continues to invert. The spread between the two-year and the 10-year is now negative 29 basis points. Mortgage rates are affected by bond market volatility, and if we get some stability in the 10 year, we should see mortgage rates work lower compared to Treasuries.

[ad_2]

Image and article originally from thedailytearsheet.com. Read the original article here.